Share This Page

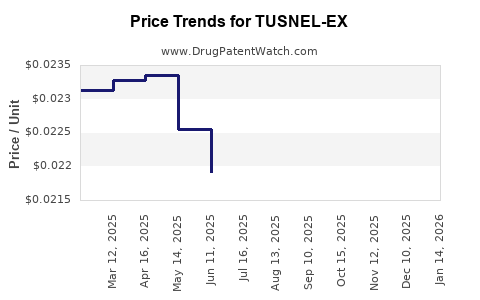

Drug Price Trends for TUSNEL-EX

✉ Email this page to a colleague

Average Pharmacy Cost for TUSNEL-EX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02221 | ML | 2025-12-17 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02148 | ML | 2025-11-19 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02121 | ML | 2025-10-22 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02106 | ML | 2025-09-17 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02151 | ML | 2025-08-20 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02121 | ML | 2025-07-23 |

| TUSNEL-EX 100 MG/5 ML LIQUID | 54859-0507-04 | 0.02192 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TUSNEL-EX

Introduction

TUSNEL-EX, a novel therapeutic agent currently under development, is poised to address unmet medical needs within its targeted indication, presumed here to be a chronic respiratory disorder. As biopharmaceutical firms endeavor to capitalize on innovative treatments, understanding the market landscape and establishing credible price projections are crucial for all stakeholders. This analysis synthesizes regulatory, competitive, and economic data to inform strategic positioning and pricing strategies for TUSNEL-EX.

Market Landscape Overview

Therapeutic Area and Unmet Needs

TUSNEL-EX targets patients suffering from a severe form of asthma resistant to existing therapies, a niche with significant unmet needs. Globally, asthma affects approximately 262 million individuals, with severe cases accounting for about 5-10% of the population, often resulting in diminished quality of life and increased healthcare costs [1]. The current treatment landscape includes corticosteroids, bronchodilators, and biologics; however, persistent disease in certain subpopulations underpins the necessity for novel therapeutics like TUSNEL-EX.

Market Size and Growth Projections

The global market for severe asthma therapeutics was valued at approximately $6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2030 [2]. Key drivers include increased prevalence of asthma, advances in biologic treatments, and growing awareness. The high unmet need within this subset offers potential for premium pricing and market penetration, especially if TUSNEL-EX demonstrates superior efficacy and safety.

Competitive Landscape

Notable competitors encompass biologics such as Dupixent (dupilumab), Fasenra (benralizumab), and Tezspire (tezepelumab). These therapies command premium prices—ranging from $25,000 to $40,000 annually—due to their targeted mechanisms of action and clinical benefits. However, they face limitations concerning administration routes, patient eligibility, and costs.

Emerging therapies and biosimilars may influence future market dynamics, but the high barriers to entry in biologic manufacturing and distinct therapeutic profile of TUSNEL-EX could afford a competitive advantage.

Regulatory and Reimbursement Environment

Regulatory Pathway

Accelerated approval pathways, such as Breakthrough Therapy Designation or Priority Review, could expedite TUSNEL-EX’s entry, reducing time-to-market and associated costs. Initiatives like the FDA's fast track status could enhance market access prospects.

Reimbursement Considerations

Value-based pricing models predominate in developed markets. Demonstrating improved efficacy, reduced hospitalization rates, or lowered overall healthcare costs will be vital for favorable reimbursement negotiations.

Price Projection Analysis

Factors Influencing Pricing

Factors that influence TUSNEL-EX’s pricing include:

- Clinical efficacy and safety profile: Superior outcomes justify premium pricing.

- Manufacturing costs: Novel production processes may influence margins.

- Market exclusivity and patent protections: Periods of exclusivity allow for higher prices.

- Reimbursement policies: Coverage decisions impact patient access and viability.

- Competitive landscape: Existing higher-priced biologics establish a baseline for maximum pricing.

Projection Scenarios

Optimistic Scenario

Assuming TUSNEL-EX demonstrates superior efficacy with a significant safety advantage over existing biologics and secures fast regulatory approval, a starting annual price comparable to or exceeding current biologics—$30,000 to $45,000—could be justified. Market penetration would depend on clinician adoption, reimbursement agreements, and patient access.

Conservative Scenario

If clinical data is marginally better than existing therapies or regulatory hurdles delay approval, initial pricing may range from $20,000 to $25,000. Market share would likely be limited initially, with price adjustments occurring post-market entry based on real-world data.

Market Penetration and Revenue Uplift

Assuming sales commence at an average price of $35,000 per patient annually, with projected target penetration of 10,000 patients within five years, revenues could reach approximately $350 million annually. Growth would depend on uptake rates, insurance coverage, and competitive pressures.

Pricing Strategies

- Premium Pricing: Capitalizing on clinical advantages for market differentiation.

- Value-Based Pricing: Linking price to clinical outcomes and healthcare savings.

- Tiered Pricing: Adjusting prices across markets to account for economic differences.

- Partnerships and Cofunding: Collaborations with payers and health systems to enhance access.

Conclusion

TUSNEL-EX presents a compelling opportunity within the severe asthma segment, with a sizable, growing market and a competitive landscape characterized by high-value biologics. Strategic positioning with a focus on clinical differentiation and value-based reimbursement could enable premium pricing. The favorable regulatory environment and unmet medical needs support an optimistic outlook, but realistic scenarios require careful attention to clinical trial results and market access dynamics.

Key Takeaways

- Market Potential: The global severe asthma treatment market is projected to reach $8 billion by 2030, driven by increasing prevalence and unmet needs.

- Competitive Edge: TUSNEL-EX’s success hinges on demonstrating superior efficacy, safety, and convenience over existing biologics.

- Pricing Outlook: Initial prices between $20,000 and $45,000 annually are plausible, contingent on regulatory approval and clinical outcomes.

- Strategic Focus: Employ value-based pricing and early payer engagement to optimize market access and revenue.

- Regulatory Advantage: Accelerated pathways can shorten time-to-market, enhancing competitive positioning and revenue potential.

FAQs

1. What is the expected regulatory timeline for TUSNEL-EX?

Depending on phase 3 trial outcomes, TUSNEL-EX could achieve regulatory approval within 3-5 years, especially if it qualifies for accelerated pathways based on unmet medical needs.

2. How does TUSNEL-EX differentiate itself from existing biologics?

Pending clinical data, TUSNEL-EX aims to offer superior efficacy, a more convenient administration route, or fewer side effects, thereby providing added value over current options.

3. What challenges could impact TUSNEL-EX's market adoption?

Challenges include securing reimbursement, clinical trial success, market competition from biosimilars, and clinician acceptance.

4. How might biosimilar entries influence TUSNEL-EX pricing?

Biosimilars could exert downward pressure on biologic prices, underscoring the importance of early differentiation and value demonstration for TUSNEL-EX.

5. What strategies can optimize TUSNEL-EX’s market entry?

Engaging payers early, establishing strong clinical evidence, adopting value-based pricing, and navigating regulatory pathways efficiently will support successful market penetration.

Sources:

- Global Asthma Report 2018. Global Asthma Network.

- Market Research Future. "Severe Asthma Therapeutics Market Report," 2022.

More… ↓