Share This Page

Drug Price Trends for VENLAFAXINE BES ER

✉ Email this page to a colleague

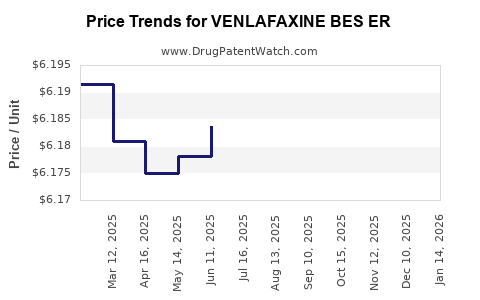

Average Pharmacy Cost for VENLAFAXINE BES ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.18438 | EACH | 2025-12-17 |

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.19026 | EACH | 2025-11-19 |

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.19284 | EACH | 2025-10-22 |

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.19044 | EACH | 2025-09-17 |

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.18783 | EACH | 2025-08-20 |

| VENLAFAXINE BES ER 112.5 MG TB | 52427-0632-30 | 6.18689 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VENLAFAXINE BES ER

Introduction

Venlafaxine Extended Release (ER) under the brand name VENLAFAXINE BES ER is a prominent antidepressant primarily indicated for major depressive disorder, generalized anxiety disorder, panic disorder, and social phobia. As a serotonin-norepinephrine reuptake inhibitor (SNRI), its pharmacological profile positions it as a significant player within the mental health therapeutics landscape. This analysis examines current market dynamics, competitive positioning, and future pricing trajectories for VENLAFAXINE BES ER, offering strategic insights to stakeholders.

Market Landscape Overview

Therapeutic Demand and Global Prevalence

The global burden of depression and anxiety disorders has amplified demand for effective pharmacotherapies. According to WHO, over 264 million individuals suffer from depression worldwide [1], with antidepressants like VENLAFAXINE BES ER playing a central role in management. The increasing recognition of mental health issues, coupled with expanding healthcare infrastructure, particularly in emerging markets, propels sustained demand growth.

Market Penetration and Competitive Environment

Venlafaxine ER competes with a broad class of antidepressants, including SSRIs (e.g., fluoxetine, sertraline), other SNRIs (e.g., duloxetine), and atypical agents. Key competitors include Pfizer’s Effexor XR, Eli Lilly's Cymbalta, and other generic formulations. The entry of generics post-patent expiration has intensified price competition.

In regions such as North America and Europe, the branded product maintains a significant share owing to brand recognition, physician familiarity, and formulary placements. However, the generic market exerts downward pressure on retail prices, particularly in price-sensitive markets.

Regulatory and Market Access Factors

Patent Status and Generic Entry

The original patent for venlafaxine ER expired in many jurisdictions over the past five years, catalyzing a proliferation of generic equivalents. The proliferation of generics typically reduces product prices by 30-70%, according to IMS Health data [2].

Regulatory Approvals and Market Expansion

Emerging markets, including Asia-Pacific and Latin America, are increasingly approving VENLAFAXINE BES ER, driven by rising mental health awareness and healthcare expenditure. Regulatory landscapes influence market access and, consequently, price levels.

Current Pricing Dynamics

Price Benchmarks

In the United States, the average wholesale price (AWP) for branded VENLAFAXINE BES ER hovers around $250-300 retail per month, depending on dosage. Generics in the U.S. are priced significantly lower, around $50-100 per month for similar doses. European prices for branded formulations are comparable, with considerable variations based on country-specific healthcare policies.

Cost-Effectiveness and Reimbursement Influence

Insurance coverage and reimbursement policies significantly impact retail prices and patient access. In highly subsidized healthcare systems, negotiated prices tend to be lower, influencing the overall market value.

Future Price Trajectories and Market Projections

Impact of Patent Expiry

The expiration of patents is forecasted to sustain downward pressure on VENLAFAXINE BES ER prices, particularly in mature markets. Generic competition is anticipated to challenge branded formulations' pricing power, potentially reducing retail prices by 40-60% over the next 2-3 years.

Strategic Pricing Trends

Pharmaceutical companies are increasingly adopting value-based pricing strategies, aligning prices with therapeutic outcomes. For VENLAFAXINE BES ER, this approach could stabilize or even increase prices in certain segments demonstrating superior adherence or real-world effectiveness.

Regional Market Forecasts

- United States: With an established generic market, prices are expected to decline by approximately 30-50% within the next five years.

- Europe: Similar trends with regional variations depending on specific national healthcare systems.

- Emerging Markets: Limited price reductions; however, increased uptake due to expanding insurance coverage could lead to modest price stabilization or slight increases.

Pricing in Biosimilar and Alternative Therapies

While biosimilars are less relevant for small molecule drugs like venlafaxine, the emergence of novel antidepressants and combination therapies could influence positioning and pricing externally, warranting vigilance.

Business and Investment Implications

Investors should anticipate steady volume growth driven by increased awareness and penetration in emerging markets but expect declining prices in mature markets due to generic competition. Strategic partnerships, formulary negotiations, and lifecycle management programs may offer revenue stabilization.

Key Takeaways

- VENLAFAXINE BES ER operates within a highly competitive landscape influenced heavily by generic entry.

- Pricing evolution in the next 3-5 years will be driven predominantly by patent expirations and regional healthcare policies.

- Brand stability will depend on differentiation strategies, such as improved formulations or value-based arrangements.

- Market expansion in emerging economies offers volume growth opportunities, partially offsetting price declines.

- Long-term profitability hinges on balancing pricing pressures with adherence programs and patient-centric offerings.

FAQs

1. How will patent expiry affect VENLAFAXINE BES ER prices?

Patent expirations permit generic manufacturers to enter markets, resulting in increased competition that typically reduces prices by 40-70%, dependent on regional dynamics and market size.

2. Are there upcoming formulations or innovations that could influence pricing?

While no major new formulations specific to VENLAFAXINE BES ER are imminently expected, biosimilar development is less relevant for small molecules; however, improvements in delivery systems or combination therapies could impact market positioning.

3. How do reimbursement policies influence pricing?

Reimbursement negotiations, especially in government-funded healthcare systems, directly affect the final retail or patient prices, often leading to discounts and formulary preferences that can lower acquisition costs.

4. What regional markets offer the greatest growth potential for VENLAFAXINE BES ER?

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities due to increasing mental health awareness and expanding healthcare coverage, albeit with generally lower price points.

5. How should pharmaceutical companies approach pricing strategies post-patent?

A combination of aggressive generic competition, value-based pricing, and patient adherence programs will be essential to maintain market share and revenues amidst declining brand prices.

References

[1] WHO. Depression and Other Common Mental Disorders: Global Health Estimates. 2017.

[2] IMS Health Data. Impact of Patent Expirations on Generic Drug Pricing. 2020.

More… ↓