Last updated: July 28, 2025

Introduction

VENTOLIN HFA (albuterol sulfate inhalation aerosol) remains a cornerstone treatment for bronchospasm associated with asthma and chronic obstructive pulmonary disease (COPD). As a rescue inhaler, its market dynamics are influenced by clinical efficacy, patent status, regulatory landscape, and competitive positioning. Understanding its current market landscape, competitive environment, and future price trajectory is essential for stakeholders including pharmaceutical companies, healthcare providers, and investors seeking to capitalize on or anticipate shifts within this sector.

Market Overview of VENTOLIN HFA

Historical Context

VENTOLIN HFA, introduced in inhaler form in the late 1990s, became the first HFA-primarily inhaled albuterol product following the transition from older propellant systems. Its widespread adoption is driven by the necessity of quick-relief bronchodilation, with pivotal FDA approval granted in 1996. The inhaler’s extensive clinical data, combined with its rapid onset of action, cemented its market dominance among short-acting beta-agonists (SABAs).

Current Market Position

As of 2023, VENTOLIN HFA remains a leading SABA medication, used globally, with an estimated annual sales volume exceeding 20 million inhalers worldwide [1]. It holds a significant market share within the inhaler segment for asthma and COPD exacerbations, especially in the United States. Despite the emergence of generic albuterol inhalers, VENTOLIN HFA continues to benefit from brand recognition, prescriber familiarity, and formulary inclusion.

Regulatory and Patent Status

Ventolin HFA’s patents expired in the early 2000s, opening pathways for generic competition. However, the brand maintains market share through formulary preferences and patient loyalty. Notably, innovative inhaler technology or formulations have not significantly disrupted VENTOLIN HFA’s position yet.

Market Drivers and Challenges

Key Drivers

- Prevalence of Respiratory Diseases: The global burden of asthma (~262 million cases) and COPD (~210 million cases) sustains high demand for inhaled SABAs, including VENTOLIN HFA [2][3].

- Regulatory Approvals: Continued approval of VENTOLIN HFA across major markets maintains its legal market presence.

- Clinical Efficacy and Safety Profile: Consistent performance and safety reinforce prescriber reliance and patient retention.

- Healthcare Policies: Insurance coverage, formulary positions, and prescribing guidelines favor established brands like VENTOLIN HFA, especially in the US.

Market Challenges

- Generic Competition: The introduction of generic albuterol inhalers, such as ProAir HFA, significantly impacts VENTOLIN HFA’s market share, often by offering reduced pricing.

- Innovation and Alternatives: The rise of combination therapies (ICS + LABA), long-acting bronchodilators, or nebulized forms limits the sole reliance on SABAs.

- Inhaler Technique and Delivery Devices: Advances in inhaler technology and devices may alter user preferences and market dynamics.

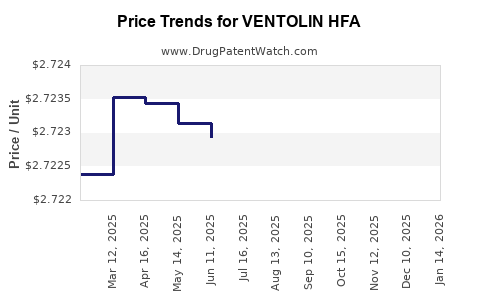

Price Dynamics and Projections

Historical Price Trends

Historically, VENTOLIN HFA’s retail price has experienced fluctuations driven by patent expirations, insurance negotiations, and market competition. When patent protection ended in the early 2000s, generic competitors drove prices downward, exemplified by the decline in branded inhaler costs by approximately 40-50%. However, the brand maintained premiums through formulary advantages and marketing.

Current Pricing Landscape

-

Brand Price Point: As per recent data, the retail list price for a 200-dose VENTOLIN HFA inhaler ranges from $30 to $50 in the US, with discounts applied through pharmacy benefit managers (PBMs) and insurance plans often reducing out-of-pocket costs to $15–$25 [4].

-

Generic Impact: Generic albuterol inhalers typically retail at approximately 30–50% less than brand-name counterparts, capturing over 60% of the inhaler market share in many regions.

Price Projection Outlook (2023–2030)

Factors Influencing Future Prices:

-

Patent and Regulatory Expiry: Continued patent challenges and the introduction of generic formulations will exert downward pressure on VENTOLIN HFA’s retail price. The expiration of the primary patent in the early 2000s established a long-term baseline, but ongoing litigation and exclusivity periods could influence timing.

-

Market Penetration of Generics: Increased availability and insurance coverage favor lower-cost generics, likely decreasing VENTOLIN HFA’s market share if the manufacturer does not innovate or implement differentiation strategies.

-

Emerging Competition: New inhalation devices and alternative therapies, such as dry powder inhalers (DPI) and soft-mist inhalers, may divert demand away from traditional HFA aerosols.

-

Pricing Strategies: Albuterol HFA inhalers are subject to market pressures encouraging price stabilization or reduction, especially amid increasing healthcare cost containment efforts in countries like the US.

Projected Price Trends:

-

Short-term (2023-2025): Expect continued price erosion in the US retail market with branded inhalers maintaining a premium of approximately 20–30% over generics. Price reductions of 15–25% occurring annually are probable, particularly as new generics penetrate more deeply.

-

Mid-term (2025-2028): Further price stabilization or slight decline as market saturation of generics consolidates. The brand may attempt to maintain pricing through value-added features or combinations but faces significant pressure.

-

Long-term (2028–2030): Prices could stabilize at around $20–$30 per inhaler, aligning with generic price points, barring breakthroughs or regulatory interventions that affect patent exclusivity or reimbursement policies.

Strategic Implications for Stakeholders

-

Pharmaceutical Manufacturers: To sustain profitability, brands like VENTOLIN HFA must invest in differentiation strategies such as patient adherence programs, device innovation, or combination therapies. Negotiations with PBMs and payers will be critical to preserve margins amid falling prices.

-

Healthcare Providers: Prescribers should weigh cost-effective options, largely favoring generics unless specific clinical advantages exist with VENTOLIN HFA. Awareness of pricing trends could optimize patient access and adherence.

-

Investors and Market Analysts: Monitoring regulatory decisions, patent litigations, and technological innovations will be decisive in forecasting future market share and revenues.

Conclusion

VENTOLIN HFA’s market remains robust due to its established efficacy, breadth of use, and historical positioning. However, the increasing penetration of generics and advancing inhalation technologies project a downward trend in its retail pricing over the next decade. While the brand will likely continue to command a premium temporarily, sustained price declines of 15–25% annually are plausible, leading to an eventual stabilization at lower price points. Stakeholders must adapt to this evolving landscape through innovation and strategic market positioning.

Key Takeaways

- The expiration of VENTOLIN HFA’s patent and subsequent generic competition have significantly reduced its retail price, with future declines expected.

- Price projections suggest a stabilization around $20–$30 per inhaler by 2030, influenced by generics and healthcare policies.

- Maintaining market share will require innovation, value-added services, and strategic payer negotiations.

- The competitive landscape emphasizes the importance of technological advancements and formulary strategies in sustaining profitability.

- Healthcare providers should consider both efficacy and cost-efficiency in prescribing practices, favoring generics when appropriate.

FAQs

Q1: How has patent expiration impacted VENTOLIN HFA prices?

A: Patent expiration facilitated generic entry, leading to significant price reductions—often 30–50%—due to increased competition.

Q2: Are there upcoming regulatory events that could influence VENTOLIN HFA pricing?

A: Patent litigations or biosimilar approvals could impact pricing, but current patent life suggests stability through the late 2020s.

Q3: Will technological innovations in inhaler devices affect VENTOLIN HFA’s market?

A: Yes. Devices offering improved delivery or combination therapies could reduce dependence on traditional HFA inhalers, pressuring prices further.

Q4: What are the primary factors driving future price declines?

A: Increased availability of generics, reimbursement policies favoring cost savings, and competitive technological advancements.

Q5: How should investors interpret VENTOLIN HFA’s market trajectory?

A: The long-term outlook suggests declining revenues due to market saturation and generics but stability in essential medication demand renders it a steady, if diminishing, revenue source.

Sources

[1] EvaluatePharma. (2022). Global sales data for inhaled respiratory drugs.

[2] World Health Organization. (2022). Asthma World Atlas.

[3] Global Initiative for Chronic Obstructive Lung Disease (GOLD). (2023). Pocket Guide to COPD Management.

[4] GoodRx. (2023). Prices of inhalers across the US pharmacy network.