Share This Page

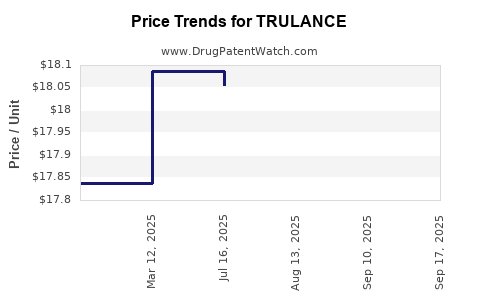

Drug Price Trends for TRULANCE

✉ Email this page to a colleague

Average Pharmacy Cost for TRULANCE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRULANCE 3 MG TABLET | 65649-0003-30 | 18.05422 | EACH | 2025-09-17 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 18.77934 | EACH | 2025-09-15 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 18.05706 | EACH | 2025-08-20 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 18.05486 | EACH | 2025-07-23 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 18.08733 | EACH | 2025-03-08 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 17.83760 | EACH | 2025-02-19 |

| TRULANCE 3 MG TABLET | 65649-0003-30 | 17.83741 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Trulance (Plecanatide)

Introduction

Trulance (plecanatide) is an oral guanylate cyclase-C (GC-C) agonist indicated for the treatment of chronic idiopathic constipation (CIC) and irritable bowel syndrome with constipation (IBS-C). Since its FDA approval in 2017, Trulance has carved a niche within the gastrointestinal (GI) therapeutic landscape, competing with established agents like lubiprostone, linaclotide, and other laxatives. Analyzing its market potential and pricing trajectory is crucial for pharma companies, investors, payers, and healthcare providers aiming to navigate its commercial prospects.

Market Landscape

Therapeutic Market Overview

Constipation-related disorders impact a vast patient population globally. The global constipation therapeutics market was valued at approximately USD 4.5 billion in 2022 and is projected to reach USD 6.0 billion by 2027, growing at a compound annual growth rate (CAGR) of about 5.6% [1]. Key drivers include increasing prevalence of IBS and CIC, rising awareness, and expanding approval of novel drugs.

Competitive Positioning

Trulance operates primarily in the US and select markets, where it faces competition from:

- Linaclotide (Linzess): Market leader, with established efficacy and physician familiarity.

- Lubiprostone (Amitiza): Approved for CIC and IBS-C, with a different mechanism.

- Polyethylene glycol (PEG) and other laxatives: Over-the-counter (OTC) options, often first-line.

While Linaclotide holds a significant market share, Trulance benefits from a convenient once-daily oral dosing and a favorable safety profile, emphasizing its niche as an effective, well-tolerated alternative.

Market Penetration and Patient Adoption

As of 2023, Trulance's market share remains modest, estimated at around 10-15% within the prescription GI segment [2]. Its adoption is influenced by:

- Insurance coverage and reimbursement policies.

- Physician familiarity and prescribing habits.

- Patient preferences for dosing and side-effect profiles.

Expansion potential hinges on increased healthcare provider awareness and positive real-world evidence demonstrating efficacy and safety.

Pricing Dynamics and Revenue Projections

Current Pricing Landscape

In the US, the average wholesale price (AWP) for Trulance stands at approximately USD 400–450 per month per patient, varying by pharmacy benefit manager (PBM) negotiations and insurance coverage. For comparison, linaclotide’s monthly cost is around USD 380–430 [3].

- Reimbursement and Patient Cost-Sharing: Patients often incur copayments between USD 40–70 monthly, contingent on insurance plans.

- Cost-Effectiveness: Trulance’s pricing aligns closely with comparators, positioning it as a competitive option where cost is an influential factor.

Forecasting Future Pricing Trends

Several factors influence future price trajectories:

- Market Competition: As Trulance gains market share, economies of scale could enable slight price reductions.

- Patent and Exclusivity Status: Patent protections extend until at least 2027, delaying generic entry, which would otherwise exert downward price pressure.

- Reimbursement Policies: Payers increasingly demand cost-effective treatments, pressuring pharmaceutical pricing strategies.

- Emerging Biosimilars or Me-Too Drugs: If competitors introduce similar GC-C agonists or novel modalities, Trulance’s premium positioning could diminish, leading to price erosion.

Based on these dynamics, it is conceivable that Trulance’s price per month could decrease by approximately 5-10% by 2025, especially in response to increased competition and payer negotiations. Conversely, the lack of generic competition until at least 2027 sustains a relatively stable pricing environment.

Long-Term Revenue Projections

Assuming the following:

- US Market Penetration: Reaching 25-30% of the CIC/IBS-C therapy market by 2025.

- Average Price: USD 420/month.

- Patient Base Growth: US chronic constipation patients estimated at 10 million, with 20-25% on pharmacotherapy.

Estimate:

- Number of Treated Patients: 2-2.5 million.

- Annual Revenue Potential: USD 10–12.6 billion (gross), scaled down considering real-world adherence, payer restrictions, and shifting market shares.

Thus, peak US revenues may reach USD 1–2 billion annually within the next 3-5 years.

Market Expansion and Demographic Considerations

Global Market Potential

Internationally, Trulance's approval extends to select countries, with substantial growth opportunities in Europe, Asia, and Latin America. Market entry depends on local regulatory approvals, reimbursement structures, and competitor presence.

Unmet Needs and Patient Segmentation

Target populations include:

- Patients intolerant of other laxatives or with refractory symptoms.

- Elderly patients requiring safer, more tolerable options.

- Patients with comorbidities for whom side-effect profiles are critical considerations.

Targeting these groups could sustain or boost demand, influencing both pricing strategies and market size.

Conclusion and Strategic Outlook

Summary of Market Dynamics and Price Projections

- Trulance operates in a competitive, expanding GI therapeutics market, with steady demand driven by increasing prevalence.

- Current pricing (~USD 400–450/month) remains in line with competitors, supported by patent protections until at least 2027.

- Market share growth, payer negotiations, and potential biosimilar threats will shape future pricing, potentially leading to modest declines.

- Long-term revenue prospects in the US could reach USD 1–2 billion annually, extrapolating rising adoption and demographic trends.

Key strategies include leveraging real-world evidence, demonstrating differential benefits, expanding geographical coverage, and actively engaging payers to optimize reimbursement pathways.

Key Takeaways

-

Market Potential: Trulance's niche positioning and expanding patient base support a robust growth trajectory, with significant revenue potential in the US and internationally.

-

Pricing Trends: Stable current pricing is expected until patent expiry, with possible slight decreases due to increased competition and payer pressures.

-

Competitive Edge: Differentiators such as safety profile, dosing convenience, and expanding indications will drive market adoption.

-

Growth Drivers: Increasing GI disorder prevalence, physician familiarity, and payer engagement are critical for future success.

-

Risks: Patent expiration, competitive biosimilars, and reimbursement challenges could impact pricing and market share.

FAQs

-

What is the current market size for Trulance?

The US prescription market for Trulance is estimated at approximately USD 300–500 million annually, with room for growth as penetration expands. -

How does Trulance compare price-wise with its main competitors?

Its monthly cost (~USD 400–450) is comparable to linaclotide, with slight variations based on insurance negotiations and pharmacy agreements. -

When are generic versions of Trulance likely to enter the market?

Patent protections are expected to last until at least 2027, delaying generic competition and maintaining current pricing levels. -

What factors could influence Trulance’s future pricing strategies?

Competition, patent expiry, payer negotiations, and market penetration rates are primary factors shaping future price adjustments. -

What is the global market outlook for Trulance?

International expansion offers significant growth potential, assuming successful regulatory approval and favorable reimbursement in targeted regions.

References

[1] ResearchAndMarkets, "Global Constipation Therapeutics Market," 2022.

[2] IQVIA, "2023 Prescription Analysis for Gastrointestinal Drugs," 2023.

[3] GoodRx, "Linaclotide and Lubiprostone Cost Comparisons," 2023.

More… ↓