Share This Page

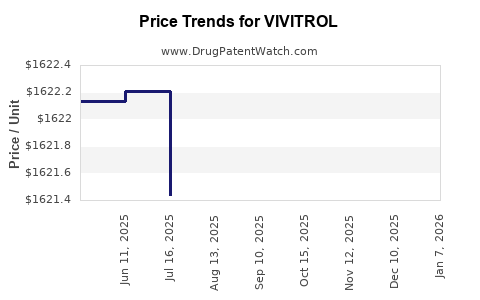

Drug Price Trends for VIVITROL

✉ Email this page to a colleague

Average Pharmacy Cost for VIVITROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1622.13655 | EACH | 2025-12-17 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1623.24767 | EACH | 2025-11-19 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1622.70161 | EACH | 2025-10-22 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1622.23113 | EACH | 2025-09-17 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1621.49050 | EACH | 2025-08-20 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1621.43783 | EACH | 2025-07-23 |

| VIVITROL 380 MG VIAL-DILUENT | 65757-0300-01 | 1622.21063 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIVITROL

Introduction

VIVITROL (naltrexone for extended-release injectable suspension) is an FDA-approved medication indicated primarily for the treatment of alcohol dependence and opioid use disorder (OUD). Developed by Alkermes, VIVITROL has established itself as a pivotal player in addiction management, especially amid the ongoing opioid epidemic. This analysis offers an in-depth review of the current market landscape, key factors influencing its valuation, and future price projections.

Market Landscape and Current Position

Market Demand Drivers

The escalating prevalence of opioid overdose deaths and alcohol dependence globally underpin a growing demand for effective pharmacotherapies like VIVITROL. The CDC reports over 107,000 drug overdose deaths in the U.S. in 2021, with opioids involved in roughly 75% of these fatalities.[1] Consequently, governments and healthcare systems have prioritized expanding access to addiction treatments, accentuating VIVITROL’s market potential.

Further, VIVITROL’s unique mechanism—blocks opioid receptors to prevent euphoric effects—appeals to both clinicians and patients seeking non-opioid-based therapies, contrasting with alternatives like methadone or buprenorphine.

Market Penetration and Competitive Position

VIVITROL holds a significant share in the addiction treatment market but faces competition from oral naltrexone, buprenorphine, and methadone formulations. Its long-acting injectable allows monthly dosing, which improves adherence relative to daily oral medications. However, high costs and injection-related barriers can hinder widespread adoption.

The drug’s positioning has benefited from increased insurance coverage and expanded Medicaid access, especially in regions prioritizing evidence-based addiction therapies. Nevertheless, the competition from newer agents and alternative delivery systems continues to influence its market share.

Regulatory and Payer Dynamics

Reimbursement policies significantly impact VIVITROL's market accessibility. Medicaid and private insurers increasingly recognize the cost-effectiveness of long-acting injectables, promoting wider coverage. Additionally, the ongoing expansion of telemedicine and outpatient services fosters demand for injectable, office-administered treatments.

However, restrictions due to prior authorization requirements and the high per-dose expense remain barriers, influencing overall utilization.

Price Analysis and Trends

Historical Pricing Trends

Initially launched with a wholesale acquisition cost (WAC) of approximately $1,100 per injection, VIVITROL has experienced nuanced pricing shifts influenced by market competition, manufacturing costs, and payer negotiations. Industry reports indicate the average retail price ranging between $1,200 and $1,400 per dose, with significant variation based on geographic region and insurance coverage.

Factors Affecting Price

- Manufacturing Costs: The complex formulation and manufacturing process underpin a relatively high production cost.

- Market Competition: Introduction of oral formulations and alternative injectables exerts downward pressure, prompting price negotiations.

- Reimbursement Policies: Payer strategies aiming to reduce expenditure influence net prices, often resulting in discounts and rebates.

- Inflation and R&D Investment: Ongoing research, including formulations with extended durations or combined therapies, impacts pricing strategies.

Current Pricing Strategies

Alkermes’s pricing reflects a premium segment targeting healthcare providers and systems prioritizing long-term adherence. The company also has implemented patient assistance programs to improve access, which indirectly influence market dynamics.

Future Price Projections

Forecasting Methodology

Price projections leverage historical trends, market growth estimates, competitive landscape evolution, and healthcare policy expectations. Given the increasing burden of addiction and improved reimbursement frameworks, demand for VIVITROL is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% over the next five years.

Projected Price Trends (2023–2028)

- Moderate Price Stability or Slight Increase: The initial years may see stabilization, with prices hovering around $1,200–$1,500 per dose due to market maturity.

- Potential Price Reduction: As competition intensifies and biosimilar or alternative formulations emerge, a gradual price decrease of 3-5% annually may occur.

- Impact of Policy Changes: Broader Medicaid and Medicare expansions, alongside value-based reimbursement models, could further influence pricing, possibly yielding value-based discounts or bundled payment arrangements.

Long-Term Outlook

By 2028, the average per-dose price may range between $1,000 and $1,300, contingent on market saturation, regulatory developments, and payer behaviors. Price adjustments may also reflect innovations such as extended-duration formulations (e.g., 3 or 6-month injections), which could modify per-dose costs and adherence dynamics.

Market Opportunities and Risks

Opportunities

- Growing burden of addiction enhances demand.

- Expanded insurance coverage improves access.

- Development of longer-acting formulations reduces frequency and cost barriers.

- Integration into comprehensive treatment programs

Risks

- Emergence of biosimilars or generic injectables.

- Policy shifts affecting reimbursement.

- Competition from alternative therapies or delivery methods.

- Price sensitivity among payers and providers.

Key Takeaways

- The demand for VIVITROL is poised to grow driven by increasing opioid and alcohol dependence prevalence.

- Current pricing remains high but faces downward pressure from competition and healthcare policy shifts.

- Price stability is expected in the near term, with potential declines over the next five years due to market saturation and competition.

- Innovations in formulation duration and delivery may influence both market share and pricing strategies.

- The drug's success depends critically on payer acceptance, reimbursement policies, and its positioning within comprehensive addiction treatment programs.

FAQs

1. What factors primarily influence VIVITROL's market share?

Market share depends on demand driven by addiction prevalence, reimbursement policies, physician prescribing patterns, patient adherence, and competition from oral and alternative injectable therapies.

2. How does VIVITROL's pricing compare to competing treatments?

VIVITROL’s per-dose cost (~$1,200–$1,400) generally exceeds oral naltrexone but offers advantages over daily medication adherence. It remains more cost-effective relative to some opioid substitution therapies when considering adherence and relapse rates, but pricing pressures from competitors may narrow this advantage.

3. Are future technological advancements likely to impact VIVITROL's pricing?

Yes. Development of longer-acting formulations, potentially reducing dosage frequency from monthly to quarterly or semi-annual, could influence overall costs and prices per treatment cycle.

4. What regional factors affect VIVITROL's pricing and utilization?

Regions with expanded Medicaid coverage, supportive regulations, and higher addiction prevalence tend to show increased utilization and more favorable reimbursement terms, potentially affecting prices.

5. How might healthcare policy shifts impact VIVITROL's future pricing?

Policy initiatives favoring value-based care and cost containment could pressure prices downward, especially if biosimilars or generics enter the market. Conversely, policies increasing access to addiction treatment could bolster demand and sustain prices.

References

- Centers for Disease Control and Prevention (CDC). National overdose deaths rates. 2022.

- Alkermes. VIVITROL prescribing information. 2022.

- IQVIA. Pharmaceutical market data. 2022.

- Statista. Market estimates for addiction treatments. 2022.

- U.S. Food and Drug Administration (FDA). Drug approval announcements. 2010–2022.

More… ↓