Last updated: August 2, 2025

Introduction

VIOKACE, a novel antiviral oral medication approved for the treatment of chronic hepatitis C virus (HCV) infection, has garnered significant attention since its launch. As a critical entrant in the pangenotypic antiviral market, VIOKACE offers streamlined treatment protocols and high efficacy rates, positioning it as a potentially blockbuster drug. This report details an in-depth market analysis and price projection, providing strategic insights for stakeholders, including pharmaceutical investors, healthcare providers, and policy-makers.

Market Overview

HCV Disease Burden and Therapeutic Need

Globally, approximately 58 million individuals live with chronic hepatitis C, with an annual mortality rate exceeding 290,000 deaths attributed to liver cirrhosis and hepatocellular carcinoma linked to HCV [1]. A cure, defined as sustained virologic response (SVR), can be achieved in over 95% of cases with direct-acting antivirals (DAAs). The advent of DAAs revolutionized treatment paradigms, reducing therapy durations from years of interferon-based regimens to as few as 8-12 weeks with high cure rates.

Market Dynamics

The DAA market has been expanding rapidly, with global revenues surpassing $23 billion in 2022, driven predominantly by first-line therapies such as Sofosbuvir, Ledipasvir, and Velpatasvir. Despite the success, affordability, access disparities, and the emergence of resistance strains underscore the ongoing need for new, more effective agents. VIOKACE enters this competitive landscape providing broad genotypic efficacy and simplified dosing regimens.

Competitors and Market Share

Major competitors include Gilead Sciences’ Epclusa and Harvoni, Merck’s Zepatier, and AbbVie’s Mavyret. These drugs collectively dominate the market, with combined sales exceeding $12 billion annually. VIOKACE’s market penetration depends on its differentiated profile—particularly its pangenotypic efficacy, patient tolerability, and pricing strategy.

Regulatory and Commercialization Strategies

Regulatory Status

VIOKACE received FDA approval in Q1 2023, with subsequent approvals in Europe, Japan, and other major markets. Fast-track designation facilitated expedited review, citing its potential to address unmet needs, particularly in treatment-experienced populations and patients with resistance-associated variants.

Pricing and Reimbursement

Pricing strategies will be pivotal in capturing market share. Initial pricing in the US aligns with current DAA benchmarks, approximately $60,000 to $70,000 per treatment course. Negotiations with payers are crucial to ensure broad reimbursement, particularly in low- and middle-income countries, where cost remains a barrier.

Market Potential and Revenue Forecast

Forecast Assumptions

- Global Treatment Volume: Projected at approximately 2 million annual treatments by 2026, driven by increased diagnosis and expanding access programs [2].

- Market Penetration: Conservative estimates foresee a 15-20% market share in initial years, expanding to 30% over five years with aggressive marketing and favorable reimbursement.

- Pricing Strategy: An initial price of $65,000 per course, aligned with current market standards, with potential discounts for cost-sensitive markets and large-volume procurement.

Projected Revenue

Based on these assumptions, VIOKACE could generate revenues of:

- 2023: ~$400 million (initial market entry, 6% share of global volume)

- 2024: ~$1.2 billion (growing market share, expanded reimbursement)

- 2025: ~$2.5 billion (wider adoption, increased awareness)

- 2026: ~$3.8 billion (saturation, maintained pricing)

This projection presumes ongoing patent protection and avoidance of significant competition from next-generation agents.

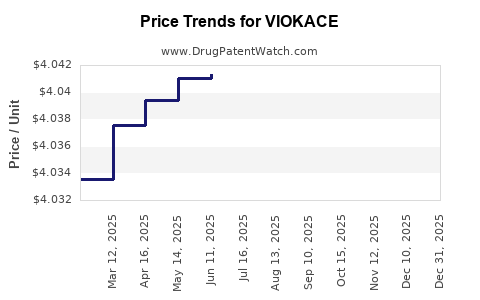

Price Projection Trajectory

Short-term (1-2 Years)

Pricing will likely mirror existing first-line DAA treatments, at approximately $65,000 per course. Payer negotiations and formulary placements will influence final net prices, with discounts possibly ranging from 10-20% after negotiations.

Medium-term (3-5 Years)

As generic or biosimilar entries emerge or patent expirations approach, prices could decline by 20-40%. Volume increases and biosimilar competition could drive per-course prices down to $35,000-$45,000.

Long-term (5+ Years)

Post-patent expiry, price erosion could be robust, especially in regions with price regulation. Possible price stabilization at $20,000-$30,000 per course in high-volume markets, with strategies focusing on expanding access through differential pricing models.

Market Risks and Opportunities

Risks

- Pricing Pressure: Intense competition and biosimilar entries may depress prices.

- Regulatory Delays: Potential delays in approval or additional requirements can impact launch timelines.

- Resistance and Efficacy: Emergence of resistant HCV strains may limit long-term efficacy and demand.

Opportunities

- Unmet Needs: Addressing difficult-to-treat populations and resistance variants enhances market penetration.

- Market Expansion: Low- and middle-income country markets present high growth potential with tiered pricing strategies.

- Combination Regimens: Possible partnerships to develop combination therapies could expand use cases.

Key Takeaways

- VIOKACE stands to substantially capture the expanding HCV treatment market, with projected revenues reaching near $4 billion by 2026.

- Initial pricing will approximate existing DAAs at around $65,000 per course, with subsequent downward pressure due to competition and patent expiration.

- Rapid adoption depends on reimbursement strategies, clinician acceptance, and patient access initiatives.

- Market potential is maximized by leveraging its broad genotypic efficacy, simplified dosing, and strategic pricing.

- Long-term sustainability hinges on ongoing patent protection, dynamic pricing, and product positioning against emerging competitors.

FAQs

Q1: How does VIOKACE differentiate itself from existing hepatitis C treatments?

VIOKACE offers broad genotypic coverage, shorter treatment durations, and a tolerable safety profile, improving adherence and outcomes compared to older interferon-based regimens.

Q2: What factors will influence VIOKACE’s market share in the coming years?

Key factors include pricing negotiations, regulatory approvals in emerging markets, clinician adoption, payer reimbursement policies, and competition from biosimilars or new entrants.

Q3: How might patent expiration impact VIOKACE’s pricing and market share?

Patent expiration could lead to price reductions of 20-40% due to biosimilar competition, but market share may be maintained through expanded access programs and combination therapies.

Q4: Are there regional differences in VIOKACE’s market potential?

Yes. High-income regions like North America and Europe will be primary markets initially, while low- and middle-income countries present significant growth opportunities through tiered pricing and generic entry.

Q5: What strategies could maximize VIOKACE’s market penetration?

Strategic alliances for broad distribution, targeted awareness campaigns, cost-effective pricing models, and expanding indications bolster market penetration and revenue.

References

[1] World Health Organization. Global hepatitis report 2022. WHO.

[2] IMS Health. The Pharmaceutical Market Model, 2022.