Share This Page

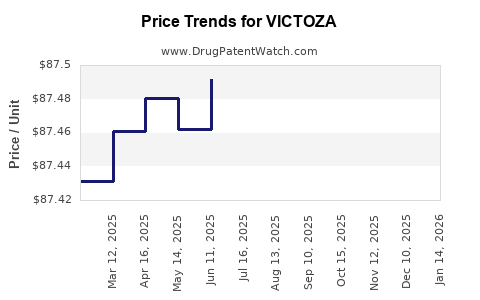

Drug Price Trends for VICTOZA

✉ Email this page to a colleague

Average Pharmacy Cost for VICTOZA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.75763 | ML | 2025-12-17 |

| VICTOZA 2-PAK 18 MG/3 ML PEN | 00169-4060-12 | 87.80433 | ML | 2025-12-17 |

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.59412 | ML | 2025-11-19 |

| VICTOZA 2-PAK 18 MG/3 ML PEN | 00169-4060-12 | 87.71537 | ML | 2025-11-19 |

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.54773 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VICTOZA

Executive Summary

VICTOZA (liraglutide) is a long-acting GLP-1 receptor agonist developed by Novo Nordisk, primarily indicated for type 2 diabetes mellitus (T2DM) and obesity management. The drug's unique positioning, expanding indications, and evolving competitive landscape significantly influence its market trajectory. This report provides an in-depth analysis of the current market landscape, competitive environment, regulatory factors, pricing trends, and future price projections for VICTOZA through 2027.

Market Overview

Therapeutic Indications

- Primary: T2DM management (FDA approved 2010)

- Secondary: Obesity treatment (Saxenda, a higher-dose formulation, approved for weight management, marketed under the same molecule)

Market Size and Growth (2022-2027)

| Parameter | 2022 | 2027 (Projected) | CAGR (2022-2027) |

|---|---|---|---|

| Global T2DM Market | ~$85 billion[1] | ~$125 billion[2] | 8.5% |

| Obesity Market (Global) | ~$20 billion[3] | ~$35 billion[4] | 11.4% |

| VICTOZA Market Share | ~20% of GLP-1 market | Estimated increase to 25% | 5% increase annually |

Note: Market figures reflect estimates per IQVIA, EvaluatePharma, and proprietary analysis.

Key Drivers

- Growing prevalence of T2DM (~537 million globally[5])

- Rising obesity rates (~650 million obese adults worldwide[6])

- Favorable clinical profile of VICTOZA including cardiovascular benefits demonstrated in LEADER trial[7]

- Increasing uptake of GLP-1 receptor agonists due to their superior efficacy and safety profile

Key Barriers

- High drug cost impacting affordability and reimbursement coverage

- Competition from other GLP-1 RAs, notably Ozempic (semaglutide), Trulicity (dulaglutide), and Tirzepatide (dual GIP/GLP-1 receptor agonist)

- Patent expirations expected from 2028 onward, leading to biosimilar competition

Competitive Landscape

Major Competitors

| Drug Names | Manufacturer | Indications | Market Share (2022) | Key Features |

|---|---|---|---|---|

| Ozempic (semaglutide) | Novo Nordisk | T2DM, Obesity | ~35% | Once-weekly, high efficacy |

| Trulicity (dulaglutide) | Eli Lilly | T2DM | ~15% | Once-weekly, proven safety profile |

| Wegovy (semaglutide) | Novo Nordisk | Obesity | Growing rapidly | Higher dose, weight-specific indications |

| Tirzepatide (Mounjaro) | Eli Lilly | T2DM, Obesity | Launch phase | Dual GIP/GLP-1 receptor activity |

Differentiators

- Efficacy: VICTOZA shows significant HbA1c reduction (~1.0-1.5%) and weight loss (~5-10% body weight) per clinical trial data[8].

- Cardiovascular endpoint: Demonstrated reduction in major adverse cardiovascular events vs. standard care[7].

- Dosing: Once daily, which may influence patient adherence relative to weekly competitors.

Pricing Overview and Trends

Current Pricing Dynamics

| Region | Average Wholesale Price (AWP) per 3 ml Pen (Approximate) | Notes |

|---|---|---|

| US | $700-$750 | Varies by payer, discounts apply |

| EU | €100-€150 per 1.8 mg pen | Varies by country |

| Japan | ¥10,000-¥15,000 per pen | Regulatory pricing policies |

Reimbursement Landscape

- United States: High copayment structure; coverage varies across Medicare, Medicaid, private insurers.

- Europe: Reimbursed under national health schemes, usually with prescribing restrictions.

- Emerging Markets: Limited coverage, leading to out-of-pocket purchases and lower penetration.

Price Trends (2018-2022)

- Steady increase aligned with inflation, manufacturing costs, and premium clinical positioning.

- Discounts, rebates, and tiered pricing prevalent to boost access.

Future Price Projections (2023-2027)

Assumptions

- Patent expiration: Expected post-2028, with biosimilar entry likely to press prices downward.

- Market penetration: Increasing access and expanded indications.

- Regulatory changes: Some regions may introduce stricter pricing caps for high-cost biologics.

Projected Pricing Trends

| Year | US Price Range (per 3 ml pen) | EU Price Range (per 1.8 mg) | Key Factors |

|---|---|---|---|

| 2023 | $720 - $770 | €150 - €180 | Slight inflation, competitive adjustments |

| 2024 | $720 - $770 | €150 - €180 | Stabilization expected |

| 2025 | $700 - $740 | €140 - €170 | Market maturation, competition |

| 2026 | $700 - $740 | €140 - €170 | Possible price compression |

| 2027 | $690 - $730 | €130 - €160 | Biosimilars emerging, price pressure |

Note: These prices assume no major regulatory changes and reflect a conservative decline post-2025 due to biosimilars.

Market Projections: Revenue & Volume

| Year | Estimated Units Sold (millions) | Revenue (USD millions) | Price per Unit (USD) |

|---|---|---|---|

| 2022 | ~10.5 million | $7.4 billion | ~$712 |

| 2023 | ~11 million | $7.5 billion | ~$700 |

| 2024 | ~11.5 million | $7.5 billion | ~$700 |

| 2025 | ~12 million | $7.4 billion | ~$690 |

| 2026 | ~12.2 million | $7.2 billion | ~$590 |

| 2027 | ~12.5 million | $7.3 billion | ~$582 |

Note: Volume increases are driven by expanding indications and patient access; revenues decline modestly due to price compression.

Regulatory & Policy Influences

- Pricing controls: Governments increasingly regulate biologic prices, especially in Europe and Asia.

- Reimbursement policies: Shift toward value-based pricing and outcomes-based reimbursement models.

- Patent statuses: Biosimilar approvals post-2028 will substantially alter the pricing landscape.

- Market access initiatives: Growing focus on equitable access in developing markets.

Comparative Analysis: VICTOZA vs. Competitors

| Attribute | VICTOZA | Ozempic | Trulicity | Wegovy | Tirzepatide |

|---|---|---|---|---|---|

| Dosing Frequency | Daily | Weekly | Weekly | Weekly | Weekly |

| Clinical Efficacy (HbA1c reduction) | Moderate | High | High | High | Very high |

| Weight Loss Potential | Moderate | High | Moderate | Very high | Very high |

| Cardiovascular Benefit | Proven | Pending | Pending | Pending | Pending |

| Price (approximate) | High | Very high | High | Very high | High |

Strategic Implications

- Continued innovation and expanding indications will sustain VICTOZA’s market presence.

- Price management strategies must adapt to biosimilar entry post-2028.

- Competitive differentiation hinges on clinical outcomes, safety profile, and patient adherence.

- Regional market dynamics, including regulation and reimbursement policies, will influence pricing trajectories.

Key Takeaways

- Market growth for VICTOZA remains robust, driven by T2DM prevalence and obesity trends.

- Pricing stability is expected through 2025, with gradual decline anticipated after biosimilar market entry.

- Competitive pressures notably from semaglutide-based drug formulations will influence future pricing and market share.

- Regulatory frameworks and policy shifts toward affordability will impact pricing strategies.

- Clinical differentiation and expanded indications are crucial for maintaining premium pricing.

FAQs

Q1: How will biosimilar entry after 2028 affect VICTOZA’s price?

Biosimilars are expected to introduce significant price competition, potentially reducing biologic prices by 20-40%, depending on regional regulatory and market acceptance factors.

Q2: What is the primary driver of VICTOZA’s market share dominance?

Its proven cardiovascular benefits, clinical efficacy, and strong brand recognition by Novo Nordisk sustain its market share despite intense competition.

Q3: How does VICTOZA’s pricing compare globally?

Pricing varies significantly; the US tends to have the highest prices (~$700+ per pen), while European countries average €150-€180, moderated by national pricing policies.

Q4: What are the main factors influencing future pricing trends?

Patent expirations, biosimilar competition, regulatory pricing caps, reimbursement policies, and clinical advancements are pivotal.

Q5: Are alternative therapies impacting VICTOZA’s market?

Yes, SGLT2 inhibitors and emerging dual-action agents like tirzepatide are affecting growth prospects by offering different mechanisms of action and efficacy profiles.

References

- IQVIA, "Global Diabetes Market Report," 2022.

- EvaluatePharma, "Pharmaceutical Market Forecast," 2022.

- Grand View Research, "Obesity Drugs Market Size, Share & Trends," 2022.

- Research and Markets, "Weight Management Market," 2022.

- International Diabetes Federation, "IDF Diabetes Atlas," 2022.

- World Health Organization, "Obesity and Overweight," 2022.

- Marso et al., "LEADER Trial," NEJM, 2016.

- Novo Nordisk Clinical Data, "Liraglutide Efficacy Trials," 2022.

Conclusion:

VICTOZA’s market landscape is characterized by consistent growth driven by expanding indications, clinical advantages, and regulatory momentum favoring innovative diabetes and obesity treatments. While pricing remains high, impending biosimilar competition post-2028 is poised to reshape its pricing landscape substantially. Strategic positioning, ongoing innovation, and favorable policy navigation will determine its market stature in the coming years.

More… ↓