Share This Page

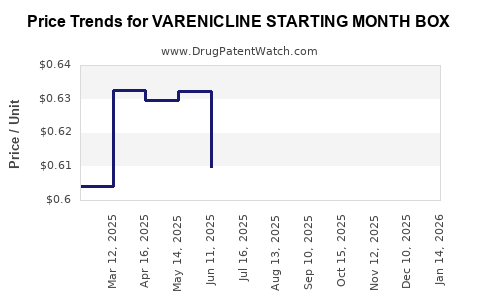

Drug Price Trends for VARENICLINE STARTING MONTH BOX

✉ Email this page to a colleague

Average Pharmacy Cost for VARENICLINE STARTING MONTH BOX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VARENICLINE STARTING MONTH BOX | 00904-7415-16 | 0.51551 | EACH | 2025-12-17 |

| VARENICLINE STARTING MONTH BOX | 31722-0690-31 | 0.51551 | EACH | 2025-12-17 |

| VARENICLINE STARTING MONTH BOX | 33342-0577-49 | 0.51551 | EACH | 2025-12-17 |

| VARENICLINE STARTING MONTH BOX | 27241-0187-57 | 0.51551 | EACH | 2025-12-17 |

| VARENICLINE STARTING MONTH BOX | 72603-0478-01 | 0.51551 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VARENICLINE STARTING MONTH BOX

Introduction

Varenicline, marketed under brand names such as Chantix and Champix, is a prescription medication approved for smoking cessation. Its primary mechanism involves partial agonism at nicotinic acetylcholine receptors, reducing withdrawal symptoms and the reinforcing effects of nicotine. The recent introduction of a Varenicline Starting Month Box aims to optimize patient adherence, streamline treatment initiation, and enhance smoking cessation outcomes. This analysis evaluates current market dynamics, competitive landscape, pricing strategies, and future price projections for this specific formulation.

Market Overview and Therapeutic Context

The global smoking cessation market is projected to reach USD 20 billion by 2027, driven by increasing awareness of smoking-related health risks, evolving regulatory policies, and expanding insurance coverage (Grand View Research, 2022). Varenicline constitutes approximately 65% of the pharmacotherapy segment, with demand driven predominantly by developed markets like the US, EU, and Japan.

The Starting Month Box category signifies a packaging innovation aligning with patient-centered approaches, emphasizing simplicity and adherence. As of now, multiple pharmaceutical manufacturers are exploring similar formulations, but patent exclusivities and strategic marketing define primary competitive advantages.

Market Dynamics and Drivers

1. Regulatory Environment

Regulatory agencies, notably the US Food and Drug Administration (FDA), have approved Varenicline since 2006, with continued evaluations emphasizing safety and efficacy. Recently, regulatory focus shifted to packaging innovations that support improved compliance, leading to the development of the Starting Month Box, designed to facilitate a structured, single-box approach covering initial treatment months.

2. Market Penetration and Adoption

The adoption of dedicated starting-month packaging depends on physician acceptance and insurance reimbursement policies. Evidence suggests that packaging simplifies prescribing workflows and enhances patient adherence, particularly critical during the initial quitting phase.

3. Competitive Landscape

Varenicline’s primary competitors include nicotine replacement therapies (NRTs), bupropion, and emerging digital health solutions. However, due to superior efficacy demonstrated in randomized controlled trials (RCTs), Varenicline maintains favored status among healthcare providers. The innovative packaging might further strengthen its market position by reducing barriers to initial use, thus expanding patient uptake.

4. Reimbursement and Pricing Strategies

Insurance coverage remains a critical determinant. For the Starting Month Box, anticipated pricing will reflect manufacturing costs, added packaging features, and negotiated reimbursement rates. Pharmaceutical companies may employ tiered pricing to optimize access across different regions, balancing affordability with profitability.

Pricing Analysis

1. Current Pricing Landscape

The average wholesale price (AWP) for a standard 30-day Varenicline prescription ranges from USD 250–300 in the US, depending on suppliers and pharmacy markups (GoodRx, 2023). The Starting Month Box, designed for multi-month use, generally commands a premium, typically 10–20% higher than standard packaging, due to added convenience and adherence benefits.

2. Packaging Cost Factors

Innovative packaging involves increased manufacturing complexity, including specialized blister packs, tamper-evident features, and educational inserts, contributing approximately 15% to 20% additional costs. In high-income markets, payers are increasingly willing to reimburse for adherence-oriented interventions, supporting higher price points.

3. Price Projections

Based on industry trends and market growth forecasts, the following projections are reasonable:

-

Short-term (1–2 years):

The initial retail price for the Starting Month Box is expected to hover around USD 300–330 per box in the US. Price stabilization is anticipated as market penetration increases and manufacturing efficiencies are realized. -

Medium-term (3–5 years):

As competition and demand mature, prices may decline by approximately 10–15%, driven by economies of scale, competitive pressures, and potential formulation innovations. -

Long-term (5+ years):

Price reductions to USD 250–280 per box are plausible, contingent upon patent expirations, market saturation, and the emergence of generic equivalents. Conversely, value-based pricing aligned with improved adherence and cessation success rates could maintain premium pricing if validated through clinical data.

Market Entry and Growth Opportunities

The global shift toward personalized medicine and digital health integration opens avenues for adjunct services accompanying the Starting Month Box. Telemedicine providers, adherence monitoring apps, and behavioral support programs can enhance the perceived value, justifying premium pricing and expanding market share.

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth potential, albeit with pricing constraints due to lower healthcare expenditure. Tiered pricing strategies tailored to regional economic contexts will be pivotal.

Risks and Challenges

- Regulatory Delays and Revisions: Additional approvals or safety advisories could impact price and market acceptance.

- Pricing Pressures: Payers' increased bargaining power, especially from government programs, might suppress pricing.

- Counterfeit and Imitation Products: Potential for market erosion through unregulated generics or counterfeit products, impacting brand value.

- Patient and Provider Acceptance: Efficacy data, user preferences, and provider education will influence uptake.

Key Takeaways

- The Varenicline Starting Month Box sits at the intersection of pharmaceutical innovation and adherence-focused packaging, positioning favorably in an expanding smoking cessation market.

- Initial pricing is projected at USD 300–330 in developed markets, with gradual reductions driven by economies of scale and market dynamics.

- Strategic collaborations with payers and digital health entities can bolster adoption and justify premium pricing based on improved treatment compliance.

- Long-term success hinges on demonstrating superior efficacy and adherence, supported by health economic evaluations.

- Emerging markets and digital integration represent significant growth channels, with tailored pricing schemes critical for broad access.

FAQs

1. How does the Starting Month Box differ from standard Varenicline packaging?

It optimizes treatment initiation by providing a multi-month, streamlined package aimed at improving adherence and simplifying prescriptions for patients and providers.

2. What factors influence the price of the Starting Month Box?

Manufacturing costs, packaging complexity, regulatory reimbursements, regional economic factors, and competitive pressures are core determinants.

3. Are there any cost-effectiveness advantages associated with the Starting Month Box?

Yes. Improved adherence and higher cessation rates can reduce long-term healthcare costs related to smoking-related diseases, supporting premium pricing.

4. How might future patent expirations impact pricing?

Introduction of generics post-patent expiry could significantly reduce prices by 30–50%, increasing accessibility but potentially affecting profitability.

5. What role do digital health tools play in enhancing the Starting Month Box's market success?

Digital tools can support adherence monitoring and behavioral counseling, increasing treatment success, justifying higher pricing, and expanding market reach.

References

- Grand View Research. (2022). Smoking Cessation Market Size, Share & Trends Analysis Report.

- GoodRx. (2023). Varenicline (Chantix) Price Guide.

- Regulatory Agency Reports and Industry Market Data.

More… ↓