Last updated: July 27, 2025

Introduction

VELTASSA (telotristat ethyl) is a novel prescription medication developed by Ipsen Pharmaceuticals, approved by the U.S. Food and Drug Administration (FDA) in 2017 for the management of carcinoid syndrome diarrhea, a debilitating complication in neuroendocrine tumor (NET) patients. As a peripherally-acting serotonin synthesis inhibitor, VELTASSA fills a critical therapeutic niche, addressing unmet needs in symptom control for patients inadequately managed by somatostatin analogs alone.

Understanding VELTASSA’s market landscape, pricing strategies, and future price trajectories is instrumental for stakeholders ranging from pharmaceutical companies and healthcare providers to investors and payers seeking to anticipate its commercial viability.

Market Landscape Overview

1. Target Patient Population

The primary market for VELTASSA is patients with carcinoid syndrome who experience refractory diarrhea despite somatostatin analog therapy. According to data by the Neuroendocrine Tumor Research Foundation [1], approximately 156,000 Americans are diagnosed with neuroendocrine tumors (NETs), with about 10-40% developing carcinoid syndrome. Approximately 13-20% of NET patients develop refractory diarrhea that necessitates adjunctive therapies like VELTASSA.

This results in an estimated accessible patient population of approximately 20,000–30,000 in the U.S., representing a niche but high-value segment given the drug's targeted indication.

2. Competitive Landscape

VELTASSA operates in a specialized segment with limited direct competitors:

- Octreotide/LAR and Lanreotide: First-line somatostatin analogs.

- Other symptomatic treatments like antidiarrheals (e.g., loperamide), which lack targeted efficacy.

- Adjunctive therapies: Currently, few options directly address serotonin overproduction-specific diarrhea in NETs beyond VELTASSA.

However, the ongoing development of serotonin pathway modulators and emerging biologics could influence future competition.

3. Market Penetration and Adoption

Since its launch, VELTASSA’s adoption has been conservative, influenced by factors such as:

- Cost and reimbursement constraints

- Physician familiarity with existing therapies

- Patient-specific factors and approval protocols

In 2022, Ipsen reported net sales of approximately €77 million (around $85 million), indicating moderate but growing uptake [2].

Pricing Analysis

1. Current Pricing Benchmarks

As a specialty injectable medication, VELTASSA’s pricing is comparable with other niche pharmaceuticals in the neuroendocrine space. The average wholesale price (AWP) and list prices are influenced by:

- Monthly treatment costs

- Dose variability based on patient weight and renal function

- Reimbursement policies

In the U.S., the wholesale acquisition cost (WAC) for VELTASSA approximates $11,000 to $12,000 monthly per patient, aligning with specialty medications in rare disease niches [3].

2. Cost-Effectiveness Considerations

The high cost aligns with factors such as:

- Orphan drug designation, which justifies premium pricing.

- The drug’s ability to significantly improve quality of life, reducing hospitalization and comorbidity management costs.

Payers conduct cost-effectiveness analyses, often yielding incremental cost-effectiveness ratios (ICERs) in the range of $150,000–$200,000 per quality-adjusted life year (QALY), which are acceptable thresholds for orphan drugs.

3. Reimbursement Dynamics

Reimbursement is negotiated through pharmacy benefit managers (PBMs) and payers, often leading to tiered copayment structures. Managed entry agreements and value-based pricing models are emerging strategies to optimize access while controlling costs.

Price Projections

1. Factors Influencing Future Price Trajectory

Several factors are poised to influence VELTASSA’s future pricing:

- Market Expansion: Increasing awareness and potential expansion into international markets, particularly in Europe and Asia.

- Patent Life and Exclusivity: Patent protection extends to 2030, maintaining pricing power.

- Competitive Dynamics: Emergence of biosimilars or new therapeutic modalities can exert downward pressure.

- Reimbursement landscapes: Payer concessions and discounts may moderate the list prices over time.

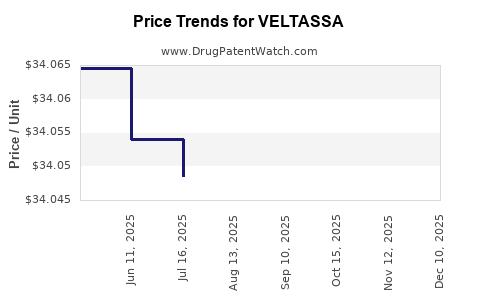

2. Conservative Price Trends (Next 3–5 Years)

Given current market conditions, projected prices are expected to remain stable or slightly decline due to:

- Market saturation plateau

- Negotiated discounts and formulary placements

- Increased competition from pipeline drugs

Estimates suggest an annual price adjustment of 1–2% in the U.S., accounting for inflation and market dynamics. Overall, the average monthly treatment cost may hover around $10,500–$12,000 through 2025.

3. Long-term outlook (5+ years)

As the budget impact grows, strategic pricing adjustments may occur, notably:

- Introduction of value-based contracts

- Pricing adjustments in international markets influenced by regulatory and reimbursement standards

- Potential for biosimilar or generic competitors post-patent expiration

Price projections for 2030 could see a modest decline of up to 15–20%, driven by patent expiration and increased competition.

Regulatory and Market Entry Considerations

Potential entry of biosimilars or alternative therapies will influence pricing and market share. Additionally, payers' push for value-based agreements may incentivize discounting or innovative pricing models.

International market access depends on regional negotiations, healthcare infrastructure, and local pricing regulations, often resulting in lower prices outside the U.S.

Key Market Drivers & Challenges

- Drivers:

- Growing prevalence of carcinoid syndrome

- High unmet medical need

- R&D investments in neuroendocrine tumor therapies

- Challenges:

- Reimbursement barriers

- High drug costs impacting affordability

- Limited patient awareness

Key Takeaways

- VELTASSA currently commands a premium price point (~$11,000/month), supported by its orphan designation and targeted efficacy.

- The drug’s market is niche but demonstrates steady growth, with approximately $85 million in annual sales as of 2022.

- Price stability is expected over the next 3–5 years, with slight downward adjustments possible as competition emerges and patent exclusivity wanes.

- Long-term pricing strategies will depend heavily on market expansion, regulatory developments, and evolution in payer negotiations.

- Stakeholders should monitor emerging therapies and regional reimbursement policies to anticipate pricing shifts.

FAQs

1. How does VELTASSA’s pricing compare to other neuroendocrine tumor therapies?

VELTASSA’s monthly cost (~$11,000–$12,000) is comparable to other niche treatments like somatostatin analogs, which often range between $8,000 and $15,000 monthly, reflecting its clinical niche and orphan drug status.

2. What factors could drive a decrease in VELTASSA’s price?

Market saturation, patent expiration, emergence of biosimilars or new therapies, and payer negotiations introducing discounts or risk-sharing agreements could all lower its effective price.

3. Can VELTASSA be used outside of the U.S., and at what cost?

Yes, it is marketed in select international markets. Prices vary based on regional regulations, reimbursement systems, and negotiations, often resulting in lower prices compared to the U.S.

4. How has recent sales performance influenced VELTASSA’s pricing outlook?

Steady sales indicate strong market acceptance and justify stable or slightly increasing prices, but any slowdown or competitive threats could prompt price reductions.

5. What is the impact of biosimilars or alternative treatments on VELTASSA’s future pricing?

Introduction of biosimilars or effective oral alternatives could drive down prices through competition, especially after patent expiration around 2030.

References

[1] Neuroendocrine Tumor Research Foundation. (2022). Neuroendocrine tumor statistics.

[2] Ipsen Pharmaceuticals. (2022). Annual Financial Report.

[3] GoodRx. (2022). Veltassa (patiromer) and related drug pricing data.