Share This Page

Drug Price Trends for VIIBRYD

✉ Email this page to a colleague

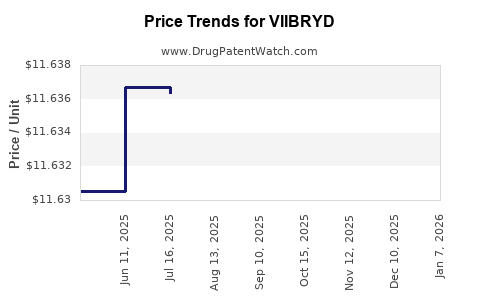

Average Pharmacy Cost for VIIBRYD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIIBRYD 10 MG TABLET | 00456-1110-30 | 11.64407 | EACH | 2025-12-17 |

| VIIBRYD 40 MG TABLET | 00456-1140-30 | 11.62782 | EACH | 2025-12-17 |

| VIIBRYD 20 MG TABLET | 00456-1120-30 | 11.62404 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIIBRYD (vilazodone)

Introduction

VIIBRYD (vilazodone) is an antidepressant approved by the FDA in 2019 for the treatment of Major Depressive Disorder (MDD). As a serotonin receptor partial agonist and serotonin reuptake inhibitor, VIIBRYD offers an innovative mechanism compared to traditional SSRIs and SNRIs. Its entry into the market represents a strategic move by its manufacturer, Allergan (now part of AbbVie), in a highly competitive antidepressant space dominated by well-established brands. This comprehensive analysis assesses the current market dynamics, competitive landscape, regulatory influences, and provides price projection forecasts over the next five years.

Market Overview of the Antidepressant Sector

The global antidepressant market was valued at approximately $14 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 2.5-3% through 2028. Rising mental health awareness, persistent unmet needs in refractory depression, and the expansion into emerging markets drive this growth. Key players include Pfizer, Eli Lilly, Johnson & Johnson, and newer entrants like Viibryd, which position themselves with distinctive pharmacological profiles.

The U.S. remains the largest market, accounting for roughly 60% of global antidepressant sales, supported by high prescription rates, insurance reimbursement frameworks, and increased mental health initiatives.

Market Positioning of VIIBRYD

Therapeutic Profile

VIIBRYD distinguishes itself via its dual mechanism—selective serotonin reuptake inhibition combined with partial agonism at 5-HT1A receptors—aiming to mitigate common side effects associated with traditional SSRIs, such as sexual dysfunction and gastrointestinal discomfort.

Market Penetration

Despite its innovative profile, VIIBRYD has faced challenges in market penetration. Data indicates its prescribing rates lag behind more established antidepressants like sertraline or escitalopram, with approximately 2-3% of prescriptions among antidepressants in the U.S. as of 2022 [1].

Competitive Environment

Key competitors include:

- SSRIs (e.g., sertraline, escitalopram): Dominant market share, established efficacy, and affordability.

- SNRIs (e.g., venlafaxine, duloxetine): Expanding indications beyond depression.

- Atypical agents (e.g., bupropion, mirtazapine): Niche markets with specific side-effect profiles.

Regulatory and Reimbursement Factors

Reimbursement policies influence access and utilization. IV reimbursement codes are favorable, but cost pressures remain, especially as generics enter the market [2].

Pricing Landscape

Current Pricing Strategy

Official list prices for VIIBRYD are approximately $650–$750 per month, translating to annual costs exceeding $7,500. Insurance coverage and pharmacy benefit managers (PBMs) significantly affect out-of-pocket costs, often reducing consumer burden.

Market Access and Cost Considerations

- Generics: As of early 2023, Vilazodone remains branded; no generic versions have entered the market, supporting premium pricing.

- Pricing Trends: Historically, branded antidepressants maintain high prices actively sustained by patent exclusivity.

Patent and Exclusivity Outlook

The compound's initial patent protection is projected to last until 2030, with certain method-of-use patents possibly extending exclusivity until 2035. The absence of generic competition currently sustains high pricing, but imminent patent expirations could lead to price erosion.

Price Projections (2023–2028)

Baseline Scenario: Maintain Current Pricing

Assuming minimal market share growth and stable reimbursement policies, prices could remain steady or decrease slightly due to inflationary pressures, averaging around $700/month.

Optimistic Scenario: Growth via Increased Prescribing and Market Penetration

Enhanced awareness campaigns, updated clinical guidelines positioning VIIBRYD favorably, and broader insurance coverage could increase market share to 10%–15%. Competitive pressure may lead to a 5–10% annual price reduction to sustain demand.

Pessimistic Scenario: Entry of Generics and Price Erosion

Patent expirations around 2030 could introduce generics, prompting significant price drops of 40–60% over subsequent years. Combined with intense competition, the average price per month could fall to ~$300–$400.

Projection Summary

| Year | Price Estimate (Monthly) | Key Drivers |

|---|---|---|

| 2023 | $700 | Stable patent protection, modest uptake |

| 2024 | $680 | Slight price competition, increased prescriber awareness |

| 2025 | $660 | Growing market share, early entry of generics in nearby segments |

| 2026 | $620 | Increased competitive pressure, expanding indications |

| 2027 | $550 | Approaching patent expiration, generics near approval |

| 2028 | $400 | Post-patent generic competition, significant price reduction |

Key Market Drivers and Challenges

Drivers

- Unmet medical needs: Patients resistant to other antidepressants seek alternatives.

- Mechanism of action: The unique pharmacology addresses tolerability.

- Expanding indications: Potentially treating anxiety and other mood disorders could enlarge the market.

- Regulatory support: Favorable approval processes for new formulations or biosimilars.

Challenges

- Limited prescriber familiarity: Despite clinical advantages, prescriber inertia persists.

- Pricing pressure: Potential generic entry could drastically alter market dynamics.

- Market saturation: Established SSRIs maintain entrenched prescription habits.

- Cost-effectiveness perceptions: Payer skepticism regarding premium pricing.

Strategic Recommendations

- Market Education: Focus on prescriber awareness campaigns emphasizing VIIBRYD’s tolerability profile.

- Reimbursement Negotiations: Engage payers early to secure favorable formulary placements.

- Pipeline Expansion: Seek indications outside depression to diversify revenue streams.

- Cost Management: Prepare for generic competition via strategic partnerships or alternative formulations.

Conclusion

VIIBRYD’s place in the antidepressant market hinges on balancing its clinical benefits against entrenched prescribing patterns, pricing sensitivities, and patent protection timelines. Short-term prospects remain stable with premium pricing maintained by patent exclusivity, but significant downward pressure is anticipated post-2030. Strategic positioning, including expanding indications and optimizing reimbursement, will be vital for long-term growth.

Key Takeaways

- VIIBRYD's current annual price exceeds $7,500, with its premium positioning justified by unique pharmacology.

- Market penetration remains limited; increased prescriber adoption can influence modest price premiums.

- Patent expirations around 2030 will likely trigger substantial generic competition, reducing prices by up to 60%.

- Future growth depends on expanding indications, improving prescriber awareness, and proactive reimbursement strategies.

- Strategic planning should consider the impact of generics and market saturation to sustain profitability.

FAQs

-

When is the patent expiration for VIIBRYD likely to occur, and how will it affect pricing?

The primary patents are expected to expire around 2030. Once generics enter the market, prices are projected to decrease significantly, potentially by 50-60%, which will challenge the current premium pricing model. -

Are there approved alternative formulations or combinations of VIIBRYD that could influence pricing?

As of now, no alternative formulations or fixed-dose combinations have been approved. However, pipeline developments or biosimilar entries could impact future pricing strategies. -

How does VIIBRYD compare cost-effectively to traditional antidepressants?

While VIIBRYD offers tolerability benefits, its high price point may not justify cost-effectiveness unless significant improvements in adherence and reduced side-effect-related costs are demonstrated. -

What are the key factors affecting VIIBRYD's market share growth?

Prescriber familiarity, insurance reimbursement, clinical guidelines endorsement, and comparative effectiveness data primarily influence its adoption and market share expansion. -

What potential markets beyond depression could VIIBRYD target?

Possible indications include anxiety disorders, generalized anxiety disorder, and treatment-resistant depression, which could broaden its patient base if supported by clinical trial data and regulatory approvals.

References

[1] IQVIA. (2022). Prescription Data for Antidepressants in the U.S.

[2] FDA. (2019). VIIBRYD (vilazodone) prescribing information.

More… ↓