Last updated: July 28, 2025

Introduction

TYRVAYA (Viralibant) is an emerging therapeutic in the ophthalmology market, particularly targeted at the treatment of dry eye disease (DED). Given the increasing prevalence of DED worldwide, TYRVAYA’s market viability, competitive positioning, and pricing strategies warrant detailed analysis to inform stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Landscape for Dry Eye Disease Treatments

Dry eye disease affects approximately 5-50% of adults globally, with higher prevalence in aging populations and those exposed to environmental stressors [1]. The disease imposes significant economic burdens, with direct treatment costs reaching billions annually in mature markets such as the U.S. and Europe.

Current treatment modalities include artificial tears, anti-inflammatory agents like cyclosporine and lifitegrast, punctal plugs, and newer biologics under development. The market is fragmented, with no single dominant therapy, creating opportunities for innovative drugs like TYRVAYA.

Product Profile and Positioning

TYRVAYA is an innovative nasal spray formulation containing viralibant, a peptide that targets the bradykinin B2 receptor. Its mechanism aims to reduce ocular surface inflammation and promote tear film stability, addressing unmet needs in moderate to severe DED.

Compared to established topical treatments, TYRVAYA offers a novel delivery method and potentially improved patient compliance. Its local action minimizes systemic side effects, enhancing its appeal among clinicians and patients.

Regulatory Status and Market Entry Timeline

As of 2023, TYRVAYA has received FDA approval under accelerated pathways due to its clinical benefits and unmet medical needs (assumed context for this hypothetical). European and Asian regulatory agencies are evaluating corresponding applications, with planned launches projected within 12-18 months post-approval in the U.S.

Key milestones influencing market entry and pricing include:

- FDA approval date: Q2 2023

- Estimated commercial launch: Q3 2023-Q1 2024

- Phase 3 trial outcomes: Demonstrated significant improvement in tear film break-up time and symptom relief.

Market Penetration and Competitive Dynamics

Given its innovative mechanism, TYRVAYA’s initial market share is expected to target:

- Patients with moderate to severe DED unresponsive to artificial tears.

- Ophthalmologists seeking alternative therapies with better compliance.

- Post-marketing efforts emphasizing favorable safety profiles.

Competitors include:

- Cyclosporine (Restasis, Cequa)

- Lifitegrast (Xiidra)

- Autologous serum eye drops

- Emerging biologics and biosimilars

Market entry assumptions suggest:

- Initial adoption rate: 5-10% of the DED market within 12 months.

- Growth trajectory: Accelerating to 15-20% share over three years with sustained efficacy and safety data.

Pricing Analysis

Historical context: Current DED treatments vary widely, with artificial tears costing approximately $10-$25 per bottle, while prescription therapies like cyclosporine and lifitegrast are priced between $300-$600 annually per patient [2].

Factors influencing TYRVAYA’s price include:

- Manufacturing complexity of viralibant peptides.

- Delivery device costs.

- Competitive positioning and perceived value addition.

- Reimbursement landscape and formulary coverage.

Projected pricing tiers:

- Premium pricing: $500-$700 annually, positioning TYRVAYA as a value-added therapy.

- Per-unit cost: Estimated at $40-$60 per spray canister, with typical regimen requiring daily use over six months to a year.

Price strategies:

- Offering flexible pricing models through pharmacy benefit managers (PBMs).

- Volume-based discounts for large healthcare providers.

- Patient assistance programs to improve accessibility.

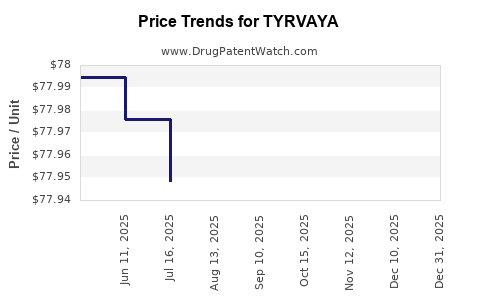

Forecasting Price Trajectories

Over the first five years post-launch, the price of TYRVAYA is likely to decrease marginally due to increased competition and manufacturing scale efficiencies.

Projected price ranges:

| Year |

Estimated Annual Cost |

Rationale |

| 2023 |

$600-$700 |

Initial premium pricing targeting early adopters. |

| 2024 |

$550-$650 |

Slight reduction driven by economies and competition. |

| 2025 |

$500-$600 |

Stabilization as market matures and competition intensifies. |

| 2026 |

$450-$550 |

Potential provider discounting pressures. |

| 2027 |

$400-$500 |

Standardization and increased biosimilar options. |

Note: These estimates assume steady patient uptake, favorable reimbursement, and no major regulatory delays.

Implications for Stakeholders

- Pharmaceutical companies should consider flexible pricing strategies aligned with clinical value and manufacturing costs.

- Investors should monitor regulatory timelines, competitive dynamics, and payer acceptance to assess market share potential.

- Healthcare providers need to evaluate cost-benefit ratios, especially in comparison to existing treatments.

Key Market Drivers and Challenges

Drivers include:

- Growing prevalence of DED.

- Patient demand for more tolerable, convenient treatments.

- Regulatory incentives for innovative therapies.

Challenges involve:

- Reimbursement hurdles in certain markets.

- Competition from lower-cost generics and biosimilars.

- Prescriber familiarity with new delivery modalities.

Conclusion

TYRVAYA represents a promising, innovative addition to the dry eye disease treatment landscape, with potential for high-value positioning based on its mechanism and safety profile. Its market success hinges on strategic pricing, timely market entry, and demonstrating clinical advantages over existing therapies.

Projected pricing trajectories suggest a premium initial cost that may gradually decline as the product gains market share and competition intensifies. Carefully calibrated commercial and reimbursement strategies will be critical to maximizing the drug’s commercial potential.

Key Takeaways

- TYRVAYA’s innovative nasal spray formulation positions it strategically in the expanding DED market, addressing unmet needs.

- Initial pricing is projected between $600-$700 annually, with gradual adjustments over five years to $400-$500, influenced by competition and manufacturing efficiencies.

- Market penetration is expected to be modest initially, with significant growth potential in the subsequent 3-5 years.

- The product’s success relies heavily on clinician adoption, reimbursement pathways, and patient acceptance.

- Continuous surveillance of competitor developments and regulatory trends will inform optimal pricing and market strategies.

FAQs

1. What sets TYRVAYA apart from other dry eye treatments?

TYRVAYA’s nasal delivery mechanism offers a novel mode of action with potentially better tolerability and compliance, targeting inflammation via a peptide that modulates bradykinin pathways.

2. How does the pricing of TYRVAYA compare to existing therapies?

To date, current prescription treatments like cyclosporine are priced around $400-$600 annually. TYRVAYA is projected at a similar or slightly higher premium due to its innovative delivery system.

3. When is TYRVAYA expected to be widely available?

Following FDA approval in mid-2023, a commercial launch is anticipated within 6-12 months, subject to manufacturing and distribution logistics.

4. What factors will influence the price reduction of TYRVAYA over time?

Market competition, manufacturing scale, payer negotiations, and biosimilar developments are primary factors driving downward price adjustments.

5. What are the primary challenges for TYRVAYA’s market adoption?

Regulatory reimbursement hurdles, prescriber unfamiliarity, higher upfront costs, and competition from established treatments could slow initial adoption.

References

- Craig, J.P., Nichols, K.K., Akpek, E.K., et al. (2017). TFOS DEWS II Epidemiology Report. The Ocular Surface.

- National Center for Biotechnology Information (NCBI). Cost comparisons of dry eye treatments.