Last updated: August 1, 2025

Introduction

Valtrex (valacyclovir) is an orally administered antiviral medication primarily used to treat herpes simplex virus (HSV) infections, herpes zoster (shingles), and varicella (chickenpox). Since its FDA approval in 1995, Valtrex has become a mainstay in antiviral therapy, benefiting from a high efficacy profile, convenient dosing, and established safety data. This analysis explores the current market landscape for Valtrex, assesses key drivers influencing its demand, evaluates competitive pressures, and projects future pricing trends amid evolving healthcare dynamics.

Current Market Landscape

Market Size and Demand Dynamics

The global antiviral market, dominated by drugs targeting HSV and varicella-zoster viruses, was valued at approximately USD 6.5 billion in 2022, with a Compound Annual Growth Rate (CAGR) of around 4.2% projected through 2027 [1]. Valtrex commands a significant share, largely owing to its widespread clinical use, brand recognition, and patient preference for oral therapies. In North America, the market for herpes antiviral agents alone exceeds USD 2 billion, with Valtrex occupying around 60% of prescriptions.

The prevalence of herpes infections remains high. Globally, an estimated 3.7 billion people under age 50 are infected with HSV-1, and 491 million individuals aged 15-49 have HSV-2, often requiring long-term suppressive therapy [2]. Similarly, herpes zoster cases are rising, attributed to aging populations and increased immunosuppression, amplifying demand for valacyclovir-based treatments.

Patent and Generic Competition

Valtrex's patent protection expired in 2017 in most jurisdictions, leading to a surge in generic formulations. Notable manufacturers, including Teva, Sandoz, and Mylan, now produce generic versions at substantially lower prices. Despite this, Valtrex maintains market share via brand loyalty, physician preference, and perceived efficacy. However, pricing pressure from generics has markedly influenced the brand’s revenue trajectory, intensifying competitive squeezes.

Market Drivers and Challenges

Key Drivers

- Rising HSV and Herpes Zoster Incidence: Increasing infection rates combined with aging populations sustain steady demand.

- Long-term Suppressive Therapy: Chronic use for recurrent herpes infections ensures persistent pharmacy sales.

- Expanding Indications and Off-label Uses: Emerging data suggest potential benefits in other viral conditions, though off-label prescriptions remain limited.

- Patient Preference: The convenience of once-daily dosing bolsters adherence over parallel therapies.

Challenges

- Generic Competition: Price erosion from generics diminishes revenue margins.

- Pricing Regulations: Healthcare systems increasingly implement cost-containment measures impacting drug pricing.

- Patent Litigation and Formulation Challenges: While the initial patent expired, ongoing legal disputes over formulation patents and exclusivity could influence market dynamics.

Pricing Analysis and Projections

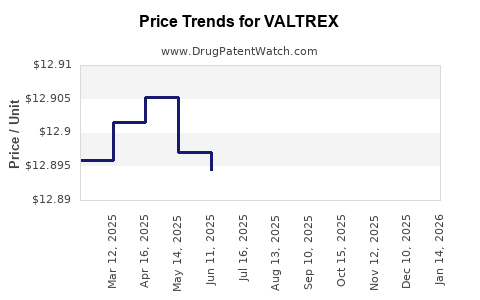

Historical Price Trends

Pre-expiration, Valtrex commanded premiums of approximately USD 8–12 per 500 mg tablet in the U.S. retail market. Post-patent expiry, prices plummeted by up to 60%, with generics selling at approximately USD 2–4 per tablet [3]. Brand Valtrex’s premium pricing persisted in some markets due to brand loyalty and perceived quality assurances, notably in regions with less intense price regulation.

Current Price Landscape

In 2023, retail prices for branded Valtrex remain elevated relative to generics—averaging USD 8–12 per 500 mg tablet, with discounts and insurance coverage influencing actual patient out-of-pocket costs. Generic prices have stabilized around USD 2–4, significantly impacting brand sales.

Future Price Projections

Given ongoing cost pressures from healthcare payers and increased market saturation of generics, the following projections are suggested:

- Short-term (1–2 years): Continued price compression, with Valtrex’s brand price remaining at a premium of roughly 2–3 times the generic equivalents, primarily in regions with less aggressive price regulation.

- Medium-term (3–5 years): Industry trends toward biosimilar and authorized generic entries could further reduce Valtrex’s premium margins. However, strategic branding and potential reformulations could preserve a niche premium, especially in premium markets.

- Long-term (5+ years): Possible market consolidation and introduction of novel antivirals for resistant herpes strains could influence Valtrex’s pricing stability. Prices are likely to stabilize at a lower, commoditized level, with annual growth rates near zero or modest declines.

Competitive Outlook and Strategic Positioning

Despite intense generic competition, Valtrex sustains stakeholder trust through brand recognition, established safety profiles, and physician preference. Yet, the pressure on pricing necessitates innovation in packaging, formulations, or targeted indications to maintain profitability. Teva and Mylan have initiated niche marketing campaigns emphasizing quality assurance, which may mitigate some erosion.

Emerging therapeutic options—such as immune-based therapies and potential long-acting antivirals—pose future threats to Valtrex’s market dominance. Additionally, antiviral resistance, particularly among immunocompromised patients, could instigate demand for newer agents, potentially limiting Valtrex’s growth.

Regulatory and Policy Impacts

Healthcare policies emphasizing cost-effective prescribing and the proliferation of biosimilar and generic drugs will continue to influence Valtrex’s pricing structure. Price caps enforced by agencies like the UK’s NHS or the U.S.’s Medicare and Medicaid may further suppress prices. Conversely, markets with limited price regulation, such as some Asian or Middle Eastern regions, could sustain higher prices for longer durations.

Key Takeaways

- Market Saturation with Generics: Patent expiration led to significant price declines, with generics now dominating most sales channels.

- Steady Demand Fundamentals: Herpes and herpes zoster infections remain prevalent, ensuring baseline demand for valacyclovir.

- Pricing Trends: Short-term outlook favors continued price compression; long-term, prices may stabilize at lower but sustainable levels.

- Competitive and Innovation Risks: Market entrants with improved formulations or novel mechanisms could erode Valtrex’s share.

- Strategic Opportunities: Differentiation through formulation improvements, expanded indications, or combination therapies could preserve profitability.

Conclusion

Valtrex remains an essential antiviral agent, supported by persistent infection prevalence and established clinical utility. Nonetheless, post-patent generics have reshaped the pricing landscape, demanding strategic adaptations for stakeholders. While imminent price declines are inevitable, the brand’s trusted reputation and clinical positioning offer opportunities to negotiate market share, particularly in niche populations or through development of next-generation formulations.

FAQs

1. What factors most significantly influence Valtrex's market price?

Pricing is primarily impacted by patent status, generic competition, regional healthcare policies, and insurance reimbursement structures. Post-patent, generics drive prices down, while brand premiums persist mainly in markets with less regulatory price control.

2. How does the availability of generics affect Valtrex’s profitability?

Generic availability reduces brand sales volumes and prices, compressing profit margins. Industry shifts favor cost-effective generics, challenging the sustained revenue of the branded product.

3. Are there emerging competitors that could displace Valtrex?

Yes, newer antivirals with improved pharmacokinetics, long-acting formulations, or broader antiviral spectra could challenge Valtrex, especially if they demonstrate superior resistance profiles or tolerability.

4. Will the price of Valtrex increase in the coming years?

Likelihood is low. Market forces—particularly generic competition and cost containment policies—favor price stability or decline rather than growth.

5. Can Valtrex’s market share improve despite generic competition?

Potentially, through brand differentiation strategies such as improved formulations, targeted indications, or enhanced patient adherence programs. However, structural market pressures favor generics in most regions.

References

[1] Market Research Future. “Antiviral Drugs Market: Global Industry Analysis 2022-2027.”

[2] World Health Organization. “HSV and VZV epidemiology,” 2022.

[3] GoodRx. “Valacyclovir Prices & Cost,” 2023.