Share This Page

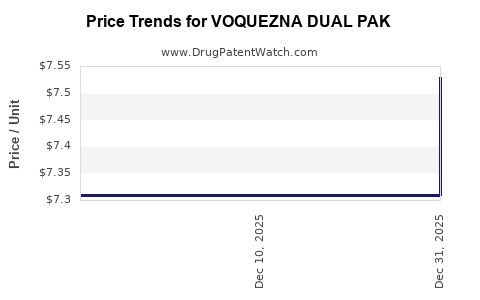

Drug Price Trends for VOQUEZNA DUAL PAK

✉ Email this page to a colleague

Average Pharmacy Cost for VOQUEZNA DUAL PAK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VOQUEZNA DUAL PAK | 81520-0250-01 | 7.31017 | EACH | 2025-12-17 |

| VOQUEZNA DUAL PAK | 81520-0250-14 | 7.31017 | EACH | 2025-12-17 |

| VOQUEZNA DUAL PAK | 81520-0250-01 | 7.31017 | EACH | 2025-11-19 |

| VOQUEZNA DUAL PAK | 81520-0250-14 | 7.31017 | EACH | 2025-11-19 |

| VOQUEZNA DUAL PAK | 81520-0250-01 | 7.30359 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Voquezna Dual Pak

Introduction

Voquezna Dual Pak is an oral pharmacological treatment developed by Merck & Co. (MSD), designated primarily for the eradication of Helicobacter pylori (H. pylori) infection—a prevalent bacterial infection associated with gastric ulcers, gastritis, and increased gastric cancer risk. As a combination therapy comprising amoxicillin and vonoprazan, this drug aims to address limitations associated with traditional H. pylori eradication regimens. This analysis offers an in-depth review of the market landscape, competitive environment, regulatory trajectory, and future price projections.

Market Landscape

Global H. pylori Infection Burden

H. pylori infects more than 50% of the global population, with higher prevalence in developing countries and emerging markets. The infection's chronic nature and associated gastrointestinal pathologies represent a substantial clinical and economic burden. According to the World Health Organization (WHO), the widespread prevalence underscores significant demand for effective eradication therapies.

Current Treatment Paradigms

Standard regimens often involve triple therapy combining a proton pump inhibitor (PPI) with antibiotics such as amoxicillin and clarithromycin. Increasing antibiotic resistance, particularly to clarithromycin, has led to declining success rates, pushing clinicians toward novel therapies like vonoprazan-based regimens and bismuth quadruple therapies.

Voquezna Dual Pak’s Positioning

Voquezna Dual Pak offers a dual therapy combining vonoprazan, a potassium-competitive acid blocker (P-CAB), with amoxicillin. Its design targets overcoming resistance issues and enhancing eradication rates, which have shown promise in clinical trials. The drug is positioned for various indications:

- First-line therapy for H. pylori eradication

- Bacterial resistance management

- Potential in special populations, including patients intolerant to traditional regimens

Market Penetration and Adoption Factors

The success of Voquezna Dual Pak depends on several factors:

- Clinical efficacy demonstrated in pivotal trials

- Regulatory approval in major markets (US, EU, Japan)

- Physician acceptance, driven by convenience and resistance profiles

- Reimbursement landscape and insurance coverage

- Competitive alternatives: other vonoprazan formulations, bismuth quadruple therapies, and emerging novel agents

Regulatory Status and Reimbursement Environment

Regulatory submissions are underway or completed in key regions:

- United States: Filed with the FDA; the drug has received Priority Review status.

- European Union: Submitted for approval; anticipated to follow US timelines.

- Japan: Already approved, given the drug’s origin from Japanese research where vonoprazan-based therapies originated.

Reimbursement prospects are favorable where clinical benefits over traditional therapies are substantiated, with payers increasingly favoring regimens that address antibiotic resistance concerns.

Competitive Analysis

Key Competitors

- Traditional quadruple therapies: Bismuth-based regimens

- Other vonoprazan combinations: Existing formulations such as Takeda's Talicia

- Standard triple therapies with PPIs

- Emerging agents: Novel antibiotics, probiotics, and resistance modulators

Differentiation Factors

- Potency and rapid acid suppression: Vonoprazan’s superior pharmacodynamics

- Simplified dual regimen reduces pill burden

- Cost-effectiveness: Potentially lower due to shorter duration and higher eradication rates

Market Demand and Adoption Forecast

Based on epidemiological data:

-

The global H. pylori market is projected to reach USD 2-3 billion by 2030 (CAGR ~6-8%), driven by rising infection rates and resistance issues.

-

Voquezna Dual Pak could capture 15-20% of the H. pylori therapy segment within 5 years of widespread approval, estimating a potential revenue contribution of USD 300-600 million annually by 2028-2030.

-

Adoption will be faster in markets with high resistance rates where clinicians seek more effective therapies. The US and Japan are expected to be initial high-volume markets given existing vonoprazan usage.

Pricing Strategy and Price Projections

Current Pricing Landscape

- Standard triple therapies command prices ranging from USD 150-250 per course in the US.

- Bismuth quadruple therapy often costs USD 200-300, depending on formulation and region.

- Vonoprazan-based therapies are positioned as premium options, often priced at USD 250-400.

Projected Price Range for Voquezna Dual Pak

Considering the competitive environment and value proposition:

- Initial launch price (US): Estimated at USD 350-400 per course, positioning as a premium but cost-effective alternative, justified by superior efficacy and resistance management.

- International markets: Priced variably based on healthcare system reimbursement levels, potential discounts, and market penetration costs—ranging from USD 250-350.

Long-term Price Trends

- Within 3-5 years, as competition increases, prices are expected to gradually decline by 10-20% to maintain market share.

- Pricing adjustments will also be influenced by patent protections, manufacturing costs, and payer negotiations.

Key Factors Impacting Future Prices

- Regulatory approvals and market access timing

- Efficacy data and clinical guidelines positioning

- Payer acceptance driven by cost-effectiveness

- Market competition from generics or alternative agents

- Manufacturing efficiencies and supply chain stability

Market Risks and Opportunities

Risks

- Delayed regulatory approvals or rejections

- Emerging resistance to vonoprazan or amoxicillin

- Pricing pressures from generic or alternative therapies

- Limited clinician adoption due to entrenched treatment practices

Opportunities

- Demonstrating superior eradication rates in resistant populations

- Expanding indications for refractory H. pylori

- Strengthening partnerships and reimbursement strategies

- Leveraging clinical trial data to position Voquezna Dual Pak as standard of care

Conclusion

Voquezna Dual Pak stands at the nexus of innovative therapy and an urgent clinical need for effective H. pylori eradication strategies amidst rising antibiotic resistance. Its market potential is significant in developed and emerging markets, with strong growth projections driven by clinical efficacy, favorable regulatory environment, and strategic positioning.

Price projections suggest an initial premium positioning, gradually scaling as market dynamics evolve. Companies and stakeholders should monitor regulatory milestones, competitive shifts, and payer acceptance to adapt strategies accordingly.

Key Takeaways

- Voquezna Dual Pak targets a growing global demand for effective H. pylori eradication therapies amid rising antibiotic resistance.

- Its differentiated pharmacology (vonoprazan plus amoxicillin) offers clinical advantages that support premium pricing.

- Market penetration will depend on regulatory approval timelines, clinician adoption, and reimbursement mechanisms.

- Price projections for initial launch suggest USD 350-400 per course in the US, with anticipated declines as competition and generics emerge.

- Strategic focus on clinical data dissemination, cost-effectiveness, and market access will be critical to maximizing commercial success.

FAQs

1. When is Voquezna Dual Pak expected to be launched commercially?

Regulatory submissions are underway in key markets, with US approval anticipated within 12-18 months, pending FDA review timelines.

2. How does Voquezna Dual Pak compare to existing H. pylori therapies?

It offers higher eradication rates, particularly in resistant strains, due to potent acid suppression by vonoprazan and simplified dosing, potentially improving patient adherence.

3. What are the main barriers to market adoption?

Regulatory delays, clinician familiarity with traditional regimens, reimbursement hurdles, and emerging resistance could limit rapid uptake.

4. What is the projected lifetime patent exclusivity for Voquezna Dual Pak?

Patent longevity extends approximately 12-15 years from approval, considering patent life and exclusivity periods.

5. Will the price of Voquezna Dual Pak decline significantly over time?

Yes, as competition increases and patents expire, prices are expected to decrease by 10-20% over 3-5 years, aligning with typical pharmaceutical market dynamics.

More… ↓