Share This Page

Drug Price Trends for TRIMETHOBENZAMIDE

✉ Email this page to a colleague

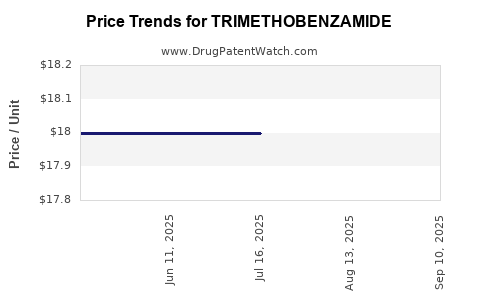

Average Pharmacy Cost for TRIMETHOBENZAMIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIMETHOBENZAMIDE 300 MG CAP | 62135-0773-30 | 17.99967 | EACH | 2025-09-17 |

| TRIMETHOBENZAMIDE 300 MG CAP | 62135-0773-30 | 17.99967 | EACH | 2025-08-20 |

| TRIMETHOBENZAMIDE 300 MG CAP | 62135-0773-30 | 17.99967 | EACH | 2025-07-23 |

| TRIMETHOBENZAMIDE 300 MG CAP | 62135-0773-30 | 17.99967 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Trimethobenzamide

Introduction

Trimethobenzamide, a medication primarily used to treat nausea and vomiting, has experienced varying demand and market dynamics over recent years. This analysis examines its current market landscape, key drivers, competitive environment, manufacturing considerations, and future price projections. Given the evolving pharmaceutical regulatory environment and patent landscape, understanding these facets is essential for stakeholders assessing investment, licensing, or commercial strategies related to trimethobenzamide.

Overview of Trimethobenzamide

Trimethobenzamide is an antiemetic belonging to the benzamide class, functioning as a dopamine D2 receptor antagonist (by blocking dopamine receptors in the chemoreceptor trigger zone). Approved and marketed primarily in the United States and Europe, it addresses nausea associated with various conditions and treatments, including postoperative recovery and chemotherapy.

Historically, trimethobenzamide faced declining usage as newer, better-tolerated antiemetics gained prominence. Nonetheless, it maintains niche applications, especially where alternatives are contraindicated or unavailable.

Market Landscape Analysis

1. Demographic and Therapeutic Demand Dynamics

-

Global Disease Burden: Nausea and vomiting are common symptoms in diverse clinical settings—postoperative, oncology, gastroenterology—ensuring a steady demand profile. However, the therapeutic landscape is shifting toward 5-HT3 receptor antagonists (e.g., ondansetron) and neurokinin-1 receptor antagonists, which are often preferred due to superior safety profiles.

-

Regional Variations: In North America and Europe, prescription trends have gradually moved away from trimethobenzamide due to safety concerns and the availability of novel agents. Conversely, in emerging markets, its affordability and familiarity sustain regional demand.

2. Regulatory Environment and Market Access

-

FDA and EMA Approvals: While trimethobenzamide remains approved in some jurisdictions, regulatory agencies in the US have issued warnings over adverse effects, leading to reduced prescribing.

-

Off-Label and Niche Uses: Some off-label applications and compounded formulations sustain alternative markets, especially where access to newer drugs is limited or cost-prohibitive.

3. Competitive Landscape

-

Main Competitors: The antiemetic market is dominated by on-demand drugs such as ondansetron, granisetron, and aprepitant. These enjoy broader acceptance due to efficacy and safety.

-

Market Share: Trimethobenzamide's market share is diminishing in mainstream healthcare, primarily restricted to specific regions and patient subsets.

Manufacturing and Supply Chain Considerations

1. Production Status

-

Generic Manufacturing: Several generic manufacturers produce trimethobenzamide, leveraging existing APIs and formulations. This commoditized landscape tends to exert downward pressure on prices.

-

Supply Chain Stability: Disruptions in active pharmaceutical ingredient (API) supply or manufacturing consolidation may lead to supply constraints, influencing pricing.

2. Regulatory Compliance and Quality Standards

- Strict adherence to Good Manufacturing Practices (GMP) is essential, especially in markets with tight regulatory control, impacting production costs but also offering opportunities to position as a high-quality product.

Price Trends and Future Projections

1. Current Pricing Landscape

-

Brand vs. Generics: Since trimethobenzamide is largely off-patent, current market prices are predominantly driven by generic competition. Wholesale prices in the US have historically ranged from approximately $0.15 to $0.50 per tablet, reflecting low per-unit costs typical for off-patent drugs.

-

Pricing Factors: Demand elasticity, regional regulations, manufacturing costs, and supply chain stability influence actual transaction prices.

2. Price Projections (2023-2030)

-

Short-term Outlook (Next 2 Years): Market prices are expected to remain relatively stable amid consistent generic competition. Slight fluctuations may occur due to supply chain dynamics or regulatory developments.

-

Medium to Long-term Outlook (3-7 Years): As newer antiemetics dominate and safety concerns about trimethobenzamide persist, demand could decline further. This downward pressure may result in additional price erosion of 10-20% annually, barring any regulatory or therapeutic resurgence.

-

Potential Resurgence Scenarios: If regulatory agencies approve novel formulations or label extensions, or if shortages of alternative drugs occur, prices could stabilize or even increase temporarily. Conversely, safety-related bans or withdrawals could eliminate markets, collapsing prices to near zero.

3. Impact of Emerging Markets

Emerging markets, with less stringent regulatory environments and cost-sensitive healthcare systems, may sustain slightly higher prices or demand intensity through local generics, with prices possibly in the $0.10–$0.30 per tablet range.

Regulatory and Market Access Outlook

Regulatory agencies’ evolving stance and rising safety concerns may result in restricted markets, particularly in high-income regions. Such shifts could lead to market contraction, further pressuring prices downward. Conversely, for compounded or specialized formulations in niche markets, premium pricing may persist.

Strategic Recommendations

-

For Manufacturers and Investors: Focus on niche markets or formulations where safety profiles are acceptable, or on regions with moderate regulatory restrictions.

-

For Distributors: Monitor regulatory updates vigilantly to anticipate market entries or exits, adjusting inventory and pricing strategies accordingly.

-

For R&D Entities: Invest in development of safer, more effective antiemetics to replace trimethobenzamide, as demand in the existing market diminishes.

Key Takeaways

-

Declining Mainstream Demand: The use of trimethobenzamide is steadily decreasing due to safety concerns and competition, limiting growth prospects.

-

Price Expectations: In the short term, prices are stable but marginally declining; long-term projections suggest additional erosion driven by generic competition and market contraction.

-

Regional Variability: Prices remain relatively higher in emerging markets but are susceptible to regulatory and supply chain risks.

-

Market Drivers: Safety profile, regulatory stance, regional healthcare policies, and availability of substitutes are primary influence factors.

-

Niche Opportunities: Focus on formulations, specialized markets, or regions where demand persists, ensuring value retention amid overall decline.

FAQs

Q1: Is trimethobenzamide still widely prescribed globally?

No. Its prescription has declined notably in Western markets owing to safety concerns and competition from newer agents. In some regions with limited access to newer drugs, it remains in limited use.

Q2: What factors could reverse the downward price trend for trimethobenzamide?

Regulatory approvals for new formulations, shortage of alternative antiemetics, or expanded approved indications could temporarily stabilize or increase prices.

Q3: How does safety concerns impact the market value of trimethobenzamide?

Adverse effects have led regulatory warnings and restrictions, decreasing demand and suppressing prices in high-income markets.

Q4: Are there any recent innovations related to trimethobenzamide?

Currently, no significant innovations or new formulations have been introduced, limiting growth opportunities.

Q5: What are the key regions to watch for future market activity?

Emerging markets where demand persists due to affordability and less regulatory stringency, and regions where regulatory agencies revisit safety profiles.

References

[1] U.S. Food and Drug Administration (FDA). Safety communications regarding trimethobenzamide.

[2] IMS Health. Global Markets Data on Anti-emetics. 2022.

[3] European Medicines Agency (EMA). Review reports on older antiemetics and safety updates.

[4] Pharmaceutical Market Reports. Trends in generic antiemetics, 2023.

[5] Global Data. Future projections for antiemetic markets and pricing trends.

More… ↓