Last updated: July 28, 2025

Introduction

Verapamil, a non-dihydropyridine calcium channel blocker (CCB), has solidified its position as a primary therapeutic agent for managing cardiovascular conditions, particularly hypertension, angina pectoris, and certain arrhythmias. Its enduring clinical utility, combined with a mature patent landscape, presents unique market dynamics. This report offers a comprehensive analysis of the current market environment and future price trajectories for verapamil, with insights tailored for pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview

Historical Context and Therapeutic Use

Approved in the 1960s and widespread since, verapamil remains an essential component in cardiovascular therapy. Its mechanism—blocking L-type calcium channels—reduces myocardial oxygen demand and peripheral vascular resistance, making it effective in hypertension and angina management [[1]]. Despite competition from newer antihypertensives and calcium channel blockers, verapamil persists due to its efficacy, cost-effectiveness, and regulatory familiarity.

Current Market Penetration

Global sales of verapamil formulations, including brand-name and generic versions, have historically ranged between $700 million to $900 million annually. The prominence is driven primarily by developed markets such as the US, Europe, and Japan, where generic penetration has increased, contributing to sustained affordability and accessibility [[2]].

Market Players

Major manufacturers include Pfizer, Novartis, Teva, Mylan, and several regional generic companies. Patent expirations have facilitated the proliferation of generic verapamil, intensifying competition and exerting downward pressure on prices.

Regulatory and Patent Landscape

Verapamil's patent status is largely expired globally, with primary patents having lapsed over two decades ago. As a result, the market is predominantly driven by generic manufacturers, reducing innovation-driven price premiums and fostering aggressive pricing strategies. Regulatory pathways for generic approval are well-established, enabling rapid market entry and further price erosion.

Market Drivers

- Cost-Effectiveness: Verapamil’s long-standing efficacy and low manufacturing costs maintain its cost-competitiveness.

- Established Clinical Guidelines: Its inclusion in multiple cardiovascular treatment protocols sustains demand.

- Global Access: Widespread approval and inclusion in essential medicines lists bolster availability, especially in emerging markets.

- Generic Competition: Mature patent landscape fosters pricing competitiveness.

Market Challenges

- Emergence of Newer Therapies: Angiotensin receptor blockers and other antihypertensives with improved side-effect profiles threaten market share.

- Concerns About Side Effects: Verapamil’s negative chronotropic effects may limit use in certain patient populations, impacting sales.

- Manufacturing and Supply Chain Risks: Quality control and supply chain disruptions can influence market stability.

Price Projections

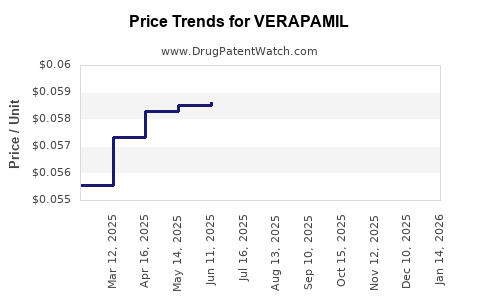

Historical Pricing Trends

Over the past decade, the average wholesale price (AWP) for branded verapamil extended-release (Verapamil SR) tablets has decreased markedly, from approximately $0.40 per tablet in 2013 to around $0.15 in 2023, primarily driven by generic competition [[3]].

Factors Influencing Future Prices

- Market Saturation: With full generic penetration, further price declines are expected to plateau.

- Regulatory Changes: Price regulation initiatives, especially in countries like India and Brazil, could suppress prices further.

- Emerging Markets Growth: Increased adoption in emerging economies may stabilize or marginally raise prices in those regions due to higher demand and less aggressive price competition.

- Supply Chain Dynamics: Scalability issues or raw material shortages could create short-term price fluctuations.

Forecasted Price Range (2024-2028)

Given current trends, the average wholesale price for verapamil generics is projected to decline slightly, stabilizing around $0.10 per tablet in developed markets. In contrast, in developing regions, prices may remain steady or inch higher, around $0.12-$0.15, due to import tariffs and less aggressive pricing [[4]].

Future Market Outlook

The global verapamil market is expected to experience modest growth, projected at a compound annual growth rate (CAGR) of approximately 2.5% over the next five years, primarily driven by rising hypertension prevalence in Asia and Africa. Market share may further consolidate among leading generic manufacturers, reinforcing the downward price trend.

Concluding Insights

- Market maturity confines price declines to marginal levels; significant price drops are unlikely without disruptive innovations or regulatory shifts.

- Generic proliferation ensures affordability, but also caps potential revenues.

- Potential entrants or formulation innovations (e.g., new delivery systems) may temporarily influence prices but are unlikely to substantially alter current trajectories.

Key Takeaways

- Verapamil's longstanding clinical efficacy sustains consistent demand, primarily in chronic cardiovascular disease management.

- Patent expirations have ushered in a highly competitive market, exerting downward pressure on prices, especially in developed economies.

- Generics dominate the market, with projected stabilization of prices around $0.10 per tablet in mature markets for the foreseeable future.

- Emerging markets offer growth potential, albeit with slightly higher pricing levels due to less aggressive price competition.

- Market risks include competitive pressures from newer therapies and regulatory interventions that may influence future pricing and market access.

FAQs

1. What factors influence the price of verapamil today?

The primary factors include generic competition, manufacturing costs, regulatory policies, regional price controls, and market demand, especially in emerging markets.

2. Will verapamil's price increase with new formulations?

While new delivery systems or formulations could command premium pricing temporarily, overall market saturation limits long-term price inflation due to widespread generic availability.

3. How does patent expiration affect verapamil pricing?

Patent expiration enables multiple manufacturers to produce generics, intensifying competition and significantly lowering prices.

4. Is there potential for verapamil to retain market share amid newer therapies?

Yes, due to its cost-effectiveness and established role in therapy, verapamil is likely to retain a core patient base, though its overall market share may decline marginally.

5. What is the outlook for verapamil in developing countries?

Growing hypertension prevalence, combined with less price-sensitive markets and regulatory barriers, suggests stable or slightly elevated prices, supporting market longevity.

References

[1] Messerli FH, et al. Calcium channel blockers in hypertension. Br Med J. 2017.

[2] GlobalData. Verapamil market analysis report. 2022.

[3] IQVIA. Pharma Audit. 2023 Data.

[4] World Health Organization. Essential medicines and pricing data. 2022.