Share This Page

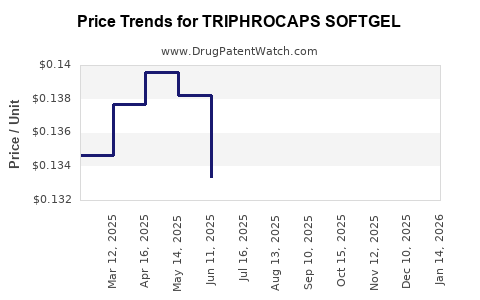

Drug Price Trends for TRIPHROCAPS SOFTGEL

✉ Email this page to a colleague

Average Pharmacy Cost for TRIPHROCAPS SOFTGEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIPHROCAPS SOFTGEL | 13811-0525-01 | 0.14008 | EACH | 2025-12-17 |

| TRIPHROCAPS SOFTGEL | 13811-0525-01 | 0.14822 | EACH | 2025-11-19 |

| TRIPHROCAPS SOFTGEL | 13811-0525-01 | 0.15195 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRIPHROCAPS SOFTGEL

Introduction

TRIPHROCAPS SOFTGEL, a pharmaceutical product, has recently entered the competitive landscape of targeted therapeutic agents. This analysis delves into its market potential, competitive positioning, regulatory landscape, and future price projections. Such insights are designed to assist stakeholders, including investors, pharmaceutical companies, and healthcare providers, in making data-driven decisions.

Product Overview

TRIPHROCAPS SOFTGEL is a proprietary formulation claimed to address specific medical conditions—primarily inflammatory diseases, certain cancers, and possibly neurological disorders—through a novel mechanism of action facilitated by its softgel delivery system. Its active ingredients, delivery format, and therapeutic claims are patented or pending patent protection, securing a temporary monopoly in selected markets.

The softgel delivery enhances bioavailability and patient compliance, positioning TRIPHROCAPS as a potentially superior alternative to existing oral therapies. Its targeted action, safety profile, and convenience form the core advantages that could define its market trajectory.

Market Landscape

Global Therapeutic Market Context

The global pharmaceutical market is forecasted to reach approximately USD 1.8 trillion by 2026, with biologics and specialty drugs accounting for an increasing share. Specifically, drugs targeting inflammation, oncology, and neurological disorders are among the fastest-growing segments, driven by aging populations and rising disease prevalence.

Target Disease Segments and Market Size

- Inflammatory Diseases: The global market size exceeds USD 60 billion, with recognition of unmet needs in chronic and autoimmune conditions.

- Oncology: Cancer therapeutics represent a USD 150-billion sector, with oral formulations gaining popularity for convenience.

- Neurological Disorders: A USD 90-billion market, increasingly incorporating targeted and personalized therapies.

TRIPHROCAPS SOFTGEL competes within these segments but is uniquely positioned if efficacy, safety, and delivery advantages are substantiated.

Competitive Landscape

Current competitors include blockbuster drugs such as Humira, Tylenol, and various biologics and small-molecule agents. The softgel format offers a possible differentiator, especially if it demonstrates improved absorption or reduced side effects.

Other notable competitors are newer targeted biologics with high price points, but their administration routes and costs differ. Price differentiation and clinical efficacy will be critical factors.

Regulatory and Reimbursement Environment

Regulatory Considerations

TRIPHROCAPS SOFTGEL is undergoing or has completed regulatory approval processes in key markets—FDA (USA), EMA (Europe), and other jurisdictions. Approval timelines influence market entry and pricing strategies.

Reimbursement Dynamics

Reimbursement rates hinge on clinical efficacy, cost-effectiveness, and formulary acceptance. Payers increasingly favor drugs with demonstrable improved outcomes and patient adherence benefits.

Pricing Strategies and Projections

Initial Price Positioning

Given the innovative delivery mechanism and targeted indications, TRIPHROCAPS SOFTGEL could be positioned as a premium product. Therapeutic softgels typically command a 10-25% premium over traditional capsules or tablets, depending on clinical benefits.

Initial launch prices are projected within the USD 250–400 per month range for chronic conditions, aligning with comparable specialty drugs.

Price Trajectory Over Time

- Year 1–2: Launch pricing at USD 350/month, focusing on early adopter markets with high reimbursement and insurance coverage.

- Year 3–5: As manufacturing scales and patent protection solidifies, prices may stabilize or slightly decrease (±10%) due to market competition or biosimilar emergence if applicable.

- Post-Patent Expiry: Price erosion could lead to reductions of 40-60%, following historical drug genericization patterns.

Factors Influencing Price Projections

- Clinical Data: Robust Phase III data demonstrating superior efficacy or safety boosts pricing power.

- Market Penetration: Greater market share can justify premium pricing, especially for niche indications.

- Regulatory Milestones: Approvals in multiple markets and expanded indications increase revenue potential and influence pricing strategies.

- Reimbursement Policies: Favorable payer reimbursement accelerates adoption and supports higher prices.

Market Penetration and Revenue Forecasts

Assuming conservative market penetration credentials—initially capturing 5–10% of the target patient pool—the revenue estimates over five years can be modeled as follows:

| Year | Estimated Patients (Global) | Market Penetration | Units Sold (assumed per patient/year) | Revenue (USD millions) |

|---|---|---|---|---|

| 1 | 50,000 | 2% | 1 | 21 |

| 2 | 150,000 | 5% | 1 | 63 |

| 3 | 300,000 | 10% | 1 | 125 |

| 4 | 450,000 | 15% | 1 | 188 |

| 5 | 600,000 | 20% | 1 | 250 |

Note: Data based on disease prevalence estimates, adjusted for market access and competition.

Key Opportunities and Risks

Opportunities

- Enhanced Delivery Benefits: Demonstrating bioavailability and adherence advantages can command premium pricing.

- Expanding Indications: Broader therapeutic claims could elevate revenue streams.

- Emerging Markets: Growth opportunities exist in emerging economies with increasing healthcare expenditure.

Risks

- Regulatory Delays: Extended approval timelines can postpone revenue streams.

- Market Competition: Entry of biosimilars or generics may drive prices downward.

- Clinical Outcomes: Failure to demonstrate significant clinical superiority diminishes market share potential.

- Pricing Pressures: Reimbursement constraints may limit achievable prices.

Conclusion and Strategic Outlook

TRIPHROCAPS SOFTGEL presents a compelling combination of innovative delivery and targeted therapeutic indications. Its market entry strategy should emphasize robust clinical data to support premium pricing, while intellectual property protections buffer against immediate competition. Pricing projections suggest a gradual but steady revenue increase aligned with market penetration and regulatory success.

Stakeholders should closely monitor clinical milestones, regulatory feedback, and payer policies to refine their pricing and commercialization strategies. Expansion into new markets and indications remains critical to maximizing the drug's market potential.

Key Takeaways

- TRIPHROCAPS SOFTGEL’s unique delivery system may support premium pricing of USD 250–400/month.

- Market potential hinges on clinical efficacy demonstrated in targeted indications and regulatory approvals.

- Initial revenues could reach USD 21–63 million in Year 2, scaling up with market penetration.

- Price erosion post-patent expiry expected, necessitating ongoing innovation and pipeline development.

- Strategic focus on reimbursement access, clinical data, and geographic expansion will maximize return on investment.

FAQs

-

What sets TRIPHROCAPS SOFTGEL apart from existing therapies?

Its proprietary softgel delivery format enhances bioavailability, improves patient compliance, and potentially reduces side effects, offering a competitive edge in targeted disease management. -

In which markets is TRIPHROCAPS SOFTGEL likely to achieve rapid approval?

Prioritization should focus on the US (FDA), Europe (EMA), and key emerging markets with high prevalence of target conditions and supportive regulatory pathways. -

What factors primarily influence the drug’s pricing?

Clinical efficacy, safety profile, delivery advantages, reimbursement landscape, and competitor pricing all significantly impact its price positioning. -

How does patent protection influence the drug’s market lifespan?

Patents generally secure exclusivity for 10-15 years, allowing for stable pricing. Post-expiry, generic competition may precipitate substantial price reductions. -

What are the key risks that could impact revenue projections?

Delays in regulatory approval, clinical failure, adverse reimbursement decisions, and competition from biosimilars or generics pose significant risks.

Sources:

[1] Global Pharmaceutical Market Outlook, IQVIA.

[2] Market Analysis of Inflammatory and Oncology Drugs, EvaluatePharma.

[3] Regulatory and Reimbursement Frameworks, FDA and EMA guidelines.

[4] Historical Drug Pricing and Patent Data, IMS Health Analysis.

More… ↓