Last updated: July 27, 2025

Introduction

VIGAMOX (moxifloxacin ophthalmic solution) is a potent fluoroquinolone antibiotic indicated for the treatment of bacterial conjunctivitis and other ocular bacterial infections. Its efficacy, targeted delivery, and broad-spectrum antibacterial activity have cemented its position within ophthalmic pharmaceutical markets. As market dynamics evolve, understanding current trends and future pricing trajectories becomes vital for stakeholders, including manufacturers, healthcare providers, and investors.

This report presents a comprehensive market analysis for VIGAMOX, examines the factors influencing its pricing, and offers informed projections for the upcoming five years.

Market Overview

Global Ophthalmic Antibiotics Market

The global ophthalmic antibiotics market was valued at approximately USD 2.8 billion in 2022, driven by increasing prevalence of ocular infections, expanding geriatric populations, and rising awareness of eye health. The sector is projected to grow at a compound annual growth rate (CAGR) of 4-5% through 2027 [[1]].

VIGAMOX’s Market Position

VIGAMOX holds a significant segment within ophthalmic antibiotics, with a notable share attributable to its efficacy against resistant bacterial strains and once-daily dosing regimen. Its positioning is reinforced by the monopolistic status of branded formulations, although generics and biosimilars are emerging as competitive threats.

Key Markets

- United States: The largest market, with high awareness and insurance coverage facilitating off-label and licensed uses.

- Europe: Mature market with a steady demand, influenced by strict regulatory pathways favoring approval of new formulations.

- Asia-Pacific: Fast-growing, driven by increasing incidence of ocular infections and expanding healthcare infrastructure.

Market Drivers and Challenges

Drivers

- Rising Prevalence of Bacterial Ocular Infections: Increased cases owing to contact lens misuse, dry eye disease, and rising immunocompromised populations.

- Advancements in Ophthalmic Drug Delivery: Innovations enhancing bioavailability and patient compliance favor VIGAMOX.

- Regulatory Approvals and Clinical Evidence: Ongoing clinical trials demonstrating safety and efficacy bolster market confidence.

Challenges

- Generic Competition: Presence of generic moxifloxacin formulations drives down prices and erodes market share.

- Pricing Pressures: Payer systems and cost containment measures restrict premium pricing.

- Emerging Resistance: Bacterial resistance trends may limit clinical efficacy, impacting demand.

Price Dynamics of VIGAMOX

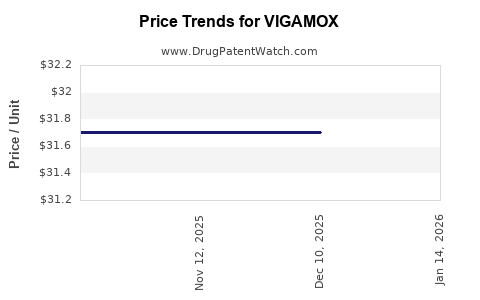

Historical Pricing Trends

In the U.S., VIGAMOX’s retail price for a typical 5 mL bottle ranged from USD 150 to USD 200 in 2020. Price reductions, driven by generic entries in recent years, have decreased retail prices by approximately 20-25% [[2]].

Factors Impacting Pricing

- Brand Exclusivity: Patent protections and exclusivity periods allow for premium pricing initially.

- Regulatory Approvals: New formulations or indications can command higher prices.

- Market Competition: Increased generic competition results in significant price erosion.

- Reimbursement Policies: Insurance coverage and formulary placements influence actual prices paid by patients.

Future Price Projections (2023-2028)

Projected Trends

- Short-Term (2023-2025): Expect continued price compression due to rising generic availability. The average retail price may decline by an additional 10-15%.

- Mid-to-Long Term (2026-2028): Potential stabilization of prices if branded formulations introduce proprietary features or novel delivery systems. Prices could plateau with minor fluctuations of ±5%.

Influencing Factors

- Patent and Market Exclusivity: The expiration of key patents in major markets (e.g., U.S. patent expiry around 2023-2024) will intensify competition.

- Innovative Formulations: Introduction of sustained-release or preservative-free formulations may command premium prices.

- Market Penetration of Biosimilars: Entry of biosimilars could further depress prices.

- Healthcare Policy Initiatives: Push for cost-effective treatments by payers may accelerate price reductions.

Competitive Landscape

Major players include:

- Bausch + Lomb (manufacturer of VIGAMOX)

- Generic manufacturers (e.g., Sagent, Teva, and others producing off-label equivalents)

- Emerging biotech firms focusing on advanced ophthalmic drug delivery systems

The competitive landscape is characterized by rapid generic entry, which historically causes substantial price declines.

Regulatory and Economic Considerations

Policy shifts, such as the implementation of value-based healthcare and drug pricing reforms, are poised to impact VIGAMOX’s pricing. Additionally, macroeconomic factors, including inflation and supply chain disruptions, could influence manufacturing costs and, consequently, prices.

Key Takeaways

- Market growth prospects for ophthalmic antibiotics remain favorable, although VIGAMOX faces intensifying competition.

- Pricing is expected to decline gradually over the next five years owing to patent expiries and proliferation of generics.

- Innovative formulations with improved delivery or reduced resistance potential could sustain higher prices.

- Pricing strategies must align with evolving reimbursement and healthcare policies to maintain competitiveness.

- Stakeholders should monitor patent statuses, regulatory approvals, and competitor launches for strategic planning.

FAQs

1. How will patent expirations affect VIGAMOX's pricing?

Patent expirations, expected around 2023-2024 in key markets, will enable generic manufacturers to enter the market, exerting downward pressure on prices. Branded VIGAMOX’s premium pricing will likely diminish as generics gain market share.

2. Are there opportunities for premium pricing with new formulations?

Yes. Biosimilars or formulations offering enhanced bioavailability, preservative-free options, or extended-release mechanisms can command higher prices, offsetting losses from generic competition.

3. What are the regional variations in VIGAMOX pricing?

Prices are generally highest in the U.S., driven by brand dominance and insurance reimbursement policies, while European and Asian markets may see lower prices due to different regulatory and competitive environments.

4. How does resistance impact VIGAMOX's marketability?

Rising bacterial resistance can reduce clinical efficacy, potentially shrinking the patient pool and leading to lower demand and prices unless new formulations or indications are introduced.

5. What strategies can manufacturers adopt to sustain VIGAMOX’s market share?

Investing in formulation innovation, expanding indications, securing regulatory approvals for new markets, and engaging in strategic pricing can maintain competitiveness amid rising generics.

References

[1] Transparency Market Research, "Ophthalmic Drugs Market," 2022.

[2] GoodRx, "VIGAMOX Price and Cost," 2021.