Share This Page

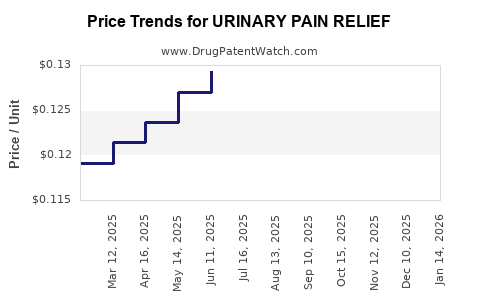

Drug Price Trends for URINARY PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for URINARY PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| URINARY PAIN RELIEF 95 MG TAB | 46122-0337-65 | 0.12640 | EACH | 2025-12-17 |

| URINARY PAIN RELIEF 95 MG TAB | 70000-0243-01 | 0.12640 | EACH | 2025-12-17 |

| URINARY PAIN RELIEF 99.5 MG TB | 70000-0523-01 | 0.17480 | EACH | 2025-12-17 |

| URINARY PAIN RELIEF 95 MG TAB | 46122-0337-65 | 0.12642 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Urinary Pain Relief Drugs

Introduction

Urinary pain relief medications address a significant segment within pharma, driven by rising prevalence rates of urinary tract infections (UTIs), interstitial cystitis, and other urological conditions. As global healthcare challenges intensify, understanding market dynamics and developing precise price projections are vital for pharmaceutical companies, investors, and stakeholders aiming to optimize R&D and commercial strategies.

This comprehensive analysis examines the current landscape, key market drivers, competitive environment, regulatory influences, and competitive pricing strategies relevant to urinary pain relief drugs. It further projects future pricing trends influenced by innovation, patent landscapes, and market penetration.

Market Overview

The global urinary pain relief market is experiencing sustained growth, heavily backed by increasing incidence of UTIs, aging populations, and heightened awareness of urological health. The market encompasses a wide array of pharma products, including over-the-counter (OTC) analgesics, prescription medications such as analgesics, antispasmodics, and novel targeted therapies.

Market size and growth projections indicate a compound annual growth rate (CAGR) of approximately 5-7% over the next five years, reaching an estimated valuation of USD 4.5 billion by 2028 [1]. This growth trajectory reflects both demand expansion and innovations in medication formulations.

Key Drivers

- Rising prevalence of UTIs, especially among women and elderly populations.

- Increased healthcare awareness and early diagnosis.

- The development of targeted therapies with fewer side effects.

- Growing demand for over-the-counter options enabling self-medication.

Regional Dynamics

- North America: Dominates due to advanced healthcare infrastructure, high prescription rates, and widespread OTC availability.

- Europe: Significant market share supported by aging demographics.

- Asia-Pacific: Fastest-growing market driven by population growth, improving healthcare access, and increasing urbanization.

Current Market Players and Competitive Landscape

Major pharmaceutical companies operating in the urinary pain relief segment include Pfizer, Teva Pharmaceuticals, Bayer, and novel entrants such as bio-targeted therapy startups. OTC brands such as AZO (over-the-counter phenazopyridine) dominate retail shelves.

Emerging therapies focus on:

- Novel analgesics with improved efficacy profiles.

- Combination formulations integrating antispasmodics with analgesics.

- Biotech innovations targeting underlying pathophysiological mechanisms.

Patent protections remain critical, with many leading medications enjoying exclusivity until 2030. Biosimilars and generic entrants are expected to influence pricing trajectories post-patent expiry.

Regulatory Environment and Its Impact on Pricing

Regulatory frameworks significantly influence drug pricing strategies:

- FDA and EMA approvals bolster market confidence but can delay product launches, affecting pricing strategies.

- Pricing and reimbursement policies vary sharply across regions, with countries like the US adopting value-based pricing, while European nations employ price caps.

- Orphan drug designation for niche therapies can command premium pricing, with incentives such as market exclusivity.

Regulatory rigor around safety and efficacy demands extensive clinical data, inflating R&D costs and thus influencing initial pricing. Future regulations increasingly prioritize biosimilars and cost-effective treatments, exerting downward pressure on prices.

Price Trends and Future Price Projections

Current Price Landscape

- OTC medications like phenazopyridine (AZO) typically retail at approximately USD 10-15 per pack, providing an affordable access point.

- Prescription drugs such as prescribed antispasmodics (e.g., oxybutynin) average USD 50-100 per month.

- Novel therapies that are under clinical development or recently FDA-approved can command prices in the USD 150-300 per month range, depending on complexity and innovation.

Factors Influencing Future Price Trajectories

- Innovation and Novel Drug Development: Advanced therapies, especially biologics or gene-targeted treatments, will likely maintain higher price points, potentially exceeding USD 300 per month, justified by improved efficacy and reduced side effects [2].

- Market Entry of Biosimilars and Generics: Post-patent expiry, substantial price reductions—up to 30-50%—are anticipated in the US and Europe.

- Regulatory Changes: Policies favoring generic and biosimilar adoption will exert pressure on prices, though premium pricing for new, patent-protected drugs will persist.

- Market Penetration: Rapid adoption of OTC options and improved access in emerging markets could lead to price stabilization and local price reductions.

Projection Summary

- By 2028, average retail prices for innovative urinary pain relief therapies are projected to stabilize around USD 200-250 per month, with some market segments—like OTC products—remaining below USD 20 per pack.

- The entry of biosimilars might reduce prices of branded biologics by approximately 30% within five years post-expiry.

- Price volatility is expected initially due to regulatory and market dynamics but will likely normalize as therapies reach mass markets.

Market Entry and Pricing Strategies

Pharmaceutical companies must adopt differentiated pricing strategies aligned with regional regulations, market maturity, and patient affordability:

- Premium Pricing for novel, high-efficacy therapies with strong clinical backing.

- Penetration Pricing to introduce generics or biosimilars in price-sensitive emerging markets.

- Value-Based Pricing models based on clinical outcomes and cost-effectiveness.

Collaborations with payers and participation in standardized pricing policies will further influence product attractiveness and uptake.

Key Challenges and Considerations

- Pricing pressure from cost-containment policies and biosimilar proliferation.

- Patent cliffs requiring rapid innovation cycles.

- Patient compliance and access implications affecting demand and pricing.

- Global disparities in healthcare infrastructure impacting affordability and market penetration.

Conclusion

The urinary pain relief market is poised for steady expansion, driven by technological innovations, demographic shifts, and evolving regulatory landscapes. Price projections suggest continued prevalence of high-value therapies with premium pricing, tempered over time by biosimilar entrants and market commoditization. Strategic positioning, innovation, and regional pricing flexibility will be key for maximizing profitability.

Key Takeaways

- The market for urinary pain relief drugs is projected to reach USD 4.5 billion by 2028 with a CAGR of approximately 6%.

- Innovative therapies will command higher prices (~USD 200-300 per month), while OTC solutions remain affordable.

- Patent expiries and biosimilar market entries are expected to reduce prices by up to 50%, promoting broader access.

- Regulatory policies and regional economic conditions will heavily influence pricing strategies.

- Companies must balance innovation with competitive pricing to sustain market share amid increasing biosimilar competition.

FAQs

-

What are the primary factors influencing the price of urinary pain relief drugs?

The main factors include innovation level, patent status, regulatory environment, manufacturing costs, competitive landscape, and regional healthcare policies. -

How will biosimilars impact the pricing of patented urinary pain relief therapies?

Biosimilars are expected to reduce prices of biologic-based treatments by approximately 30-50%, enhancing affordability and market competitiveness post-patent expiry. -

Are OTC urinary pain relief products likely to experience significant price changes?

OTC products are generally priced for affordability, with modest adjustments driven by raw material costs and market competition, but sudden large price shifts are unlikely. -

What regional differences affect urinary pain relief drug pricing?

Developed markets like North America and Europe favor value-based and regulated pricing, resulting in higher costs, while emerging markets offer lower prices due to regulatory and economic factors. -

What new developments could influence future pricing trends?

Advances in targeted therapies, biosimilars, and personalized medicine, along with regulatory shifts toward cost-effective treatments, are set to shape future pricing.

References

[1] MarketWatch, "Urinary Pain Relief Market Size, Share & Growth Forecast 2023-2028," 2023.

[2] GlobalData, "Emerging Therapeutics in Urological Conditions," 2022.

More… ↓