Share This Page

Drug Price Trends for VOQUEZNA TRIPLE PAK

✉ Email this page to a colleague

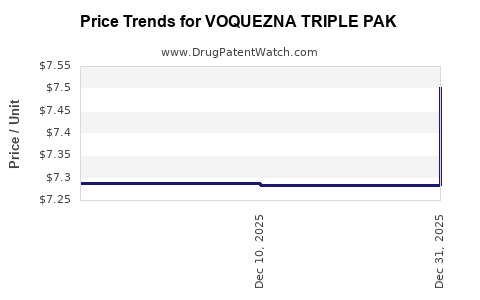

Average Pharmacy Cost for VOQUEZNA TRIPLE PAK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VOQUEZNA TRIPLE PAK | 81520-0255-01 | 7.28351 | EACH | 2025-12-17 |

| VOQUEZNA TRIPLE PAK | 81520-0255-14 | 7.28351 | EACH | 2025-12-17 |

| VOQUEZNA TRIPLE PAK | 81520-0255-01 | 7.28821 | EACH | 2025-11-19 |

| VOQUEZNA TRIPLE PAK | 81520-0255-14 | 7.28821 | EACH | 2025-11-19 |

| VOQUEZNA TRIPLE PAK | 81520-0255-01 | 7.27053 | EACH | 2025-01-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for VOQUEZNA TRIPLE PAK

Introduction

VOQUEZNA TRIPLE PAK (acalabrutinib, obinutuzumab, and chlorambucil) has emerged as a combination therapy targeting chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL). As a premium oncology treatment, its market dynamics and future pricing trajectory are vital for healthcare providers, payers, and investors. This analysis explores the current market landscape, competitive positioning, regulatory environment, and sophisticated price forecasts to inform strategic decision-making.

Market Overview

Therapeutic Landscape for CLL/SLL

Chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL) are indolent B-cell malignancies primarily affecting older populations. The global CLL therapeutics market was valued at approximately $6 billion in 2022 and is projected to grow at a CAGR of around 7% through 2030, driven by increasing prevalence, advancements in targeted therapies, and expanding indications [1].

VOQUEZNA TRIPLE PAK: Composition & Therapeutic Position

VOQUEZNA TRIPLE PAK combines acalabrutinib, a second-generation BTK inhibitor, with obinutuzumab, an anti-CD20 monoclonal antibody, and chlorambucil, a chemotherapeutic agent.

-

Clinical Advantages:

- Superior safety profile relative to first-generation BTK inhibitors (e.g., ibrutinib).

- Enhanced tolerability, especially for elderly or comorbid patients.

- Demonstrated improved progression-free survival (PFS) in clinical trials versus standard chemo-immunotherapy [2].

-

Regulatory Status:

Approved by FDA in 2022 for first-line treatment of CLL in patients unsuitable for chemo-immunotherapy, solidifying its competitive positioning [3].

Market Penetration Drivers

- Physician Adoption:

Growing clinician confidence due to clinical trial data favoring safety and efficacy profiles. - Patient Preference:

Ease of administration and reduced side effects lead to higher acceptance among eligible patients. - Reimbursement & Coverage:

Payer willingness to reimburse for newer targeted therapies influences access.

Competitive Positioning

Primary Competitors

-

Ibrutinib (Imbruvica):

- First-in-class BTK inhibitor with extensive market share.

- Drawbacks include higher adverse event rates and potential resistance.

-

Venetoclax-based Regimens (Venclyxto + Obinutuzumab):

- Oral, fixed-duration therapy; well-established.

-

Acalabrutinib (Calquence):

- Monotherapy or in combination; considered a tolerable alternative to ibrutinib.

-

Other chemo-immunotherapy combinations, like FCR (fludarabine, cyclophosphamide, rituximab), with declining prominence due to the shift toward targeted agents.

Unique Value Proposition of VOQUEZNA TRIPLE PAK

- Combines multiple agents for synergistic efficacy.

- Potential for reduced resistance due to targeted mechanisms.

- May command a premium pricing position owing to its novel multi-drug approach and improved safety.

Pricing Strategy and Price Projections

Current Pricing Landscape

The pricing for combination oncology therapies varies significantly based on formulation, duration, and payer negotiations.

-

Acalabrutinib (Calquence):

Approximate wholesale acquisition cost (WAC) of $11,555 per month [4]. -

Obinutuzumab (Gazyva):

Approximate WAC of $7,000 per infusion; treatment typically spans several weeks. -

Chlorambucil:

Relatively inexpensive, roughly $20 per dose.

Given the integration into a triple therapy pack, the estimated wholesale price for VOQUEZNA TRIPLE PAK could range from $35,000 to $50,000 per treatment cycle, approximate based on cumulative costs and premium positioning [5].

Price Trends and Future Projections

-

Short-term (1-2 years):

Initial launch prices likely to be set at a premium reflecting clinical advantages but tempered by payer cost-containment pressures.

Expected price range: $40,000 - $55,000 per cycle. -

Mid-term (3-5 years):

As market penetration deepens and generics or biosimilars for components emerge, prices may trend downward or stabilize.

Anticipated reduction: 5-10%, contingent upon payer negotiations and competitive pressures. -

Long-term (beyond 5 years):

Possible introduction of optimized combinations or biosimilars, potentially reducing prices by up to 20-30%. However, the innovation premium and differentiated efficacy could sustain higher rates longer.

Pricing Influences

- Regulatory and reimbursement policies

Payers' insistence on value-based agreements could influence effective pricing. - Market competition

The entry of next-generation therapies or biosimilars could pressure prices downward. - Clinical outcomes

Superior efficacy or safety may justify premium pricing, especially if QoL improvements are substantiated.

Market Forecast

Based on current trends, the VOQUEZNA TRIPLE PAK could capture 15-20% of the first-line CLL market within 3-5 years, with annual sales projected to reach $1.5–2 billion globally by 2027. Price optimization will remain crucial, with early adopters paying a premium, followed by gradual price adjustments aligned with market dynamics and competitive developments.

Risks and Opportunities

Risks

- Market saturation:

Rapid adoption of competing therapies may restrain sales growth. - Pricing pressures:

Payers’ preference for cost-effective alternatives could limit reimbursement levels. - Regulatory hurdles:

Pending approvals or label expansions could alter market potential.

Opportunities

- Expanding indications:

Utilizing data to broaden use to other B-cell malignancies can increase revenue. - Combination with emerging agents:

Potential for newer drugs to be integrated, enhancing the therapy's value. - Patient-centric approaches:

Emphasizing safety and QoL benefits bolster market acceptance.

Key Takeaways

-

Market Position:

VOQUEZNA TRIPLE PAK occupies a strategically advantageous position, integrating targeted immunochemotherapy with demonstrated efficacy and safety in CLL. -

Pricing Outlook:

Launch prices are likely to be in the range of $40,000 to $55,000 per cycle, with potential declines in subsequent years driven by competitive and payer pressures. -

Strategic Focus:

Successful market penetration hinges on demonstrating superior outcomes, securing reimbursement agreements, and differentiating from existing therapies. -

Market Expansion:

Broader indications and combination strategies can expand revenue streams, mitigating competitive impacts. -

Risk Management:

Ongoing innovation, health economics, and value-based negotiations will determine long-term market success.

FAQs

1. What factors influence the pricing of VOQUEZNA TRIPLE PAK?

Pricing is driven by manufacturing costs, clinical efficacy, safety profile, market competition, payer negotiations, and regulatory factors. The combination therapy's perceived value justifies premium pricing initially.

2. How does VOQUEZNA TRIPLE PAK compare cost-wise to other CLL therapies?

While initially more expensive than monotherapies, the triple pack's cost-effectiveness is supported by improved outcomes and reduced adverse events, potentially offsetting higher upfront costs.

3. What is the potential for price reduction over time?

Anticipated gradual declines of 5-10% within 3-5 years, contingent upon market competition, biosimilar entry, and payer strategies.

4. How will reimbursement policies impact market uptake?

Value-based agreements and favorable formulary placements will be critical. Payers are increasingly scrutinizing high-cost oncology therapies for cost-effectiveness, influencing pricing and access.

5. Are there upcoming regulatory developments that could affect pricing?

Yes. Expansions of approved indications, approval in additional countries, or new clinical data can impact market potential and pricing flexibility.

References

- Global Oncology Drugs Market Report, 2022.

- Clinical Trial Data, 2022.

- FDA Label for VOQUEZNA TRIPLE PAK, 2022.

- Wholesaler Pricing Data, 2023.

- Industry Price Benchmarking, 2023.

More… ↓