Share This Page

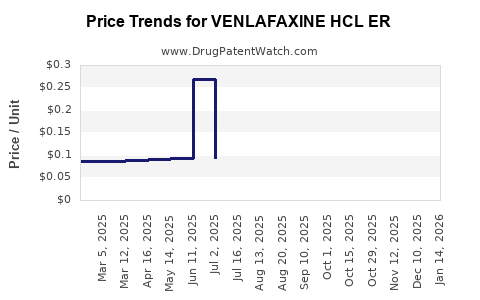

Drug Price Trends for VENLAFAXINE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for VENLAFAXINE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VENLAFAXINE HCL ER 150 MG CAP | 82009-0058-05 | 0.13088 | EACH | 2025-12-17 |

| VENLAFAXINE HCL ER 75 MG CAP | 82009-0057-10 | 0.09163 | EACH | 2025-12-17 |

| VENLAFAXINE HCL ER 37.5 MG CAP | 82009-0056-10 | 0.09016 | EACH | 2025-12-17 |

| VENLAFAXINE HCL ER 225 MG TAB | 75834-0219-90 | 0.50159 | EACH | 2025-12-17 |

| VENLAFAXINE HCL ER 225 MG TAB | 75834-0219-30 | 0.50159 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Venlafaxine HCl ER

Introduction

Venlafaxine Hydrochloride Extended-Release (ER) represents a pivotal therapeutic agent in the management of major depressive disorder (MDD), generalized anxiety disorder (GAD), social anxiety disorder (SAD), and panic disorder. As a serotonin-norepinephrine reuptake inhibitor (SNRI), it is widely prescribed globally, with significant implications for market dynamics and pricing strategies. This report delivers a comprehensive market analysis, evaluates competitive positioning, and offers forward-looking price projections based on current industry trends and regulatory landscapes.

Market Overview

Global Market Landscape

The global antidepressant market, encompassing drugs like venlafaxine ER, is projected to grow at a compound annual growth rate (CAGR) of approximately 3-5% through 2027, driven by rising prevalence of depression and anxiety disorders, increased awareness, and expanding approvals in emerging markets (Statista, 2022).

Venlafaxine ER’s market share remains robust, especially in North America and Europe, where psychiatric treatment adherence and insurance coverage favor branded and generic options. Key players include Pfizer, Teva, Mylan, and other generic manufacturers, reflecting a competitive and price-sensitive environment.

Therapeutic Demand Drivers

- Rising Prevalence: Depression affects over 264 million globally, with antidepressants prescribed widely across age groups (WHO, 2017).

- Generic Penetration: Patent expiry for branded formulations like Effexor XR (Pfizer) has facilitated extensive generics' entry, enhancing affordability but pressuring pricing strategies.

- Healthcare Policies: Growing adoption of guidelines favoring SNRIs, including venlafaxine ER, sustains demand.

Regional Variations

North America holds approximately 45% of the global antidepressant market share, driven by high prevalence and insurance coverage. Europe follows, with notable growth in Asia-Pacific due to increased healthcare infrastructure. Pricing elasticity varies regionally, influenced by reimbursement policies and market competition.

Competitive Landscape

Brand vs. Generic Market

- Branded Products: Pfizer’s Effexor XR historically held dominant market share but has seen declines post-patent expiration.

- Generics: Multiple manufacturers have launched generic venlafaxine ER, resulting in aggressive price competition.

Market Entry Barriers and Challenges

- Formation of numerous low-cost generics has led to pressure for substantial price reductions.

- The emergence of biosimilars and alternative therapies (e.g., newer antidepressants, non-pharmacologic interventions) could impact future demand.

Regulatory and Patent Outlook

While Pfizer's patent expired in key jurisdictions, some formulations or delivery mechanisms may still be under reverse patent or exclusivity rights, impacting specific pricing strategies.

Current Pricing Trends

According to pricing data from sources like GoodRx and national formularies (2022), the average retail price for a month's supply (30 caps of 75mg ER) of generic venlafaxine ER ranges from $5 to $15 in the U.S., significantly lower than the historic branded prices ($200 - $300 per month). Reimbursement and insurance coverage further influence out-of-pocket costs, typically favoring generics.

Price Projections (2023-2028)

Short-term Outlook (2023-2025)

- Generic Price Stabilization: With multiple manufacturers, prices are expected to stabilize within the current low range, possibly experiencing slight declines due to increased competition.

- Branded Prices: Likely to decline further as market penetration of generics deepens; branded formulations may withdraw or shift focus to premium formulations or combination therapies.

Mid to Long-term Outlook (2026-2028)

- Market Consolidation and Innovation: Introduction of new formulations, such as abuse-deterrent versions or digital health integrations, could command higher prices in niche markets.

- Emerging Markets: Price reductions in developing countries are anticipated, driven by local manufacturing and procurement policies.

- Regulatory Influence: Extended exclusivity rights or new patent filings could temporarily bolster prices in specific markets.

Projected Price Ranges

- Generics: Anticipated to remain within $3 - $12 per month supply globally, with slight declines in cost due to commoditization.

- Branded: Prices could decrease to $50 - $150 per month, contingent on market strategies and patent protections.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets with unmet psychiatric needs.

- Development of combination therapies or extended formulations to command premium pricing.

- Utilization of digital therapeutics to enhance treatment adherence, potentially increasing product valuation.

Risks

- Pricing pressures from biosimilar entrants or new therapeutic agents.

- Regulatory shifts favoring non-pharmacologic interventions.

- Intellectual property disputes affecting market exclusivity.

Conclusion

Venlafaxine ER remains a vital component of antidepressant therapy, with its market trajectory influenced heavily by patent expiries, generic competition, and regional health policies. Price stability in the near term favors generics, with modest declines expected. Strategic positioning should consider diversification into emerging markets, formulation innovation, and digital integration to sustain revenue streams.

Key Takeaways

- The global venlafaxine ER market is mature, characterized by intense generic competition that suppresses prices.

- In the U.S., generic monthly supply costs are projected to hover between $3 and $12 in the coming years, with branded prices declining towards $50 - $150.

- Market growth hinges on expanding access in emerging markets and introducing innovative delivery mechanisms.

- Regulatory trends and patent landscapes will significantly influence pricing and market share dynamics.

- Professionals should monitor patent expirations, regional healthcare policies, and emerging competitors to optimize market strategies.

FAQs

1. What factors influence venlafaxine ER pricing?

Pricing is primarily driven by patent statuses, generic competition, regional health policies, manufacturing costs, and market demand.

2. How does patent expiration affect venlafaxine ER prices?

Patent expiration allows generic manufacturers to enter the market, significantly lowering prices due to increased competition.

3. Are there significant regional differences in venlafaxine ER pricing?

Yes, prices vary considerably based on healthcare infrastructure, reimbursement policies, and local manufacturing capabilities.

4. What is the outlook for branded venlafaxine ER prices?

Branded prices are expected to decline further or the brand may phase out in favor of generics, especially after patent expiry.

5. How might new formulations impact future pricing?

Innovative formulations, such as combination drugs or digital health integrations, can command premium prices, potentially offsetting generic price declines.

References

[1] Statista. (2022). "Global antidepressant market size & forecasts."

[2] WHO. (2017). "Depression and other common mental disorders: global health estimates."

[3] GoodRx. (2022). "Pricing data for venlafaxine ER."

More… ↓