Last updated: July 27, 2025

Introduction

Valganciclovir, an antiviral medication primarily used for the prevention and treatment of cytomegalovirus (CMV) infections, has established a vital role in immunocompromised patient care, including transplant recipients and HIV-positive populations. As demand for effective CMV management persists globally, understanding its market dynamics, competitive landscape, and pricing outlook becomes essential for stakeholders. This report offers a comprehensive market analysis, supported by recent trends, and forecasts Valganciclovir’s pricing trajectory over the next five years.

Market Overview

Therapeutic Use and Clinical Demand

Valganciclovir is an oral prodrug of ganciclovir, exhibiting improved bioavailability for CMV prophylaxis and treatment. It is predominantly employed post-organ transplantation to mitigate CMV disease, a significant complication with substantial morbidity and mortality. Its usage extends to HIV/AIDS patients with CMV retinitis historically, although evolving treatment landscapes and drug competition have shifted prevalence. The global rise in transplantation procedures and HIV management sustains steady demand for Valganciclovir.

Market Size and Growth Drivers

The global antiviral drugs market, specifically targeting CMV infections, was valued at approximately USD 600 million in 2022, with Valganciclovir constituting a significant segment due to its widespread approval and use. The compound annual growth rate (CAGR) for the CMV antiviral segment is projected at 4-6% through 2028, driven by:

- Increasing transplant volumes: The World Health Organization reports over 130,000 organ transplants performed annually worldwide, rising in developing regions.

- Expanding treatment indications: Growing screening and early detection of CMV infections expand treatment pools.

- Enhanced adoption in emerging markets: Price reductions and healthcare infrastructure improvements increase access.

Competitive Landscape

Key Market Players

- AbbVie Inc. (brand: Valcyte): The patent holder with significant market share, although patent expiry plans loom.

- Sun Pharmaceutical Industries Ltd. and other generic manufacturers: Increasing generic availability post-patent expiration, exerting downward pressure on prices.

- Other contenders: Generic firms in India, China, and Brazil contributing to a rapidly evolving competition landscape.

Regulatory and Patent Considerations

AbbVie's patent expiry in the U.S. and Europe is anticipated by 2024-2025, opening the gates for generic entrants. This heralds a potential price decline and increased accessibility in key markets.

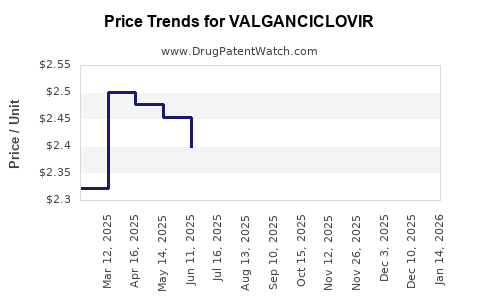

Pricing Trends and Projections

Current Pricing Scenario

In the United States, brand-name Valcyte retails at approximately USD 14,000–USD 17,000 per treatment course (e.g., 900 mg dosage for 3 weeks). Generics in emerging markets offer prices below USD 500 per course, driven by local manufacturing costs and regulatory environments.

Price Decline Forecast

Based on historical post-patent expiry patterns for antiviral drugs:

- Short-term (1-2 years post-patent expiry): A 25-40% reduction in brand-name prices, with generic versions gaining market share.

- Mid-term (3-5 years): Further price erosion up to 60-70% relative to current brand prices, as generics dominate.

Regional Variations

In developed markets (U.S., EU), high healthcare prices sustain relative premium pricing, but increased generic competition and pricing reforms (e.g., Medicare negotiations) could accelerate reductions. In emerging markets, prices may decline gradually, with effective competition maintaining affordability.

Future Market Dynamics

Emerging Trends and Influences

- Patent challenges and biosimilar development: Expectation of increased generic and biosimilar entries post-2024.

- Pricing regulation impacts: Governments in developed nations aim to reduce drug expenditure, pressuring prices downward.

- Innovations in CMV management: New therapeutic agents are under investigation, potentially disrupting Valganciclovir’s market share.

Pricing Strategy

Manufacturers should anticipate a transition from premium pricing to a more commoditized market. Effective pipeline development, cost containment, and strategic collaborations will be key for maintaining profitability margins.

Conclusion

Valganciclovir’s market remains robust within an expanding global antiviral segment, with sustained demand driven by transplantation and immunosuppressed patient populations. However, impending patent expirations and intensifying generic competition forecast significant price reductions over the coming years. Stakeholders must prepare for a transition towards competitive pricing environments, with opportunities in emerging markets offsetting declines in staple markets.

Key Takeaways

- Market growth is moderate (~4-6% CAGR), driven by transplantation and HIV treatment needs.

- Patent expiration around 2024 simplifies market entry for generics, leading to substantial price reductions (up to 70% over 5 years).

- Pricing remains higher in developed markets but is influenced heavily by regulatory and policy reforms aiming to reduce drug costs.

- Future market stability will hinge on competitive responses, pipeline innovations, and regulatory landscape shifts.

- Developing strategic partnerships and cost-efficient manufacturing will be critical to sustain profitability in a commoditized environment.

Frequently Asked Questions

1. When will Valganciclovir's patent expire, and how will it affect the market?

AbbVie's flagship patent is expected to expire by 2024-2025 in major markets like the U.S. and EU. Post-expiry, generic manufacturers will introduce equivalents, drastically reducing prices and increasing access, particularly in emerging markets.

2. How does the price of generic Valganciclovir compare to the branded version?

Generic versions are typically priced 60-80% lower than the branded product, with prices ranging from USD 300-USD 500 per treatment course depending on regional factors.

3. Which regions are expected to see the most significant price declines?

Developed markets such as the U.S. and EU will experience rapid price decreases following patent expiration. Emerging markets will observe gradual declines, contingent upon regulatory policies and market competition.

4. Are there alternative therapies emerging for CMV management?

Yes, investigational drugs, including newer antivirals and immunotherapies, are under clinical evaluation. If approved, these could influence Valganciclovir’s market share and pricing dynamics.

5. What strategies should pharmaceutical companies adopt?

Companies should focus on optimizing cost structures, extending patent protections through formulations or delivery innovations, and expanding into underserved markets to sustain revenue streams amid declining prices.

References

- Global Market Insights. (2022). Antiviral Drugs Market.

- World Health Organization. (2022). Transplantation Data.

- IQVIA. (2022). Global Pharmaceutical Pricing Trends.

- Pharmaceutical Technology. (2022). Patent Expiry Impact on Antiviral Market.

- U.S. Food & Drug Administration. (2023). Valganciclovir Approvals and Patents.