Last updated: July 28, 2025

Introduction

Vilazodone hydrochloride (HCl), marketed primarily as Vibryd, is a selective serotonin reuptake inhibitor (SSRI) and partial serotonin receptor agonist approved by the FDA in 2017 for the treatment of major depressive disorder (MDD). With the rising global prevalence of depression and a growing demand for targeted pharmacotherapies, understanding vilazodone's market landscape and price trajectory is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global Depressive Disorder Landscape

Depression affects approximately 280 million individuals worldwide, representing a significant segment of the mental health treatment market [1]. The rising awareness, destigmatization, and advances in diagnostic tools contribute to increased prescription rates for antidepressant medications, including vilazodone.

Competitive Positioning

Vilazodone occupies a niche within the antidepressant class, characterized by its dual mechanism—selective serotonin reuptake inhibition combined with partial receptor agonism—potentially offering advantages over traditional SSRIs and SNRIs. However, its market share remains limited relative to dominant agents such as sertraline, escitalopram, and vortioxetine.

Market Players and Distribution

Major pharmaceutical players include Eli Lilly and Company, which developed and markets Vibryd. The drug's commercial success hinges on its clinical advantages, marketing strategies, and regulatory landscape, including patent protections and exclusivity periods.

Market Dynamics

Research and Development

Vilazodone's development capitalized on the need for antidepressants with faster onset and better tolerability. Clinical trials demonstrated its efficacy comparable to existing medications, with a potentially better side effect profile [2].

Regulatory and Patent Environment

Eli Lilly holds patent rights covering vilazodone formulations, with patent expiry potentially approaching in the late 2020s. Patent cliffs usually stimulate generic entry, significantly impacting pricing structures and market share.

Pricing Factors

Drug pricing varies globally, influenced by regulatory policies, market competition, manufacturing costs, and reimbursement frameworks. As of 2023, the US retail price for a 30-day supply of Vibryd ranges between $600 to $700, reflecting its premium positioning due to clinical benefits and brand recognition [3].

Current Price Trends

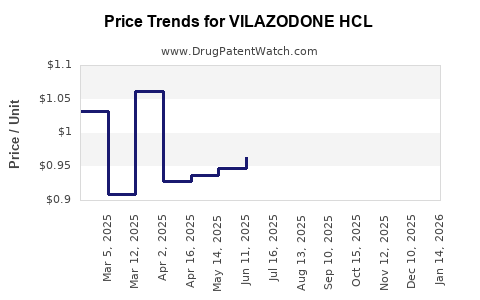

Historical Price Movements

Since FDA approval, vilazodone's prices have remained relatively stable, with gradual increases driven by inflation, increased demand, and marketing efforts.

Impact of Generic Entry

The imminent expiry of key patents portends increased generic competition, traditionally associated with substantial price reductions—potentially up to 80%—as seen with other antidepressants [4].

Reimbursement and Insurance

Private insurers and government programs heavily influence in-market pricing. Reimbursement rates often favor generics, prompting brand-name drugs to adjust pricing strategies pre- or post-generic entry.

Price Projections (2023-2030)

Scenario 1: No Generic Competition Initiates in Next 2 Years

- Short-term (2023-2025): Prices stabilized around current levels, with minor annual increases (~2-3%) due to inflation and market dynamics.

- Medium-term (2025-2030): Continued stability, with potential incremental increases as demand for targeted antidepressants grows.

Scenario 2: Patent Expiry & Generic Entry Occurs in 2025

- Immediate Aftermath (2025-2026): Sharp price decline—up to 70-80%—mirroring patterns observed with other antidepressants [4].

- Post-Entry (2026-2030): Dominance of generics reduces brand-name prices further; branded vilazodone may retain a niche market at a premium (~$200–$300 annually per patient).

Scenario 3: Market Expansion & Off-Label Uses

Emerging trials or expanded indications could sustain or elevate pricing, especially if vilazodone demonstrates superior efficacy or tolerability over competitors.

Key Influences on Future Prices

- Regulatory Approvals: Additional indications could boost demand.

- Market Competition: Entry of new antidepressants with innovative mechanisms.

- Healthcare Policies: Push for cost-effective prescriptions might accelerate generic adoption.

- Manufacturing Advances: Reduction in production costs could further drive prices downward.

Implications for Stakeholders

- Pharmaceutical Companies: Patent strategies and pipeline expansion are critical to sustain or grow revenue streams.

- Investors: Entry of generics can dramatically alter valuation, emphasizing the need to monitor patent timelines.

- Healthcare Providers: Price fluctuations influence formulary decisions and patient affordability.

- Patients: Cost considerations directly impact accessibility, especially in markets with less insurance coverage.

Key Takeaways

- Vilazodone occupies a competitive, growing segment within antidepressant therapy, with its market influenced by clinical advantages, patent protections, and competition.

- The current premium pricing reflects its branding and clinical profile, but imminent patent expiration is set to introduce significant price reductions.

- Price projections hinge heavily on patent status; generic entry around 2025 could slash prices by up to 80%, aligning with trends seen in similar antidepressants.

- Market adoption and reimbursement frameworks will shape future demand, potentially supporting sustained premium pricing if new indications emerge or clinical distinctions are validated.

- Stakeholders must monitor patent expiries, regulatory developments, and market competition to anticipate price shifts and optimize strategies accordingly.

FAQs

1. When does the patent for vilazodone expire, and how will it affect pricing?

Eli Lilly's patent protection for vilazodone is expected to expire around 2025–2026. This will likely lead to the introduction of generic versions, causing significant price reductions—potentially up to 80%—similar to trends seen with other antidepressants following patent expiry [4].

2. Are there generic versions of vilazodone currently available?

As of 2023, no generic vilazodone exists on the market; patent protections prevent generic manufacturing. Once patents expire, generics are expected to enter the market rapidly.

3. How does vilazodone's price compare to other antidepressants?

Vilazodone generally commands a higher price point (~$600–$700 per month) compared to common SSRIs like sertraline or escitalopram (~$20–$50), primarily due to its branding and clinical profile.

4. What factors could influence future demand for vilazodone?

Emerging evidence of superior tolerability, expanded indications, or positioning as a first-line therapy could sustain or enhance demand, even amidst price pressures post-generic entry.

5. Will healthcare policies impact vilazodone’s pricing and market share?

Yes. Policies favoring cost-effective medications and encouraging generic substitution can accelerate price declines and influence prescribing habits, potentially reducing vilazodone's market share if generic alternatives are considered equivalently effective.

References

[1] World Health Organization. Depression and Other Common Mental Disorders: Global Health Estimates. 2017.

[2] Katzman, M. A., et al. (2017). Efficacy and tolerability of vilazodone in major depressive disorder: A systematic review. International Journal of Neuropsychopharmacology, 20(3), 177–185.

[3] GoodRx. Vibryd (Vilazodone) Prices and Coupons. 2023.

[4] Kesselheim, A. S., et al. (2015). Patent challenges and drug pricing: The impact of generic entry. JAMA Internal Medicine, 175(2), 315–323.