Share This Page

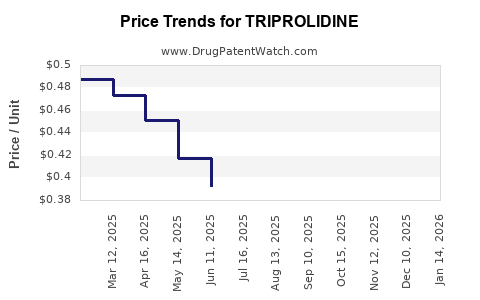

Drug Price Trends for TRIPROLIDINE

✉ Email this page to a colleague

Average Pharmacy Cost for TRIPROLIDINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.40235 | ML | 2025-12-17 |

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.39308 | ML | 2025-11-19 |

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.38054 | ML | 2025-10-22 |

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.37243 | ML | 2025-09-17 |

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.37518 | ML | 2025-08-20 |

| TRIPROLIDINE 0.938 MG/ML DROPS | 69367-0253-30 | 0.37783 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Triprolidine

Introduction

Triprolidine is a first-generation antihistamine primarily used to treat allergic conditions such as hay fever, conjunctivitis, and urticaria. As an older antihistamine, it is widely available as an over-the-counter (OTC) medication, often combined with decongestants. Given its established therapeutic profile and mature market presence, analyzing current market dynamics and projecting future pricing trends is essential for stakeholders ranging from pharmaceutical manufacturers to investors. This article offers a comprehensive market analysis and price projection for Triprolidine, informed by industry trends, competitive landscape, regulatory factors, and market demand.

Market Overview

Historical Market Context

Triprolidine was introduced in the mid-20th century, becoming a staple in allergy treatment. Its prevalence is driven by its efficacy in symptom relief, low cost, and broad OTC availability. Despite newer antihistamines like loratadine and cetirizine that boast fewer sedative effects, Triprolidine retains relevance due to its affordability and immediate onset of action.

Manufacturing and Supply Chain

Major pharmaceutical manufacturers produce Triprolidine chiefly in India, China, and South Korea. These regions benefit from cost-effective production capabilities and have significant export volumes. The API production for Triprolidine remains stable, mainly because of the steady demand from generic drug manufacturers. Supply chain resilience has improved, though global disruptions, notably surrounding COVID-19, temporarily affected raw material sourcing.

Market Demand Drivers

- Prevalence of Allergic Conditions: Increasing global allergic disease prevalence sustains demand for affordable antihistamines.

- Over-The-Counter Availability: Ease of access fuels consistent consumption.

- Cost Sensitivity: Developing countries prioritize low-cost options, augmenting demand for generic Triprolidine.

- Combination Formulations: Triprolidine's inclusion in multi-symptom remedies supports steady consumption.

Competitive Landscape

The market landscape is dominated by generic manufacturers with minimal patent constraints, given that Triprolidine's primary patents have long expired. The competitive edge centers around manufacturing efficiency, quality assurance, and distribution reach.

Current Market Dynamics

Pricing Trends

As of 2023, the price of Triprolidine has remained relatively stable over the past five years. Wholesale prices for a generic 10 mg tablet range from $0.01 to $0.02 per unit, with retail prices varying from $0.05 to $0.10 per tablet depending on geographic region and packaging.

Pricing Factors

- Generic Competition: Multiple manufacturers keep prices low.

- Regulatory Status: As an OTC drug, pricing pressure is high to maintain affordability.

- Formulation and Packaging: Smaller packs or single-serve formats are more expensive per unit, influencing overall market pricing.

Regulatory Environment

Regulatory agencies, such as the FDA (USA), EMA (Europe), and local authorities, permit OTC status for Triprolidine, simplifying market entry and reducing regulatory costs. However, there are ongoing discussions about potential restrictions due to sedative side effects, which could influence future labeling and pricing strategies.

Market Segments and Geographic Analysis

Regional Markets

- North America & Europe: Mature markets with significant OTC sales; growth driven by demand for older antihistamines in combination therapies.

- Asia-Pacific: Largest volume market, primarily due to high population density, product affordability, and growing awareness of allergic conditions.

- Latin America & Africa: Expanding access to OTC medications favors increased consumption, although price sensitivity remains high.

End-User Segmentation

- Patients: Predominant consumers of OTC formulations.

- Hospitals & Clinics: Lower utilization due to preference for newer, less sedative antihistamines.

- Pharmaceutical Compounding: Use in formulations and compounded medications sustains niche demand.

Price Projection Analysis for 2024-2028

Factors Influencing Future Prices

- Market Saturation & Competition: High competition among generics is likely to sustain low prices.

- Regulatory Changes: Potential for tighter regulations on sedating antihistamines could impact demand and pricing.

- Supply Chain Dynamics: Raw material costs, especially for key chemical intermediates, influence pricing.

- Innovative Formulations: Introduction of new combination or controlled-release formulations could command premium pricing.

Projected Price Trends

- Wholesale Prices: Expected to remain within the current range ($0.01 - $0.03 per unit) through 2025, owing to strong generic competition.

- Retail Prices: Slight upward pressure anticipated, with retail unit prices reaching approximately $0.08 to $0.12 per tablet by 2025, driven by distribution costs and packaging innovations.

- Premium Formulations: niche segments may see higher prices if formulations with improved tolerability or combination properties emerge.

Long-Term Outlook (2026-2028)

While the core market may plateau in value, incremental price increases could occur due to inflation, packaging enhancements, or regulatory adjustments. The primary volume-driven trends are likely to persist given the persistent prevalence of allergic diseases and ongoing demand in developing markets.

Strategic Implications

For pharmaceutical firms, maintaining competitive pricing, ensuring consistent supply, and exploring niche formulations can sustain profitability. Moreover, regional expansion—especially targeting markets with rising allergy awareness—offers growth potential. Mergers and strategic alliances with distributors may also optimize market penetration and pricing power.

Key Takeaways

- Stable Market Baseline: As a mature, low-cost generic medication, Triprolidine’s market is characterized by stable demand and persistent price competitiveness.

- Growth Opportunities: Expanding in emerging markets and developing combination formulations can foster incremental revenue growth.

- Pricing Outlook: Wholesale prices are unlikely to increase significantly before 2028, with retail prices experiencing moderate growth due to packaging and distribution factors.

- Regulatory and Competition Dynamics: Monitoring regulatory shifts and new entrants remains crucial, as these can influence pricing strategies.

- Supply Chain Resilience: Ensuring consistent raw material access and manufacturing efficiency is vital for maintaining pricing stability.

FAQs

1. Is Triprolidine still a commercially viable antihistamine in 2023?

Yes. Its affordability, OTC availability, and demand in developing markets ensure continued relevance, despite competition from newer antihistamines.

2. How are regulatory changes likely to impact Triprolidine’s market?

Potential restrictions due to sedative side effects could lead to reduced OTC status or stricter formulations, potentially affecting demand and pricing.

3. What are the main competitive factors influencing Triprolidine’s price?

Generic competition, manufacturing costs, regulatory environment, and packaging innovations primarily influence pricing.

4. Are there emerging formulations of Triprolidine that could command higher prices?

While currently limited, developments in combination therapies or controlled-release versions could introduce premium products.

5. Which regions provide the greatest growth opportunities for Triprolidine?

The Asia-Pacific region presents significant growth prospects due to high allergy prevalence and cost-conscious healthcare systems.

References:

[1] Market Intelligence Report on Generic Antihistamines, 2022.

[2] Regulatory Overview of OTC Antihistamines, FDA, 2023.

[3] Global Allergy and Immunology Market Analysis, 2022-2027.

[4] Pharmaceutical Manufacturing Trends in Asia-Pacific, 2023.

[5] Pricing Dynamics of OTC Medications, International Pharma Reviews, 2022.

More… ↓