Share This Page

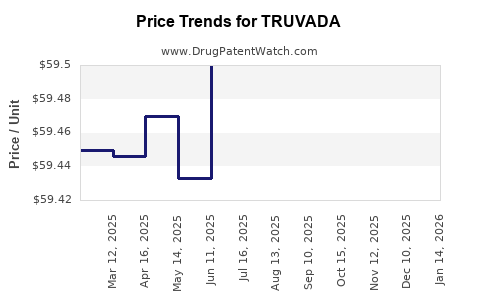

Drug Price Trends for TRUVADA

✉ Email this page to a colleague

Average Pharmacy Cost for TRUVADA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRUVADA 200 MG-300 MG TABLET | 61958-0701-01 | 59.64498 | EACH | 2025-11-19 |

| TRUVADA 200 MG-300 MG TABLET | 61958-0701-01 | 59.58095 | EACH | 2025-10-22 |

| TRUVADA 200 MG-300 MG TABLET | 61958-0701-01 | 59.57137 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Truvada

Introduction

Truvada (emtricitabine and tenofovir disoproxil fumarate) is a combination antiretroviral medication developed by Gilead Sciences. It is primarily indicated for the treatment of HIV-1 infection and as a pre-exposure prophylaxis (PrEP) for high-risk populations. Since its FDA approval in 2012, Truvada has become a cornerstone in HIV prevention and therapy. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and projects future pricing trends.

Market Overview

Global HIV/AIDS Landscape and Truvada's Position

The global HIV epidemic persists, with approximately 38 million people living with HIV worldwide as of 2021 [1]. The expansion of PrEP programs and evolving treatment guidelines have significantly increased demand for effective antiretroviral therapies like Truvada.

In 2021, Gilead reported net HIV product revenues exceeding $4 billion, with Truvada constituting a substantial portion. The United States remains the largest market, driven by high HIV prevalence rates and established PrEP initiatives supported by the CDC.

Segmental Breakdown

- Treatment Market: Truvada is used for HIV-positive patients as part of combination therapy.

- Pre-Exposure Prophylaxis Market: Increasingly adopted among at-risk populations, including men who have sex with men (MSM), transgender women, and serodiscordant couples.

Competitive Landscape

While Truvada holds a dominant position, it faces competition from:

- Descovy (FTC/TAF): Also by Gilead, marketed as a safer alternative with reduced renal and bone toxicity.

- Generic formulations: Since patent expiry in 2020 for some formulations, generics are entering the market, pressuring pricing.

- Other PrEP agents: Less prevalent but emerging contenders, including long-acting injectable options like Cabotegravir (ViiV's Cabenuva).

Regulatory Framework and Patent Position

Gilead's patent protection for Truvada extends into the mid-2020s; however, patent litigations and generic approvals have started impacting the monopoly. The FDA approved generic versions in several countries, notably India, in 2020, significantly reducing global prices.

Legal battles and patent challenges: Ongoing, with legal disputes in various jurisdictions over patent extensions and approval of generics.

Market Dynamics Influencing Pricing

Factors Driving Price Trends

- Patent Expiry and Generics: The entrance of generics globally has led to steep price reductions, especially in developing markets.

- Healthcare Policies: Governments increasingly favor cost-effective treatments, driving negotiations and price caps.

- Reimbursement Policies: US Medicare and Medicaid, and international health authorities' coverage decisions impact OOP costs and market pricing.

- Manufacturing Costs: Biotechnology production efficiencies have historically driven down prices post-patent expiry.

- Innovation and New Formulations: Introduction of newer formulations (e.g., Descovy, long-acting injectables) may impact Truvada's market share and pricing strategies.

Historical Price Trends

In high-income countries, Truvada's wholesale acquisition cost (WAC) was approximately $1,800 to $2,000 per month pre-generic entry. Post-generic approval, prices in India and other countries have declined by over 90%.

In the U.S., as of 2022, retail prices for branded Truvada ranged from $2,000 to $2,200 per month, although insurance coverage and patient assistance programs significantly reduce out-of-pocket expenses [2].

Current Pricing Avenues

- Brand Name: Gilead maintains higher prices for the proprietary medication.

- Generics: Available at significantly lower prices in markets where patent barriers are lifted.

- Assistance Programs: Gilead's Gilead Advancing Access program offers subsidies for eligible patients.

Price Projection Analysis

Near-Term (Next 1-3 Years)

Projected declines: With increased generic penetration and potential biosimilar entry, prices are expected to decrease by at least 50% in developed markets, stabilizing brand prices around $800-$1,000 per month, primarily for remaining proprietary formulations.

Market driver: Continued patent expiries, healthcare policies favoring cost savings, and increased availability of generics will dominate the pricing landscape.

Mid to Long-Term (4-10 Years)

Long-term trends: The shift toward newer formulations—particularly long-acting injectables like Cabotegravir—may erode Truvada's market dominance. For HIV prevention, injectable options could significantly alter PrEP pricing dynamics, potentially reducing demand for oral formulations.

Potential price stabilization: As newer drugs gain market share, branded Truvada prices may decline further or be repositioned as niche therapies, possibly to $500-$700 per month.

Market consolidation: Potential mergers or strategic alliances could influence prices, either stabilizing or further reducing costs.

Factors Impacting Future Pricing

- Regulatory decisions: Patent litigations and approvals of biosimilars or generics will be pivotal.

- Market acceptance of alternatives: Uptake of long-acting injectables in PrEP could diminish oral Gilead drug sales, influencing strategic pricing.

- Genomic and biomarker-based therapies: Advances may shift treatment paradigms, indirectly affecting Truvada's valuation.

- Global health initiatives: Donor-funded programs and subsidies will continue to influence prices in low and middle-income countries.

Strategic Implications for Stakeholders

For pharmaceutical companies, understanding the impending generic competition underscores the importance of lifecycle management—including developing next-generation formulations. Policymakers and healthcare systems should evaluate balance between cost containment and access, especially given the public health importance of HIV prevention.

Clinicians and payors must stay apprised of evolving options and pricing trends to optimize treatment strategies and cost-efficiency.

Key Takeaways

- The global HIV treatment and prevention market has propelled Truvada into a dominant position since 2012; however, patent expiration and generic competition are rapidly reshaping the landscape.

- Prices in developed markets are predicted to decline significantly over the next 1-3 years due to generics, with further reductions possible long-term.

- The advent of long-acting injectable therapies poses direct competition to oral PrEP drugs like Truvada, potentially accelerating price erosions.

- Gilead's strategic moves—including patent defense, formulation innovation, and patient assistance—will influence pricing dynamics.

- Policymakers and industry players must adapt to shifting supply chains, regulatory environments, and technological advancements to maintain market relevance.

FAQs

1. How has patent expiration impacted Truvada’s pricing?

Patents expiring in key markets have enabled generic manufacturers to introduce lower-cost alternatives, reducing Truvada’s retail prices by over 90% in some regions, increasing access, especially in low- and middle-income countries.

2. What are the primary competitors to Truvada in HIV prevention?

Descovy is a notable competitor with a similar efficacy profile but improved safety margins. Long-acting injectable agents like Cabotegravir (ViiV) are emerging as effective PrEP alternatives, potentially shifting market dynamics.

3. Will the price of Truvada stabilize after generic entry?

While initial prices may stabilize, ongoing competition, advances in formulations, and healthcare policies will likely maintain downward pressure, especially in cost-sensitive markets.

4. How do healthcare policies influence Truvada pricing?

Government reimbursement schemes, procurement strategies, and national health policies significantly influence prices; programs promoting generic use usually result in lower costs.

5. What is the outlook for Gilead’s revenue from Truvada?

Gilead expects declining revenue from Truvada due to patent challenges and market competition but aims to offset this through next-generation therapies and expanding global access initiatives.

Sources:

[1] UNAIDS, Global HIV & AIDS Statistics — Fact Sheet, 2021.

[2] Medicare.gov, Drug Price Search.

More… ↓