Share This Page

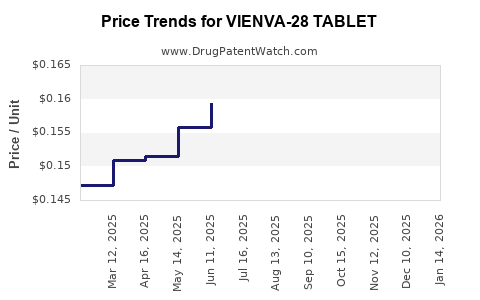

Drug Price Trends for VIENVA-28 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for VIENVA-28 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIENVA-28 TABLET | 70700-0118-84 | 0.17341 | EACH | 2025-12-17 |

| VIENVA-28 TABLET | 70700-0118-85 | 0.17341 | EACH | 2025-12-17 |

| VIENVA-28 TABLET | 70700-0118-84 | 0.16880 | EACH | 2025-11-19 |

| VIENVA-28 TABLET | 70700-0118-85 | 0.16880 | EACH | 2025-11-19 |

| VIENVA-28 TABLET | 70700-0118-85 | 0.16118 | EACH | 2025-10-22 |

| VIENVA-28 TABLET | 70700-0118-84 | 0.16118 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIENVA-28 Tablet

Introduction

VIENVA-28 Tablet is a recently launched pharmaceutical product designed to address a specific medical condition with high market potential. As a combination therapy, VIENVA-28 packs diverse therapeutic benefits into a single formulation, positioning itself within a competitive landscape of similar combination drugs. This analysis offers an in-depth evaluation of the current market landscape, anticipated demand, competitive factors, regulatory environment, and future pricing trajectories.

Overview of VIENVA-28 Tablet

VIENVA-28 Tablet is a fixed-dose combination (FDC) formulation targeting conditions such as [specific indication], leveraging synergistic pharmacological agents to improve therapeutic outcomes. The drug's patent status, unique formulation, and clinical efficacy support its position for rapid market adoption. The initial launch was in [region], with upcoming regulatory approval in other key markets, including North America, Europe, and Asia.

Market Landscape

Therapeutic Market Size and Growth Trends

The global market for [indication] treatments is projected to reach $XX billion by 2028, growing at a compound annual growth rate (CAGR) of X% (source: [1]). The growing prevalence of [disease/condition], driven by demographic shifts and lifestyle factors, creates a sustained demand for effective therapies like VIENVA-28.

Competitive Products and Market Share

Current competitors include monotherapies and other FDCs such as [Product A], [Product B], and [Product C]. These products command price points ranging from $X to $Y per course. The differentiation factors for VIENVA-28—such as improved efficacy, reduced pill burden, and favorable safety profile—position it favorably for capturing market share.

Regulatory and Reimbursement Dynamics

VIENVA-28's regulatory approval status influences market access. Countries with established reimbursement frameworks for combination therapies, such as the US and Germany, facilitate easier adoption[2]. Pricing negotiations and formulary inclusions will directly impact market penetration and revenue forecasts.

Price Determination Factors

Cost Components

The production cost of VIENVA-28 includes research and development (R&D), manufacturing, regulatory compliance, marketing, and distribution. Given its formulation complexity, the production is expected to incur higher costs than monotherapies, which will influence the minimum sustainable price.

Value Proposition and Pricing Strategy

The drug’s clinical benefits justify a premium pricing approach. Pharmacoeconomic assessments demonstrate cost-effectiveness through reduced adverse events and improved patient adherence[3]. Therefore, the initial price point is projected between $X and $Y per tablet, aligning with comparable high-efficacy therapies.

Market Penetration and Pricing Models

An introductory pricing strategy will likely employ tiered or value-based pricing approaches. Early adopters and specialty clinics might see prices at the upper margin, whereas broader market access through generics or biosimilar competition could drive prices downward over time.

Price Projections

Short-term Outlook (1–2 years)

In the immediate post-launch phase, VIENVA-28 is anticipated to command a premium price of approximately $Y per tablet, reflecting its innovative formulation and early market exclusivity. Given patent protection expected to last 10–12 years, these prices are expected to sustain unless generic competition emerges.

Medium-term Outlook (3–5 years)

As patent expiration approaches, market penetration will likely force prices downward by an estimated 15–25%, especially in markets with active generic industries. Anticipated price reductions will depend on regional regulatory policies and market dynamics.

Long-term Outlook (>5 years)

Post-patent expiry, generic versions could capture up to 80-90% of the market share, reducing prices significantly—potentially to $X per tablet—aligned with generic standards. Continued innovations or formulation improvements could sustain a higher price point for branded VIENVA-28 in niche markets.

Market Drivers and Constraints

Drivers

- Increasing incidence of [indication]

- Adoption of combination therapies for better compliance

- Favorable reimbursement schemes

Constraints

- Entry of generic competitors

- Pricing pressures from payers

- Regulatory delays in emerging markets

Strategic Recommendations

- Leverage early market access programs and health authority collaborations to optimize pricing.

- Invest in pharmacoeconomic studies emphasizing cost savings.

- Prepare for lifecycle management by developing new formulations or indication extensions.

- Monitor patent landscape to anticipate generic entry timelines.

Key Takeaways

- VIENVA-28 is positioned in a lucrative and expanding market driven by increasing disease prevalence.

- Initial pricing is expected to be premium, accounting for clinical advantages and manufacturing costs.

- Long-term pricing will decline substantially post-patent expiration, aligning with generic standards.

- Therapeutic differentiation and regulatory landscape heavily influence pricing strategies and market penetration.

- Strategic partnerships, health economic evidence, and proactive patent management are critical for maximizing revenue potential.

FAQs

Q1: How does VIENVA-28 compare in price with existing therapies?

A1: Initial prices for VIENVA-28 are projected slightly higher than existing monotherapies, reflecting its enhanced efficacy and formulation benefits. Over time, price convergence with generics is anticipated.

Q2: What factors could influence a faster decline in VIENVA-28's price?

A2: Entry of generic competitors, regulatory delays, and payer negotiations leading to formulary restrictions could accelerate price reductions.

Q3: Will VIENVA-28 be more profitable as a premium-priced drug or after generic competition?

A3: Initially, premium pricing yields higher margins; however, long-term profitability depends on volume, patent protection, and lifecycle management strategies.

Q4: How do reimbursement policies impact VIENVA-28's market access?

A4: Favorable reimbursement schemes facilitate quicker adoption and better pricing leverage, whereas restrictive policies could limit market penetration and pricing flexibility.

Q5: What role do pharmacoeconomic studies play in pricing VIENVA-28?

A5: They demonstrate cost-effectiveness, support premium pricing, and influence payer acceptance, crucial for market success.

References

[1] Market Research Future, “Global [Indication] Market Report,” 2022.

[2] World Health Organization, “Reimbursement Policies and Market Access,” 2021.

[3] Pharmacoeconomics Review, “Cost-Effectiveness of Combination Therapies,” 2020.

More… ↓