Last updated: July 27, 2025

Introduction

Varenicline, commercially known as Chantix or Champix, is a prescription medication developed by Pfizer and other manufacturers for smoking cessation. Since its FDA approval in 2006, Varenicline has become a mainstay in tobacco harm reduction strategies. Its unique mechanism as a partial agonist at nicotinic acetylcholine receptors underpins its efficacy in reducing withdrawal symptoms and cravings. The drug’s market dynamics are influenced by regulatory, competitive, and societal factors, which warrant detailed analysis to project future pricing and market potential.

Current Market Landscape

Market Size and Demand Drivers

The global smoking population, estimated at over 1.1 billion smokers worldwide, continues to be a significant driver for Varenicline's demand. Although international smoking prevalence has declined, regions like Asia-Pacific still account for substantial smoking rates, particularly in China, India, and Southeast Asia. The World Health Organization estimates that tobacco kills over 8 million people annually, creating continuous demand for cessation therapies (WHO, 2021).

In developed markets such as North America and Europe, tobacco control policies, public health initiatives, and increased awareness about cessation options have elevated the adoption of pharmacotherapy, including Varenicline. The rise of evidence-based protocols further supports its market penetration, especially among healthcare providers.

Competitive Landscape

Varenicline's principal competitor remains nicotine replacement therapies (NRTs), such as patches and gums, and other pharmacological agents like bupropion (Zyban). Recently, e-cigarettes and novel digital cessation tools have entered the scene, potentially impacting traditional pharmacotherapy demands.

Key competitors include:

- Bupropion (Zyban): Offers an alternative mechanism but has differing efficacy profiles.

- NRTs: Widely available with established safety profiles.

- Digital cessation aids: Mobile apps and online platforms that supplement or replace pharmacological interventions.

However, Varenicline's relative efficacy, demonstrated in numerous clinical trials, positions it as a preferred choice for many clinicians.

Regulatory Environment

Regulatory stances significantly influence the market. While the FDA approved Varenicline after confirming its safety and efficacy, concerns over neuropsychiatric adverse effects led to initial warnings. Subsequent post-market surveillance has mitigated these concerns, maintaining regulatory approval in multiple jurisdictions.

In some countries, regulatory frameworks have introduced restrictions or expanded access programs, affecting pricing and distribution. Furthermore, ongoing patent protections and potential biosimilar entries shape competitive dynamics and pricing strategies.

Pricing Trends and Factors

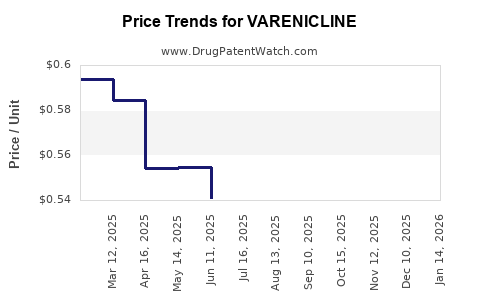

Historical Price Trajectory

Varenicline’s pricing has experienced fluctuations driven by patent status, manufacturing costs, and market competition. Original brand-name products, like Chantix, commanded premium prices, often exceeding $200 per prescription in the U.S. (CMS data). Generic versions, introduced after patent expiration, have significantly decreased costs, with retail prices dropping below $100 per course.

Patent Expiry and Generic Competition

Pfizer's patents on Chantix expired in various jurisdictions (e.g., the U.S. in 2021), catalyzing generic entry. Generics tend to reduce prices by 60-80%, broadening access and affecting the profitability of the original brand.

Insurance and Reimbursement Policies

In major markets, insurance coverage influences retail prices. Public reimbursement schemes, such as Medicaid and Medicare in the U.S., negotiate drug prices and rebate agreements, often leading to lower effective prices for payers. Pharmacoeconomic assessments, demonstrating cost-effectiveness relative to smoking-related health burdens, support favorable reimbursement policies.

Manufacturing and Distribution Costs

Manufacturing innovations and supply chain efficiencies have maintained stable production costs for Varenicline. However, recent disruptions—e.g., raw material shortages or regulatory compliance costs—could modestly influence pricing.

Market Projections

Short to Medium-Term Outlook (Next 5 Years)

We project a moderate decline in average retail prices for Varenicline due to increasing generic competition and healthcare policy shifts favoring cost-effective smoking cessation therapies. The prevalence of smoking globally is projected to decline marginally, but the total patient pool remains sizable, ensuring sustained demand.

In regions with expanding healthcare coverage and public health campaigns, Varenicline's utilization is expected to grow, especially as clinician familiarity increases and newer formulations or delivery methods (e.g., combination therapies) emerge.

Long-Term Outlook (Next Decade)

In the longer term, innovations such as digital adherence tools, novel formulations, or biosimilars could substantially alter the pricing landscape. The advent of personalized medicine approaches might lead to targeted Varenicline applications, potentially commanding premium pricing for tailored therapies.

Regulatory developments, especially around safety and adverse effects, could either broaden or restrict usage, subsequently impacting market size and prices. If new clinical evidence solidifies Varenicline’s superior efficacy, payers might prioritize its coverage, supporting sustained higher prices relative to rivals.

Key Market Drivers and Risks

Drivers

- Persistent global smoking burden

- Efficacy and safety profile of Varenicline

- Increasing healthcare coverage and reimbursement support

- Continuous clinician awareness and patient acceptance

Risks

- Emergence of alternative therapies (e-cigarettes, digital tools)

- Regulatory restrictions or safety concerns

- Patent expiring, leading to commoditization

- Market saturation in mature regions

Concluding Assessment

While patent expirations and competitive pressures are poised to depress retail prices, Varenicline's proven efficacy sustains demand across diverse markets. Strategic positioning—such as consolidating its role within multi-modal cessation programs—will be critical for manufacturers to maintain profitability and relevance.

Key Takeaways

- Varenicline remains a cornerstone in global smoking cessation strategies, with a sizable and persistent market.

- Competitive dynamics, notably generic entries, are exerting downward pressure on prices, particularly in developed markets.

- Regulatory environments and reimbursement policies significantly influence pricing trajectories.

- Future innovations and clinical evidence could stabilize or enhance Varenicline’s market value.

- Stakeholders should monitor legal, technological, and societal trends to optimize market positioning and pricing strategies.

FAQs

Q1: How does the patent expiration of Varenicline impact its market price?

A: Patent expiration typically allows generic manufacturers to produce cheaper versions, leading to a significant reduction in retail prices—often by 60-80%—thus improving access but reducing profit margins for original producers.

Q2: What are the main factors influencing Varenicline’s pricing in different regions?

A: Pricing is affected by patent status, manufacturing costs, local regulatory policies, prescription reimbursement schemes, and competitive landscape, including availability of generics and alternative therapies.

Q3: How might future innovations affect Varenicline’s market and price?

A: Advances such as combined pharmacotherapy, digital adherence tools, or personalized medicine could either enhance the drug’s value proposition or introduce competitive substitutes, influencing pricing strategies.

Q4: Are there safety concerns that could influence Varenicline's market dynamics?

A: Initial neuropsychiatric safety concerns led to warnings but have diminished with post-market surveillance data. Ongoing safety evaluations remain critical, as adverse findings could restrict use and impact demand and pricing.

Q5: What role do healthcare policies play in shaping Varenicline’s market?

A: Policies promoting smoking cessation, coverage for pharmacotherapies, and regulatory approvals directly influence prescription rates and reimbursement levels, thus affecting market size and pricing.

Sources

[1] World Health Organization. (2021). Tobacco Fact Sheet.

[2] Centers for Medicare & Medicaid Services. (2022). Drug Pricing and Reimbursement Data.

[3] Pfizer Inc. Annual Reports and Patent Data. (2022).

[4] MarketResearch.com. (2022). Global Smoking Cessation Market Analysis.

[5] Food and Drug Administration. (2006). FDA Approval of Varenicline.