Last updated: July 27, 2025

Introduction

Urea, a critical nitrogenous fertilizer and industrial chemical, plays an essential role in global agriculture and manufacturing sectors. With an annual production volume exceeding 180 million tonnes, urea’s market dynamics are shaped by agricultural demand, energy prices, environmental regulations, and geopolitical factors. This report provides an extensive market analysis and price projections, emphasizing current trends, supply-demand fundamentals, and future outlooks to assist decision-makers across industries.

Market Overview

Global Production and Consumption

Globally, China, India, and the Middle East dominate urea production, collectively accounting for over 70% of the output. China alone contributes approximately 50 million tonnes annually, with India close behind, driven by its large agricultural sector. The Middle East, especially countries like Saudi Arabia and Qatar, primarily exports urea, leveraging cheap natural gas supplies, which constitute about 70% of manufacturing costs.

Worldwide consumption aligns closely with agricultural fertilizer needs, given urea’s status as the most cost-effective nitrogen fertilizer. Approximately 175 million tonnes of urea are utilized annually for fertilizers, while the rest serves industrial purposes in chemicals, plastics, and resins.

Market Drivers

- Agricultural Demand: As the global population surpasses 8 billion, demand for nitrogen-based fertilizers intensifies, with developing countries experiencing the highest growth rates.

- Energy Prices: Natural gas prices significantly influence urea production costs. A decline in natural gas prices in the Middle East and the US has led to increased competitiveness.

- Environmental Regulations: Stricter emission standards and policies promoting sustainable agriculture impact production methodologies and costs.

- Trade Policies: Tariffs, export quotas, and sanctions influence regional supply flows.

Supply Dynamics

Major Producers and Exporters

- China: The world’s largest producer, primarily for domestic consumption but also a significant exporter. Chinese policy shifts on export restrictions influence global supply.

- India: Self-sufficient but reliant on imports during supply shortages; government subsidies also affect trade flows.

- Middle East & North Africa: Large-scale, cost-effective production due to abundant natural gas; key exporters to Asia and Africa.

- US & Russia: Smaller players with niche markets; US producers benefit from shale gas, while Russia’s exports are impacted by geopolitical tensions, notably with sanctions.

Supply Risks

- Feedstock Variability: Natural gas shortages or price spikes can constrain production.

- Geopolitical Tensions: US-China trade disputes, Middle East conflicts, and sanctions on Russian supplies disturb regional outputs.

- Environmental Policies: Carbon pricing and emissions reductions may increase operational costs.

Demand Projections

Agricultural Outlook

Projected global fertilizer consumption CAGR of approximately 3% through 2030 largely driven by emerging markets expanding agricultural productivity. India and Africa are expected to be prominent growth centers, championed by government initiatives and population growth.

Industrial & Other Uses

While fertilizer remains dominant, industrial applications in plastics, resins, and chemical manufacturing are expanding, especially in regions adopting petrochemical industries.

Price Dynamics and Projections

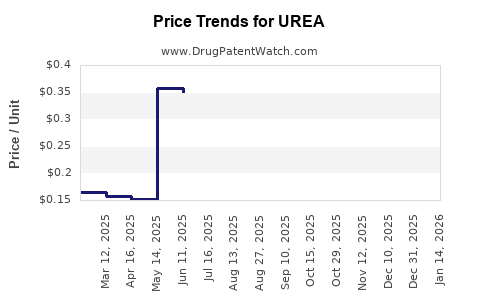

Recent Price Trends

Urea prices reached an average of $300-$350 per tonne FOB (Free on Board) in 2022–2023, driven by:

- Elevated natural gas prices in certain regions.

- Disruptions caused by COVID-19 supply chain constraints.

- Geopolitical tensions affecting supply chains, notably the Russia-Ukraine conflict impacting Russian exports.

Projected Price Range (2023–2028)

Based on current supply-demand fundamentals and macroeconomic variables, the following projections are outlined:

| Year |

Expected Price Range (USD/tonne FOB) |

Rationale |

| 2023 |

$330 – $370 |

Stabilization post-pandemic, sustained energy prices, and demand. |

| 2024–2025 |

$310 – $340 |

Slight decline as new capacities ramp up and energy markets stabilize. |

| 2026–2028 |

$290 – $330 |

Potential oversupply with capacity additions, moderated by environmental regulations and energy costs. |

Assumptions:

- Natural gas prices stabilize between $3–$4 per MMBtu.

- No major geopolitical disruptions; stable trade policies prevail.

- Sustainable agricultural practices maintain steady fertilizer demand growth.

Key Factors Influencing Price Trends

- Energy Costs: As natural gas remains the primary input, any fluctuation significantly impacts urea prices.

- Capacity Expansion: New projects in the Middle East and North Africa could increase supply, tempering prices.

- Environmental Policies: Carbon taxes or emissions regulations may elevate costs, ultimately increasing prices.

- Trade Policies: Tariffs or export bans could distort regional availability, impacting global price levels.

Market Opportunities and Risks

-

Opportunities:

- Capitalizing on expanding demand in Asia, especially India and Southeast Asia.

- Investing in low-cost, environmentally efficient production facilities.

- Developing alternative feedstock utilization methods to mitigate energy price volatility.

-

Risks:

- Overcapacity leading to oversupply and price depression.

- Stringent environmental policies raising operational costs.

- Geopolitical tensions disrupting supply chains.

- Volatility in energy markets affecting feedstock costs.

Regulatory & Environmental Considerations

Rising environmental consciousness compels producers to adopt cleaner production technologies. Carbon pricing mechanisms in Europe and potential similar policies elsewhere could escalate costs, affecting price stability and competitiveness. Persistent pressure to reduce greenhouse gas emissions pushes investment toward green ammonia and alternative fertilization methods, potentially reshaping urea markets in the long term.

Conclusion

The urea market exhibits a complex interplay of demand growth, supply capacity, energy prices, and regulatory factors. Prices are expected to stabilize but remain susceptible to macroeconomic shifts, energy cost fluctuations, and trade dynamics. Strategic positioning in regions with access to cheap feedstock, technological innovation toward sustainable production, and awareness of geopolitical risks can enhance profitability and market resilience.

Key Takeaways

- The global urea market is poised for moderate growth, driven primarily by emerging market demand in Asia, Africa, and Latin America.

- Prices are projected to range between $290 and $370 per tonne over the next five years, influenced heavily by natural gas prices and capacity additions.

- Supply-side risks include energy price volatility and geopolitical tensions, notably in producer regions like Russia and the Middle East.

- Environmental policies will increasingly impact production costs and market competitiveness, prompting investment in cleaner technologies.

- Strategic insights indicate that regional dominance, technological innovation, and responsiveness to regulation will be critical for market participants.

FAQs

1. How do natural gas prices directly impact urea prices?

Natural gas accounts for approximately 70% of urea production costs. Fluctuations in gas prices directly influence manufacturing expenses, subsequently affecting FOB prices. Higher gas prices lead to increased urea prices, whereas declines tend to suppress costs and prices.

2. What are the primary regions for urea production and export?

China, India, and Middle Eastern countries like Saudi Arabia and Qatar are leading producers. China mainly supplies domestic markets, while the Middle East and North Africa focus on export-led growth due to abundant cheap natural gas.

3. How might environmental regulations affect the urea market?

Stricter emissions standards and carbon pricing can increase production costs, potentially raising prices. Conversely, sustainability initiatives may promote innovation in alternative fertilizers or low-carbon production methods, influencing market dynamics.

4. What are the growth prospects for urea demand in Africa?

Africa’s agricultural sector is expanding due to population growth and food security initiatives, projecting a CAGR of approximately 4–5% in fertilizer consumption, including urea, through 2030.

5. Can renewable energy sources influence urea production costs?

Yes. Innovations in green ammonia (via renewable-powered electrolysis) could reduce reliance on fossil fuels, lower emissions, and potentially stabilize or reduce long-term production costs, transforming market economics.

Sources

[1] Allied Market Research. Urea Market Statistics.

[2] IFA (International Fertilizer Association). World Fertilizer Trends and Outlook.

[3] U.S. Energy Information Administration. Natural Gas Prices.

[4] GlobalData. Urea Market Forecasts.

[5] International Monetary Fund. Energy Price Volatility and Its Impact on Fertilizer Markets.