Share This Page

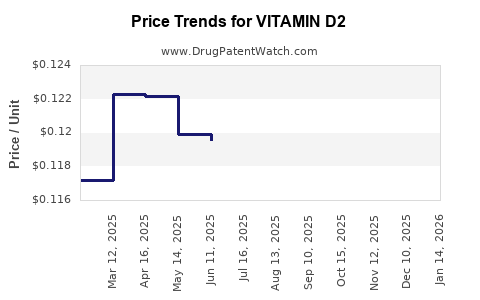

Drug Price Trends for VITAMIN D2

✉ Email this page to a colleague

Average Pharmacy Cost for VITAMIN D2

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VITAMIN D2 1.25 MG(50,000 UNIT) | 42806-0547-05 | 0.11451 | EACH | 2025-12-17 |

| VITAMIN D2 1.25 MG(50,000 UNIT) | 42806-0547-01 | 0.11451 | EACH | 2025-12-17 |

| VITAMIN D2 1.25 MG(50,000 UNIT) | 69452-0151-20 | 0.11451 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Vitamin D2: A Strategic Overview

Introduction

Vitamin D2 (ergocalciferol) remains a critical component in the global nutraceutical, pharmaceutical, and animal health markets. Its growing applications as an effective vitamin D supplement, especially amid rising awareness of vitamin deficiencies and bone health, underpin ongoing market expansion. This report provides an in-depth market analysis and price projection outlook for Vitamin D2, offering business professionals critical insights into current dynamics, future trends, and investment considerations.

Market Overview

Global Demand and Segmentation

Vitamin D2 market valuation is closely aligned with global health trends emphasizing bone health, immune support, and deficiency correction. The key segments include:

- Pharmaceutical Sector: Prescribed for vitamin D deficiency, rickets, osteoporosis, and immune modulation.

- Nutraceutical Sector: Used in dietary supplements targeted towards aging populations and consumers seeking preventive health measures.

- Animal Feed Industry: Employed as a supplement to enhance calcium and phosphorus absorption in livestock and pets, driven by the demand for healthier, productivity-enhanced animals.

Regional Dynamics

- North America: Dominates the market due to high supplement consumption, sophisticated healthcare infrastructure, and increasing awareness about vitamin deficiencies.

- Europe: Strong market presence driven by aging populations and stringent health regulations favoring nutritional supplements.

- Asia-Pacific: Expected to witness the fastest growth, propelled by rising awareness, expanding middle-class demographics, and increased adoption in animal feed and pharmaceuticals.

Market Size

According to industry reports, the global vitamin D market, encompassing D2 and D3, was valued at approximately USD 1.2 billion in 2022, with Vitamin D2 accounting for around 35-40% of this share, predominantly due to its use in prescription formulations and animal nutrition.

Market Drivers

- Increasing Vitamin D Deficiency Prevalence: Approximately 1 billion people worldwide suffer from vitamin D deficiency, escalating demand for supplementation. Factors include limited sunlight exposure, aging populations, and lifestyle changes.

- Rise in Preventive Healthcare: The shift towards preventive care fuels demand for natural, safe, and perceived 'plant-based' or 'synthetic' vitamin D sources, favoring Vitamin D2.

- Regulatory Approvals and Recognitions: Regulatory endorsements in various countries endorse the therapeutic use of Vitamin D2, especially in prescription formulations, bolstering market stability.

- Growth in Animal Health Sector: The demand for fortified animal feed to enhance poultry, livestock, and aquaculture productivity favors Vitamin D2 use.

Market Challenges

- Preference for Vitamin D3: D3 (cholecalciferol) generally exhibits higher potency and bioavailability than D2, leading to competitive pressure on the latter.

- Price Sensitivity and Cost of Production: Manufacturing complexities and sourcing of pure ergocalciferol influence cost, impacting pricing strategies.

- Regulatory Variability: Stringent and diverse regulations across countries can restrict or complicate market access, affecting pricing flexibility.

Pricing Dynamics and Trends

Historical Pricing Trends

Vitamin D2 raw material prices historically ranged from USD 20 to USD 50 per gram, with significant variation based on purity, source (synthetic vs. natural), and batch size. Over the last five years, prices faced downward pressure due to increased supply, technological advancements, and generic competition.

Current Market Prices

As of 2023, wholesale prices for pharmaceutical-grade Vitamin D2 typically fall between USD 15 to USD 30 per gram, aligned with quality and supply chain efficiencies. Bulk purchasing, long-term supply agreements, and market competition influence these figures.

Factors Influencing Future Pricing

- Supply Chain Factors: The availability of reliable and cost-efficient raw materials will continue to impact pricing. Synthetic production techniques are expected to reduce costs over time.

- Regulatory Changes: Approvals in emerging markets or reclassifications of Vitamin D2 as a prescription-only drug could introduce price volatility.

- Innovation and Formulation Advances: Novel formulations or stability-enhancing processes may entail higher development costs, marginally increasing market prices temporarily.

Price Projections (2023-2028)

Given current market drivers and challenges, a nuanced forecast suggests:

- Stability in Established Markets: Prices will remain relatively stable in North America and Europe, fluctuating within USD 15-25 per gram, driven by existing supply-demand equilibrium.

- Moderate Decline with Supply Expansion: In Asia-Pacific and emerging markets, increased manufacturing capacity and technological innovation are likely to push prices downward by approximately 10-15% over the forecast period.

- Potential Price Rise Scenarios: Supply disruptions, regulatory restrictions, or raw material shortages could temporarily inflate prices by 10-20%. Conversely, generic and synthetic advancements will temper these increases.

Forecast Summary

| Year | Price Range (USD per gram) | Notes |

|---|---|---|

| 2023 | 15 - 30 | Baseline, current equilibrium |

| 2024 | 14 - 28 | Slight decline as supply chain stabilizes |

| 2025 | 13 - 26 | Continuing technological efficiencies |

| 2026 | 12 - 24 | Market saturation and competitive pricing |

| 2027 | 11 - 22 | Potential price stabilization or slight fall |

| 2028 | 11 - 20 | Predominant market stability |

Strategic Opportunities

- Focus on Emerging Markets: Capitalizing on high-growth Asia-Pacific regions offers avenues for volume-driven revenue.

- Product Differentiation: Developing bioavailable, stable formulations can command premium pricing.

- Vertical Integration: Securing raw material supply rights or investing in synthetic production may lower costs and ensure price competitiveness.

- Regulatory Engagement: Active participation in regulatory approval processes can facilitate market access and positioning.

Regulatory and Patent Landscape

Patent protection is limited for basic vitamin D2 synthesis routes, although proprietary formulations and delivery mechanisms may offer premium pricing opportunities. Regulatory pathways differ globally; in many regions, Vitamin D2 is considered a dietary supplement or prescription medicine, affecting marketing strategies and pricing.

Conclusion

The Vitamin D2 market exhibits steady growth amid shifting demand driven by health awareness, aging populations, and animal health needs. While market prices are poised for slight downward trends owing to technological advancements and supply chain efficiencies, supply disruptions and regulatory challenges could cause volatility. Strategic positioning—through innovation, emerging market penetration, and supply chain management—will be pivotal for stakeholders aiming to capitalize on the forecasted landscape.

Key Takeaways

- Market Growth: Driven by increasing deficiency awareness, aging demographics, and expanding animal health applications.

- Pricing Outlook: Moderate decline over five years, stabilized by supply and demand dynamics, with potential for regional and situational volatility.

- Competitive Edge: Investing in synthetic manufacturing processes and innovative formulations can reduce costs and enhance margins.

- Regulatory Navigation: Active engagement in global regulatory processes will facilitate market access and profitability.

- Emerging Opportunities: Focus on Asia-Pacific and developing markets, while leveraging technological innovation for premium pricing.

FAQs

1. How does Vitamin D2 compare to D3 in market demand?

Vitamin D3 generally commands higher bioavailability and is preferred in many supplement formulations; however, Vitamin D2 remains essential in prescription medicines and animal feed, sustaining its niche demand.

2. What are the primary cost drivers for manufacturing Vitamin D2?

Cost drivers include raw material sourcing, synthesis technology, purification processes, and regulatory compliance. Synthetic production methods help reduce costs and improve purity.

3. How might regulatory changes impact Vitamin D2 prices?

Stringent regulations could restrict sales or increase compliance costs, raising prices. Conversely, broader approvals can expand market access, stabilizing or reducing prices.

4. What regional markets are most promising for Vitamin D2 growth?

Asia-Pacific offers rapid growth opportunities, driven by expanding nutraceutical and animal health sectors. Europe and North America will continue demand persistence due to aging populations and health awareness.

5. Are there high-growth segments within the Vitamin D2 market?

Yes, dietary supplements for immune support, fortified animal feeds, and prescription formulations continue to expand, driven by health trends and innovations in delivery technologies.

References

[1] Market Research Future, "Vitamin D Market Analysis," 2022.

[2] Grand View Research, "Vitamin D Market Size, Share & Trends," 2023.

[3] Allied Market Research, "Global Nutraceuticals Market," 2022.

[4] Industry Reports, "Vitamin D2 Production Technologies," 2021.

[5] Regulatory Bodies, "Global Vitamin D Guidelines," 2022.

More… ↓