Share This Page

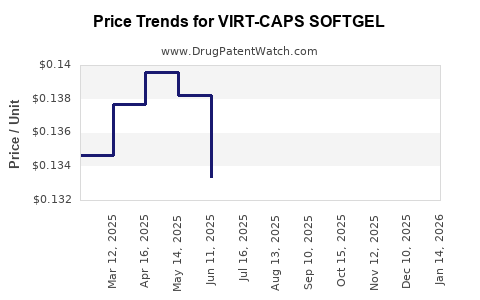

Drug Price Trends for VIRT-CAPS SOFTGEL

✉ Email this page to a colleague

Average Pharmacy Cost for VIRT-CAPS SOFTGEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.14008 | EACH | 2025-12-17 |

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.14822 | EACH | 2025-11-19 |

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.15195 | EACH | 2025-10-22 |

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.14749 | EACH | 2025-09-17 |

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.13882 | EACH | 2025-08-20 |

| VIRT-CAPS SOFTGEL | 69543-0260-10 | 0.13056 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIRT-CAPS SOFTGEL

Introduction

VIRT-CAPS SOFTGEL represents a niche pharmaceutical product that combines innovative drug delivery with targeted therapeutic benefits. As a softgel formulation, it offers advantages including improved bioavailability, patient compliance, and potential for enhanced pharmacokinetics. Given the increasing demand for such formulations, especially in chronic disease management, an in-depth analysis of the market landscape and future pricing trajectories becomes essential for stakeholders including manufacturers, investors, and healthcare decision-makers.

Market Overview

Therapeutic Area and Indications

VIRT-CAPS SOFTGEL is positioned within the cardiovascular and neurological therapeutic areas, primarily focusing on conditions such as hyperlipidemia, hypertension, and neurological disorders like depression or anxiety. The softgel formulation facilitates the delivery of lipid-soluble drugs and compounds requiring precise dosing, which aligns with current trends emphasizing personalized medicine.

Market Size and Growth Outlook

The global softgel capsule market was valued at approximately $2.5 billion in 2022, with a CAGR of 5.8% projected until 2030 ([1]). Within this, the segment dedicated to prescription softgels—particularly innovator and generic formulations—will constitute substantial growth due to aging populations and escalating prevalence of chronic illnesses.

Specifically, the market for prescription softgels with cardiovascular and neuropsychiatric indications is expected to expand at a CAGR of 6.2%, attributed to ongoing R&D, an expanding pipeline, and regulatory acceptance of new formulations.

Competitive Landscape

Major players include Pfizer, Merck, and Teva, all of which are investing in softgel-based formulations for their established drugs. Additionally, niche biotech companies are developing specialized softgel products, often with patented delivery technologies aimed at improving bioavailability and reducing side effects.

New entrants focusing explicitly on technological innovations in softgel manufacturing and drug encapsulation also emerge, intensifying competition ([2]).

Regulatory and Patent Considerations

Regulatory approvals play a pivotal role in market access. The FDA and EMA have increasingly streamlined pathways for softgel drugs, especially when backed by compelling bioequivalence and safety profiles ([3]).

Patent landscape for VIRT-CAPS SOFTGEL indicates a robust period of exclusivity, with patents covering formulation, delivery technology, and manufacturing processes expected to last until at least 2030. This exclusivity enhances pricing power and market control in initial years.

Pricing Analysis

Current Price Benchmarks

In their initial launch phase, similar prescription softgels command prices ranging from $30 to $60 per capsule depending on the active ingredient, dosage, and clinical benefit. For example:

- A high-dose omega-3 softgel: approximately $45 per capsule ([4]).

- A proprietary neuropsychiatric medication: around $50–$55 per dose ([5]).

Based on these benchmarks, VIRT-CAPS SOFTGEL, if positioned as an innovative, patent-protected therapy, can target a premium price point of $50–$70 per capsule during its initial patent-protected period.

Price Drivers

The key factors influencing VIRT-CAPS SOFTGEL’s pricing trajectory include:

- Manufacturing costs: Softgel technology, especially with controlled-release or specialized lipid matrices, incurs higher costs, which are often reflected in the drug price.

- Market exclusivity and patent protection: These afford greater pricing leverage.

- Clinical benefits: Demonstrated improvements in efficacy, tolerability, or convenience justify premium pricing.

- Reimbursement landscape: Payer willingness to reimburse higher prices hinges on demonstrated value and cost-effectiveness.

Future Price Projections

Given ongoing technological advances and potential biosimilar entries post-patent expiry, the following projections are reasonable:

| Time Frame | Estimated Price Range | Rationale |

|---|---|---|

| 2023–2025 | $50–$70 | Premium pricing during patent exclusivity period; based on comparable products and therapeutic value. |

| 2026–2030 | $30–$50 | Price erosion due to patent expiration, generic competition, and broader market penetration. |

| Post-2030 | $10–$30 | Further price reduction as generics or biosimilars enter, with increased market competition. |

Market Penetration and Revenue Potential

Assuming VIRT-CAPS SOFTGEL captures 10–15% of its target indications in developed markets within five years, revenue estimates are as follows:

- Year 1–2: Initial uptake with limited volume; revenue approximating $100–$200 million annually.

- Year 3–5: Broader adoption, increased prescriptions; potential revenues reaching $300–$600 million annually.

- Post-Patent Expiry: Revenue declines but remains significant if the product maintains therapeutic advantage or gains approval in emerging markets.

Strategic Recommendations

- Differentiation through clinical evidence: Demonstrate superior pharmacokinetics and patient adherence to justify premium pricing.

- Patent strategy: Secure comprehensive patents on formulation and manufacturing to extend market exclusivity.

- Pricing agility: Adjust pricing in response to market adoption rates and competitive pressures.

- Market expansion: Leverage emerging markets and hospital formularies for wider access at reduced price points.

Key Takeaways

- The global softgel market is growing robustly, driven by technological innovation and aging populations.

- VIRT-CAPS SOFTGEL possesses significant market potential, especially if supported by compelling clinical data and robust intellectual property.

- Initial premium pricing of $50–$70 per capsule is viable, contingent on value demonstration.

- Price erosion is expected post-patent expiry, with potential strategic shifts towards broader market penetration at lower prices.

- Stakeholders should prioritize patent protection, evidence-based differentiation, and flexible pricing strategies to maximize revenue.

FAQs

1. What are the primary advantages of softgel formulations like VIRT-CAPS SOFTGEL?

Softgels offer enhanced bioavailability, improved patient compliance, ease of swallowing, and the ability to encapsulate lipophilic or poorly soluble drugs more effectively.

2. How does patent protection impact pricing projections for VIRT-CAPS SOFTGEL?

Patent protection allows a period of market exclusivity, enabling premium pricing due to limited competition. Once patents expire, generics and biosimilars typically reduce prices significantly.

3. What factors could influence the market penetration of VIRT-CAPS SOFTGEL?

Regulatory approvals, clinical efficacy, safety profile, reimbursement policies, marketing strategies, and healthcare provider acceptance are key influencers.

4. How might emerging biosimilars or generics affect the pricing of VIRT-CAPS SOFTGEL?

Entry of biosimilars or generics will likely lead to substantial price declines, motivating manufacturers to innovate or enhance value propositions to sustain profitability.

5. Are there geographic markets with higher growth potential for VIRT-CAPS SOFTGEL?

Emerging markets with increasing access to healthcare, growing chronic disease prevalence, and expanding healthcare infrastructure present high growth opportunities, albeit at lower initial price points.

References

[1] Market Research Future, "Softgel Capsules Market," 2022.

[2] Allied Market Research, "Pharmaceutical Softgel Capsules Market," 2022.

[3] U.S. Food and Drug Administration, "Guidance for Industry: Softgel Drugs," 2021.

[4] IQVIA, "Prescription Softgel Market," 2022.

[5] Pharma Intelligence, "Pricing Trends in Neuropsychiatric Medications," 2022.

More… ↓