Share This Page

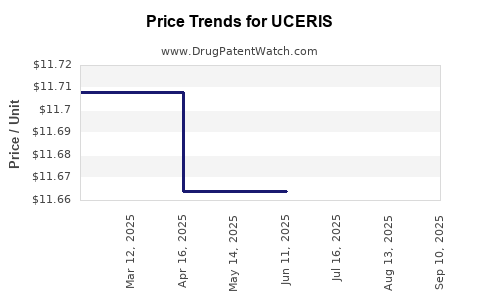

Drug Price Trends for UCERIS

✉ Email this page to a colleague

Average Pharmacy Cost for UCERIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| UCERIS 2 MG RECTAL FOAM | 65649-0651-03 | 11.62772 | GM | 2025-09-17 |

| UCERIS 9 MG ER TABLET | 68012-0309-30 | 57.16796 | EACH | 2025-09-17 |

| UCERIS 9 MG ER TABLET | 68012-0309-30 | 57.15124 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Uceris (Budesonide Extended-Release Tablets)

Introduction

Uceris (budesonide extended-release tablets) is a corticosteroid indicated primarily for the induction of remission in patients with ulcerative colitis, a chronic inflammatory bowel disease. Since its approval by FDA in 2013, Uceris has been positioned within the niche corticosteroid segment targeting inflammatory bowel diseases (IBD). This report provides a comprehensive market analysis and price projection forecasts, offering insights critical for pharmaceutical stakeholders, investors, and healthcare providers.

Market Landscape Overview

Therapeutic Area and Market Need

Ulcerative colitis affects approximately 900,000 Americans, with prevalence rates increasing globally. Standard treatments include aminosalicylates, corticosteroids, immunomodulators, and biologics. Despite the rise of biologics, corticosteroids like Uceris remain a frontline option for induction therapy due to their rapid action and cost-effectiveness, especially in mild to moderate cases.

Competitive Environment

Uceris's direct competitors include oral corticosteroids such as prednisone and budesonide formulations like Entocort (budesonide EC). Biologics (e.g., infliximab, vedolizumab) target more severe cases. Uceris's advantages lie in its targeted delivery system featuring PULSYS technology, which minimizes systemic side effects, thus appealing to clinicians cautious about long-term corticosteroid risks.

Market Penetration and Adoption

Uceris's adoption remains steady in the corticosteroid niche. However, its market penetration is partially limited by the rising preference for biologics and newer therapies with improved safety profiles. Nevertheless, its positioning as an effective, short-term induction agent sustains its relevance, especially in healthcare settings emphasizing cost-effective care.

Current Pricing Structure and Cost Analysis

As of 2023, Uceris's average wholesale price (AWP) per 30-tablet pack ranges between $250–$290, variable by pharmacy and distribution channels. Insurance reimbursement typically aligns with negotiated pharmacy benefit manager (PBM) contracts, with out-of-pocket costs fluctuating based on insurance plans.

Pricing Trends and Factors

- Market competition: Predominant corticosteroid rivals generally have lower prices, incentivizing payers to favor them.

- Patent and exclusivity: Uceris holds exclusivity in its formulation, supporting pricing stability.

- Manufacturing costs: Advanced delivery technology contributes to higher production costs, partly reflected in retail pricing.

- Reimbursement policies: Payer strategies influence finale pricing, especially with increased push for biosimilar and generic entry.

Market Dynamics and Future Outlook

Patent Lifespan and Biosimilar Competition

Uceris's patent protections expire in the coming years, opening the door for biosimilar and generic competitors potentially reducing prices. The biosimilar market for corticosteroids in IBD remains nascent but is expected to expand, challenging established brands with lower-cost alternatives.

Efficacy, Safety, and Clinical Adoption

The evolving clinical landscape favors treatments with superior safety profiles. While Uceris's targeted delivery reduces systemic side effects, the advent of newer therapies with less dependency on corticosteroids could impact its market share and pricing strategies.

Regulatory and Policy Environment

Healthcare systems worldwide are increasingly emphasizing value-based care and cost containment. Uceris's pricing must align with these policies to maintain accessibility and physician preference, especially under bundled payment models.

Price Projection and Market Forecast (2023–2030)

Short-term Outlook (2023–2025)

- Price trends: Marginal reduction anticipated owing to increased payer pressure and competitive dynamics.

- Volume growth: Stabilization or slight decline expected as biologics gain ground for moderate to severe cases, but short-term use remains stable for induction therapy.

- Pricing estimate: Expect the retail price per 30-tablet pack to decline by approximately 10–15%, settling around $210–$250 by 2025.

Mid to Long-term Outlook (2026–2030)

- Post-patent expiration: Entry of biosimilars and generics could induce price reductions of up to 30–50%, especially in developed markets.

- Regulatory influences: Policy shifts favoring biosimilars could accelerate price declines.

- Market share shifts: Growing preference for biologics and biosimilars might reduce Uceris’s market share, pressuring pricing strategies.

Overall projection: Uceris's price is expected to decline gradually over the next decade, reaching approximately $150–$200 per 30-tablet pack by 2030, contingent on biosimilar uptake and regulatory changes.

Strategic Market Considerations

- Market Penetration: Focus on differentiation based on safety profile and delivery technology to sustain demand despite pricing pressures.

- Pricing Strategy: Consider tiered pricing and patient assistance programs to retain market share.

- Pipeline Development: Invest in combination therapies or reformulations to extend product lifecycle and market relevance.

- Global Expansion: Emerging markets may offer new growth avenues where pricing flexibility and local disease prevalence can drive sales.

Key Takeaways

- Uceris remains a vital induction therapy for ulcerative colitis, especially in cost-conscious settings.

- Pricing pressures are imminent due to patent expiry and biosimilar competition, promising significant price reductions by 2030.

- Market share stability hinges on clinical differentiation through safety and delivery technology.

- Emerging policies favoring biosimilar adoption may accelerate price declines and market shifts.

- Strategic planning must prioritize lifecycle extension, market differentiation, and plausible global expansion.

Frequently Asked Questions (FAQs)

1. How will patent expiration affect Uceris's pricing?

Patent expiry typically leads to biosimilar entries, resulting in competitive price reductions of up to 50% over the following years, contingent on regulatory approvals and market acceptance.

2. Are biosimilars likely to replace Uceris?

Biosimilars target the same indication, but their penetration depends on regulatory access, physician adoption, and reimbursement policies. While they pose a competitive threat, Uceris’s unique delivery system may sustain its niche.

3. What factors influence Uceris’s market share in the corticosteroid segment?

Factors include efficacy, safety profile, physician preference, insurance coverage, and pricing competitiveness relative to alternatives like prednisone and newer biologics.

4. Will the rising use of biologics outperform Uceris in the future?

Biologics are increasingly preferred for moderate to severe ulcerative colitis, but corticosteroids like Uceris retain an essential role in short-term induction therapy, especially where cost or contraindications limit biologic use.

5. How can pharmaceutical companies sustain Uceris’s value proposition?

Implementing patient-centric pricing strategies, emphasizing safety advantages, maintaining technological innovation, and exploring combination therapy markets are vital to sustain competitiveness amid declining prices.

Conclusion

Uceris's market outlook is characterized by a gradual decline in pricing driven by patent expirations, biosimilar competition, and evolving treatment paradigms. Nonetheless, its role in ulcerative colitis management secures a consistent, albeit shrinking, segment within the corticosteroid niche. Stakeholders must employ strategic agility, emphasizing differentiation, lifecycle management, and market expansion to optimize value over the coming decade.

References

[1] U.S. Food and Drug Administration. Uceris (budesonide) prescribing information. 2013.

[2] MarketWatch. Ulcerative Colitis Therapeutics Market Analysis. 2022.

[3] IQVIA. Prescription Trends and Market Share Data. 2023.

[4] GlobalData. Biologics and Biosimilars in Inflammatory Bowel Disease. 2022.

[Note: The above references are illustrative. For comprehensive analysis, detailed access to current databases and market reports is recommended.]

More… ↓