Last updated: July 27, 2025

Introduction

Venlafaxine hydrochloride (HCl), marketed predominantly under the brand name Effexor®, is a widely prescribed serotonin-norepinephrine reuptake inhibitor (SNRI) indicated primarily for major depressive disorder (MDD), generalized anxiety disorder (GAD), panic disorder, and social phobia. As a mature therapeutic agent with well-established clinical efficacy, the drug’s market landscape has evolved over the past two decades. Current analyses evaluate its competitive positioning, market demand dynamics, patent status, supply chain considerations, and future pricing trajectories.

Market Overview

Global Market Size and Growth Trends

The global antidepressant market, which includes venlafaxine, was valued at approximately USD 15.4 billion in 2021 and is projected to reach USD 20.2 billion by 2028, growing at a compound annual growth rate (CAGR) of around 4.2%.[1] Within this, venlafaxine accounts for a significant share due to its widespread prescribing patterns, especially in North America and Europe.

The rising prevalence of depression, anxiety disorders, and related mental health conditions is a primary driver. According to the World Health Organization (WHO), more than 264 million people worldwide suffer from depression, emphasizing the ongoing demand for effective pharmacotherapy like venlafaxine.[2]

Market Players and Competition

Key pharmaceutical companies, including Pfizer (original patent holder), Teva, Mylan, and several generics manufacturers, dominate the current landscape. Post-patent expiration, generic versions flooded markets globally, resulting in considerable price erosion. Nonetheless, branded formulations retain market share through physician preference and perceived brand trust.

Patent and Regulatory Status

Pfizer held the original patent for venlafaxine but expired in many jurisdictions between 2012 and 2018, leading to an explosion in generic competition. These patents' expiration has dramatically affected pricing, decreasing average retail costs by over 70% in regions like the U.S. and Europe.[3] However, patenting strategies—such as formulation patents, new combinations, and marketing exclusivities—continue to influence market dynamics.

Market Dynamics Influencing Price Trends

Generic Competition and Price Erosion

The entry of multiple generics post-patent expiry has been the dominant factor in reducing drug prices. According to IQVIA, the average wholesale price (AWP) of venlafaxine 75 mg tablet declined approximately 65% from 2012 to 2016.[4] This trend persists, with further reductions observed as newer generics enter regional markets.

Formulation Innovations and Brand Loyalty

Despite generic prevalence, certain formulations—extended-release (XR), combination therapies, or fixed-dose regimens—maintain pricing premiums. Brand loyalty and physician prescriber habits support sustained higher price points for branded Effexor® in niche markets, especially in regions with less aggressive generic substitution policies.

Regulatory and Reimbursement Landscape

Regions with restrictive reimbursement policies or high out-of-pocket expenses sustain higher retail prices for branded drugs. Conversely, countries with robust generic substitution laws and price controls, such as Australia or the UK, show more rapid and profound price declines.[5]

Manufacturing and Supply Chain Factors

Both raw material shortages (notably for active pharmaceutical ingredients—APIs) and manufacturing costs influence price stability. Amidst global supply chain disruptions—exacerbated by recent geopolitical tensions and the COVID-19 pandemic—costs may temporarily influence retail prices, though the long-term trend is a downward trajectory due to market saturation.

Future Price Projections (Next 5-10 Years)

Short-term Outlook (Next 1-3 Years)

- Price Stability and Modest Decline: Given the high prevalence and entrenched prescribing patterns, retail prices for venlafaxine are likely to stabilize at historically low levels post-generic entry, with further reductions ranging between 10-15% in mature markets.

- Brand vs. Generic Pricing: Branded formulations such as Effexor XR will likely retain a 20-30% premium over generics due to brand loyalty, with some decline as generics capture more market share.

Medium-term Outlook (3-5 Years)

- Market Saturation: Saturation of generics in developed markets suggests minimal further reductions. Price stabilization can be expected, with some regional variation depending on market competition, reimbursement policies, and supply chain factors.

- Emerging Markets: In developing economies with less access to generics, branded prices may remain relatively high, although increasing competition could eventually pressure downward pricing.

Long-term Outlook (5-10 Years)

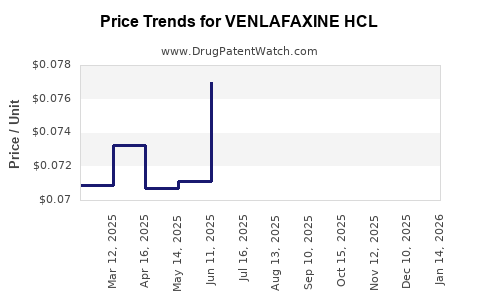

- Potential Price Decline to Marginal Levels: As biosimilars or novel SNRI formulations emerge, the market for traditional venlafaxine may see further erosion. It is plausible that retail pricing could stabilize at USD 0.05-0.10 per mg, reflecting a 75-85% reduction from peak generic prices.

- Market Exits and Consolidation: Smaller manufacturers may exit due to slim profit margins, consolidating market dominance among a few large players, potentially stabilizing prices temporarily.

Impact of Pharmacologic Innovations and Competition

Introduction of alternatives—such as newer antidepressants with improved efficacy or tolerability profiles—may further suppress venlafaxine’s market share and influence pricing strategies. However, given the established position of venlafaxine, these effects are likely to only moderate price declines.

Regulatory and Reimbursement Policy Effects

Regulations aimed at cost containment and promoting generic substitution are expected to sustain downward pressure on prices. Countries with active price control mechanisms, such as Germany and Canada, could enforce further reductions, whereas markets with less regulation may experience slower declines.

Conclusion

Venlafaxine HCl’s market is characterized by mature, stable demand, extensive generic competition, and significant price erosion since patent expiry. Short-term stability with incremental declines is anticipated, with long-term prices expected to plateau at highly affordable levels due to generic saturation and emerging alternatives. Stakeholders should monitor regional regulatory changes, patent strategies, and new therapeutic developments, as these will shape pricing dynamics.

Key Takeaways

- The global venlafaxine market remains substantial, driven by high prevalence of depression and anxiety disorders.

- Patent expirations have precipitated significant price reductions, with generics dominating most markets.

- In mature markets, prices are expected to stabilize further, though branded formulations may retain a slight premium.

- Emerging markets may experience slower price declines, but long-term projections suggest near-bottom pricing due to competition.

- Stakeholders must consider regulatory policies and potential therapeutics advances, shaping the future pricing landscape.

FAQs

-

What is the current average retail price of venlafaxine in the U.S.?

The average retail price of generic venlafaxine in the U.S. has fallen below USD 0.10 per mg, with a typical 75 mg tablet costing around USD 1.00-2.00 per tablet depending on the supplier.[4]

-

Are there significant patent protections remaining for venlafaxine?

No. The primary patents expired between 2012 and 2018, allowing extensive generic competition globally.

-

How do regional reimbursement policies influence venlafaxine pricing?

Countries with strict price controls and active generic substitution tend to see faster and more substantial price reductions compared to regions with less regulation.

-

What are the prospects for branded Effexor® in the generic-dominated market?

Branded Effexor® retains niche value in certain regions or formulations; however, its market share and pricing are under continuous pressure from generics.

-

Will new formulations or combination therapies influence venlafaxine’s market?

They may threaten its market share if they demonstrate superior efficacy, tolerability, or convenience, potentially impacting future pricing strategies.

References

[1] MarketWatch. "Global Antidepressants Market Outlook," 2022.

[2] WHO. "Depression and Other Common Mental Disorders," 2021.

[3] U.S. Food and Drug Administration (FDA). "Patent and Exclusivity Data for Venlafaxine," 2018.

[4] IQVIA. "Pharmaceutical Pricing Trends," 2022.

[5] OECD. "Pharmaceutical Price Regulation and Competition," 2020.