Share This Page

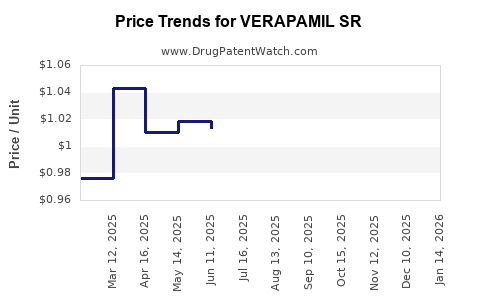

Drug Price Trends for VERAPAMIL SR

✉ Email this page to a colleague

Average Pharmacy Cost for VERAPAMIL SR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VERAPAMIL SR 120 MG CAPSULE | 52536-0880-01 | 1.58449 | EACH | 2025-12-17 |

| VERAPAMIL SR 180 MG CAPSULE | 00591-2882-01 | 1.98482 | EACH | 2025-12-17 |

| VERAPAMIL SR 120 MG CAPSULE | 00591-2880-01 | 1.58449 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VERAPAMIL SR

Introduction

Verapamil SR (sustained-release) is a calcium channel blocker primarily used in the management of hypertension, angina pectoris, and certain arrhythmias. As a long-acting formulation, it provides extended therapeutic effects, improving adherence and patient outcomes. This report analyzes the current market landscape for Verapamil SR, evaluates competitive dynamics, and projects pricing trends over the next five years—empowering stakeholders with strategic insights.

Market Overview

Global Market Size and Growth Potential

The global calcium channel blocker market, valued at approximately USD 2.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of roughly 4.2% through 2030 [1]. Verapamil SR, as a leading agent within this class, accounts for a significant market share driven by its established efficacy, favorable tolerability profile, and long-acting formulation.

The uptick in hypertension prevalence, especially in aging populations, sustains demand for Verapamil SR. According to the World Health Organization, the number of adults with hypertension is expected to reach 1.5 billion by 2025 [2], further underpinning demand for essential antihypertensives like Verapamil SR.

Market Segments and Geography

- Developed Markets: The United States, Europe, and Japan dominate, driven by high hypertension prevalence, advanced healthcare infrastructure, and reimbursement policies.

- Emerging Markets: Countries in Asia-Pacific, Latin America, and Africa exhibit faster growth owing to increasing urbanization, lifestyle shifts, and expanding healthcare penetration.

Key Players

Major pharmaceutical companies producing Verapamil SR include:

- Pfizer (now part of Viatris after spin-offs)

- AbbVie

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sandoz (Novartis)

These companies compete on product quality, bioequivalence, and pricing strategies, particularly in generic markets.

Regulatory and Patent Landscape

- Patent Status: Many Verapamil SR formulations transitioned to generic status post-patent expiry (typically after 2005-2010), intensifying price competition.

- Regulatory Approvals: Mass approvals across jurisdictions facilitate widespread marketing but impose quality and bioequivalence standards, especially for generics.

The expiry of patents has led to an aggressive price erosion, especially in highly commoditized markets.

Pricing Dynamics

Current Price Range

- Brand-Name Verapamil SR: In the United States, retail prices generally range from USD 20 to USD 50 for a 30-day supply, depending on dosage and pharmacy mark-up.

- Generic Verapamil SR: Prices are substantially lower, often between USD 4 and USD 10 per month, due to increased competition.

In Europe, similar trends apply, with branded drugs commanding premium prices and generics offering cost-effective alternatives [3].

Market Drivers Impacting Price

- Generic Competition: The influx of low-cost generics markedly reduces prices.

- Manufacturing Costs: Improvements in formulation and manufacturing efficiency contribute to cost reductions.

- Reimbursement Policies: Payers’ negotiations and formulary placements influence pricing strategies.

- Patient Access Programs: Discounts, coupon programs, and bulk purchasing further pressure net prices.

Forecasting Price Trends (2023-2028)

Base Scenario

- Short-term (2023-2025): Prices are expected to stabilize given widespread generic availability, with slight downward pressure driven by market saturation.

- Mid-term (2025-2028): Further commoditization likely leads to a 10-15% decrease in average prices, especially in mature markets.

Factors Influencing Future Prices

- Emerging Market Growth: Expansion into developing countries may temporarily boost revenues but at lower price points.

- Formulation Innovations: Newer sustained-release technologies, such as controlled-release microspheres, could command premium pricing if demonstrating superior bioavailability or reduced side effects.

- Regulatory Changes: Stricter bioequivalence standards or manufacturing audits could temporarily impact pricing and supply chains.

Projected Price Range (2028):

| Market Segment | Price Range (USD/month) | Notes |

|---|---|---|

| Brand-Name | USD 40 - USD 60 | Limited increase expected |

| Generic | USD 3 - USD 8 | Likely to remain stable or decline slightly |

Market Opportunities & Risks

Opportunities

- Emerging Markets: Rapid population growth and increasing hypertension prevalence create expanding demand.

- Combination Therapies: Potential for fixed-dose combinations with other antihypertensives may open new revenue streams.

- Patient-centric Formulations: Innovating with once-daily, tolerability-enhanced formulations could command higher prices.

Risks

- Pricing Pressure: Ongoing commoditization limits profit margins.

- Regulatory Stringency: Stricter standards may increase compliance costs, impacting prices.

- Market Saturation: The widespread availability of low-cost generics constrains pricing flexibility.

Strategic Recommendations

- Focus on Differentiation: Invest in innovative formulations that improve patient adherence.

- Explore Emerging Markets: Tailor pricing models to local economic contexts, maximizing penetration.

- Leverage Regulatory Pathways: Seek approval for new combinations or extended-release versions to capture niche segments.

- Cost Optimization: Streamline manufacturing to sustain competitiveness in a low-price environment.

Key Takeaways

- The Verapamil SR market is mature, with significant generic penetration reducing prices but maintaining demand driven by hypertension prevalence.

- In the next five years, prices are projected to decline modestly, especially in developed markets, with stable or slightly decreasing average prices.

- Emerging markets present growth opportunities but at lower unit prices, emphasizing the importance of adaptable pricing strategies.

- Innovation, such as novel delivery systems and combination therapies, can enable premium pricing and market differentiation.

- Competitive landscape shifts and regulatory changes necessitate continuous market monitoring and strategic agility.

FAQs

1. What factors most influence the price of Verapamil SR?

Primarily, patent expiry, generic competition, manufacturing costs, regulatory standards, and reimbursement policies shape pricing dynamics.

2. Will Verapamil SR’s price increase with newer formulations?

It is unlikely in the short term; however, innovations offering clinical benefits—like improved tolerability or convenience—may command premium prices, offsetting market saturation.

3. How do emerging markets impact Verapamil SR pricing?

While increasing demand creates growth opportunities, prices typically remain lower due to economic factors and regulatory environments, leading to thinner margins but larger volumes.

4. Are there upcoming regulatory challenges affecting Verapamil SR?

Strict bioequivalence standards and quality requirements could pose challenges for manufacturers, potentially leading to reformulation costs or supply disruptions.

5. What strategies can pharmaceutical companies pursue to maximize Verapamil SR revenues?

Focus on formulation innovation, expanding into underserved markets, engaging in patient adherence programs, and developing combination therapies.

Sources

[1] MarketWatch. (2022). Calcium Channel Blocker Market Size, Share & Trends.

[2] WHO. (2021). Hypertension Fact Sheet.

[3] IQVIA. (2022). Global Pharmaceutical Pricing & Reimbursement Report.

More… ↓