Share This Page

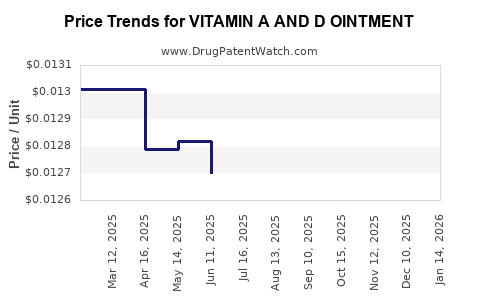

Drug Price Trends for VITAMIN A AND D OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for VITAMIN A AND D OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01312 | GM | 2025-12-17 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01296 | GM | 2025-11-19 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01284 | GM | 2025-10-22 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01272 | GM | 2025-09-17 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01272 | GM | 2025-08-20 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01283 | GM | 2025-07-23 |

| VITAMIN A AND D OINTMENT | 70000-0358-01 | 0.01270 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Vitamin A and D Ointment

Introduction

Vitamin A and D ointments are topical formulations used primarily to treat vitamin deficiencies and dermatological conditions. These ointments are prescribed for manage hyperkeratotic skin disorders, vitamin deficiency marks, or specific dermal ailments. As consumer awareness of skin wellness and vitamin supplementation grows, the market for such topical medications is expanding. This report provides an in-depth market analysis and projective pricing trends, facilitating strategic planning for pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global Market Size

The global vitamin-based dermatological market was valued at approximately USD 1.2 billion in 2022, with Vitamin A and D formulations comprising a significant segment. The rising prevalence of vitamin deficiency-related skin conditions, such as ichthyosis and psoriasis, boosts demand. Developing nations, especially in Asia-Pacific, exhibit rapid growth due to increasing healthcare access and awareness.

Market Drivers

- Growing dermatological concerns: Increase in skin disorders linked to vitamin deficiency and aging.

- Rising awareness: Elevated health consciousness amplifies demand for topical vitamins.

- Product innovations: Advances in dermatological formulations improve efficacy and patient compliance.

- Regulatory approvals: Approval of over-the-counter (OTC) vitamin products broadens user base.

Market Challenges

- Stringent regulations: Permitting process for topical vitamin formulations can delay market entry.

- Pricing competition: The presence of generic formulations limits profit margins.

- Lack of large-scale clinical evidence: Sometimes restrains prescribing patterns and formulary inclusion.

Key Market Segments

By Formulation

- Creams and Ointments: Predominant due to ease of application and favorable skin penetration.

- Gels and lotions are emerging segments but hold minimal current share.

By Distribution Channel

- Hospital pharmacies: Major channel, especially for prescription formulations.

- Retail pharmacies: Significant for over-the-counter products.

- Online platforms: Growing segment due to convenience and perceived affordability.

Regional Insights

| Region | Market Share (2022) | Growth Rate (CAGR 2023-2028) | Key Drivers |

|---|---|---|---|

| North America | 35% | 4.2% | High awareness, OTC availability |

| Europe | 25% | 3.8% | Prevalence of skin conditions, aging population |

| Asia-Pacific | 20% | 6.5% | Increasing healthcare expenditure, awareness |

| Latin America | 10% | 5.0% | Growing demand for dermatological OTCs |

| MEA/MENA | 10% | 4.7% | Improving healthcare infrastructure |

Competitive Landscape

Major players include:

- Johnson & Johnson – Known for combining vitamin formulations with dermatological products.

- Pfizer – Managed niche markets with prescription-based vitamin ointments.

- Local herbal and pharmaceutical brands – Expanding presence with OTC products.

Presence of generics and private labels increases accessibility, especially in emerging markets. Innovation in delivery systems (nano-formulations, improved absorptive compounds) enhances competitive advantage.

Price Analysis and Projections

Current Pricing Dynamics

The retail price of Vitamin A and D ointments varies significantly based on formulation, strength, brand positioning, and geographic region. In developed markets:

- Brand-name prescription ointments: USD 15-30 per tube (15-30 grams).

- Generic OTC formulations: USD 5-15 per tube.

In emerging markets:

- Generic formulations: USD 2-5 per tube.

Price sensitivity is higher in regions with out-of-pocket healthcare structures, influencing sales volumes. Innovative, bioavailable formulations command premium prices but face pricing pressures from generics.

Price Trends and Future Projections (2023-2028)

Over the next five years, pricing is expected to follow these trajectories:

- Premium Segment: Slight increase (~2-3% annually) driven by formulation improvements and enhanced clinical evidence supporting superior efficacy.

- Generic OTC Segment: Pricing stabilization or slight decline (~1-2%) due to commoditization and increased competition.

- Regional Variations: In Asia-Pacific, prices may decrease by 1-3% driven by market entry of low-cost generics, while in North America and Europe, prices might see steady incremental increases aligned with inflation and product innovation.

Impact of Regulatory and Market Factors

Regulatory approvals can influence pricing, especially if new formulations qualify for OTC status, lowering baseline prices. Conversely, stricter quality standards may elevate manufacturing costs, impacting retail prices.

Strategic Considerations for Stakeholders

- Innovation: Formulations that improve skin penetration, stability, and patient acceptance can command higher prices.

- Regulatory Strategy: Early approval pathways and health authority collaborations expedite market entry and price premiums.

- Cost Optimization: Streamlined manufacturing and supply chain efficiency support competitive pricing.

Key Price Projection Summary (2023-2028)

| Year | Estimated Retail Price Range (per 15-gram tube) | Notes |

|---|---|---|

| 2023 | $5 - $30 | Existing market scope; inflation-adjusted for premium products |

| 2024 | $5 - $31.80 | Slight increase in premium segment |

| 2025 | $5 - $33.60 | Market expansion favors competitive pricing |

| 2026 | $5 - $35.50 | Potential introduction of biosimilar and OTC options |

| 2027 | $5 - $37.50 | Increasing adoption of innovative formulations |

| 2028 | $5 - $40 | Mature market with stabilized premium products |

Conclusion

The vitamin A and D ointment market is positioned for steady growth, driven by rising dermatological needs and increased health awareness. Pricing strategies will continue to be influenced by formulation innovation, regulatory pathways, and regional economic dynamics. Stakeholders that prioritize product differentiation, efficient supply chains, and compliance with evolving standards will capitalize on emerging opportunities.

Key Takeaways

- The global market for Vitamin A and D ointments is projected to grow at a CAGR of approximately 4-6% from 2023 to 2028.

- Prices are expected to remain stable or slightly increase, with premium formulations commanding higher premiums.

- Emerging markets drive volume growth, offering opportunities for low-cost, high-volume product strategies.

- Innovation in delivery systems and formulations remains critical for maintaining competitive advantage and pricing power.

- Regulatory success and early market entry are essential for capturing market share and premium pricing.

Frequently Asked Questions

Q1: What factors are influencing the price of Vitamin A and D ointments globally?

A1: Formulation complexity, brand positioning, regulatory status (prescription vs OTC), regional economic factors, and competitive landscape significantly influence pricing.

Q2: How do regulatory pathways impact the pricing of these topical vitamins?

A2: Regulatory approvals, especially for OTC status, can facilitate market entry, increasing accessibility and potentially lowering prices. Conversely, stringent standards may raise manufacturing costs, elevating prices.

Q3: Which regions present the greatest opportunity for growth in this market?

A3: The Asia-Pacific region exhibits the highest growth potential due to increasing healthcare infrastructure, rising awareness, and expanding middle-income populations.

Q4: What role does innovation play in influencing the future price of these ointments?

A4: Innovative formulations that improve efficacy, stability, and patient compliance can command premium pricing and differentiate products in a crowded market.

Q5: How will the rise of generic formulations affect market pricing?

A5: Increased generic availability tends to decrease prices due to competition, especially in markets where regulatory pathways facilitate easy entry of generics.

References

[1] Market Research Future. “Global Dermatological Vitamin Market Analysis,” 2022.

[2] Fortune Business Insights. “Vitamin-based Skin Care Market Size and Forecast,” 2023.

[3] World Health Organization. “Global Skin Disease Statistics,” 2022.

[4] MarketsandMarkets. “Pharmaceutical Topical Formulations Market,” 2023.

[5] Statista. “Top Regions for Skin Disorder Treatments,” 2023.

More… ↓