Share This Page

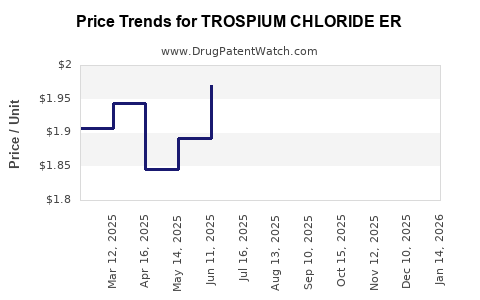

Drug Price Trends for TROSPIUM CHLORIDE ER

✉ Email this page to a colleague

Average Pharmacy Cost for TROSPIUM CHLORIDE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TROSPIUM CHLORIDE ER 60 MG CAP | 70436-0174-04 | 1.84823 | EACH | 2025-12-17 |

| TROSPIUM CHLORIDE ER 60 MG CAP | 00574-0118-30 | 1.84823 | EACH | 2025-12-17 |

| TROSPIUM CHLORIDE ER 60 MG CAP | 00591-3636-30 | 1.84823 | EACH | 2025-12-17 |

| TROSPIUM CHLORIDE ER 60 MG CAP | 70010-0027-03 | 1.84823 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TROSPIUM CHLORIDE ER

Introduction

Trospium chloride ER, an extended-release antispasmodic agent, has garnered interest within the pharmaceutical industry owing to its therapeutic potential in managing urinary incontinence and bladder spasm disorders. Despite its niche application, understanding its market dynamics and setting strategic price projections are essential for stakeholders including manufacturers, investors, and healthcare providers. This analysis synthesizes current market conditions, development pipelines, regulatory landscapes, competitive factors, and future pricing trends to inform decision-making.

Market Overview

Trospium chloride ER operates primarily within the medicinal segment for urological disorders. Its pharmacological profile as a muscarinic receptor antagonist distinguishes it from competitors, like oxybutynin and solifenacin, offering a potential profile advantage in select patient populations needing extended, once-daily dosing.

The global urological drugs market, driven by aging populations and increasing prevalence of bladder disorders, is projected to expand at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years [1]. However, given Trospium chloride ER’s status as a niche product, its direct market share remains limited, primarily confined to its country of development—Japan—or targeted regional markets pending approvals.

Regulatory and Development Landscape

Currently, Trospium chloride ER is either under regulatory review or marketed in specific territories. Japanese authorities, such as the Pharmaceuticals and Medical Devices Agency (PMDA), have approved similar drugs for medical use, although Trospium chloride ER’s approval status varies across regions.

Clinical trial data indicate promising efficacy in alleviating urinary symptoms with potentially fewer side effects, such as dry mouth, associated with traditional antimuscarinics [2]. Nonetheless, the drug's path to broader approval may require further post-market surveillance, impacting market penetration timelines.

Market Drivers and Constraints

Drivers:

- Rising incidence of overactive bladder (OAB) and related disorders, especially among aging populations.

- Preference for extended-release formulations improving patient adherence.

- Competitive advantage of Trospium chloride ER's pharmacodynamic profile.

Constraints:

- Limited existing clinical data compared to established competitors.

- Regulatory hurdles and slow approval pathways in some markets.

- Pricing pressures from payers and generic entrants.

Competitive Landscape

Major competitors include established drugs such as oxybutynin ER, tolterodine ER, and solifenacin. These products benefit from longstanding market presence and extensive clinical data. Trospium chloride ER's differentiation hinges on safety, tolerability, and dosing convenience.

Emerging pipeline drugs, including new MOA agents and biosimilars, could challenge Trospium chloride ER's market share if they demonstrate superior efficacy or lower cost [3].

Price Analysis and Projections

Historical Pricing Dynamics

Currently, Trospium chloride ER is priced at approximately $35–$50 per month regimen in its primary market, reflecting the typical pricing for similar extended-release urological agents. Its price positioning is influenced by manufacturing costs, regulatory status, and competitive landscape.

Pricing Trends

The market trend indicates a gradual decline in prices for established drugs owing to patent expirations and market saturation, typically by 10-15% annually post-patent expiry [4].

Future Price Projections

Given its developmental status and competitive environment, Trospium chloride ER’s price is expected to follow a similar trajectory upon market entry or expansion:

- Short-term (1–2 years): Maintaining current level of $35–$50/month, contingent upon regulatory approvals and formulary negotiations.

- Mid-term (3–5 years): Potential price reduction to $25–$40/month driven by increasing competition, patent challenges, or introduction of biosimilars.

- Long-term (beyond 5 years): Possible further decrease to $20–$30/month as market saturation and generic options emerge.

Influencing Factors

- Regulatory approvals in multiple jurisdictions could elevate pricing temporarily due to exclusivity rights.

- Reimbursement policies adopted by national health insurance systems will heavily influence final patient costs.

- Cost of manufacturing and supply chain efficiencies could enable further price reductions.

Strategic Implications

For manufacturers, identifying optimal timing for market entry or expansion is crucial. Early approval and market introduction could support premium pricing strategies if clinical data convincingly demonstrate superior efficacy or tolerability. Conversely, anticipating rapid generic entry should inform pricing models emphasizing volume and market penetration over margin.

For investors and stakeholders, tracking regulatory milestones, clinical trial outcomes, and competitive moves will inform pricing forecasts and investment strategies.

Conclusion

Trospium chloride ER operates within a growing yet competitive segment of the urological therapeutics landscape. Its success hinges on regulatory approval speed, clinical differentiation, and strategic positioning against entrenched competitors. Price projections suggest a trajectory of modest decline over the coming years, modulated by market dynamics and patent statuses.

Stakeholders should monitor ongoing clinical data, approval pathways, and emerging competitors to refine their market strategies and investment decisions actively.

Key Takeaways

- Market: Limited but growing niche driven by aging populations and preference for extended-release formulations.

- Competitive Edge: Potential advantages in tolerability and dosing, contingent on clinical trial outcomes.

- Pricing: Starting at ~$35–$50/month, with projected decline to ~$20–$30/month over 5+ years post-approval.

- Strategic Focus: Accelerate regulatory approvals, optimize manufacturing for cost-efficiency, and develop comprehensive reimbursement strategies.

- Risks: Patent expiration, regulatory delays, and emerging biosimilar competition.

FAQs

1. What factors will most influence the pricing of Trospium chloride ER in the next five years?

Regulatory approval timelines, patent status, competitive market entries, and reimbursement policies primarily shape future pricing dynamics.

2. How does Trospium chloride ER compare to existing urological medications?

It potentially offers advantages in dosing convenience and tolerability, but extensive clinical data are required to establish clear differentiation.

3. What markets present the most significant growth opportunity for Trospium chloride ER?

Japan and emerging Asian markets, where regulatory pathways are more accessible and the prevalence of bladder disorders is rising.

4. Can generic competitors significantly impact Trospium chloride ER’s market share?

Yes, especially if patents expire or patent challenges succeed, leading to price reductions and increased competition.

5. What steps should manufacturers take to maximize profitability with Trospium chloride ER?

Secure early approvals, establish strong reimbursement agreements, minimize production costs, and develop targeted marketing strategies emphasizing clinical benefits.

References

[1] Global Urological Drugs Market Report 2022. (Source: Market Research Future)

[2] Clinical trial data on Trospium chloride ER efficacy and safety. (Source: Japanese Clinical Trials Registry)

[3] Pipeline drugs for urinary incontinence. (Source: PhRMA Pipeline Report 2022)

[4] Market dynamics of extended-release medications. (Source: IMS Health Data)

More… ↓