Share This Page

Drug Price Trends for TRILEPTAL

✉ Email this page to a colleague

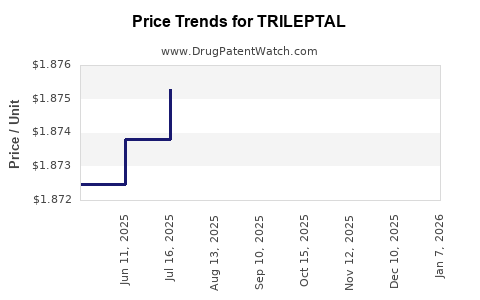

Average Pharmacy Cost for TRILEPTAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRILEPTAL 600 MG TABLET | 00078-0457-05 | 18.73173 | EACH | 2025-12-17 |

| TRILEPTAL 150 MG TABLET | 00078-0456-05 | 5.55497 | EACH | 2025-12-17 |

| TRILEPTAL 300 MG/5 ML SUSP | 00078-0357-52 | 1.87822 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRILEPTAL (Oxcarbazepine)

Introduction

TRILEPTAL, the brand name for oxcarbazepine, is an antiepileptic medication widely prescribed for the management of partial seizures and bipolar disorder. As a third-generation antiepileptic drug (AED), TRILEPTAL has differentiated itself through enhanced tolerability and fewer drug-drug interactions compared to traditional options such as carbamazepine. An understanding of the current market landscape and future pricing trajectories for TRILEPTAL is critical for stakeholders—including pharmaceutical companies, investors, healthcare providers, and policymakers seeking to optimize strategic planning and competitive positioning.

Market Overview

Global Market Size

The global antiepileptic drugs (AEDs) market was valued at approximately USD 4.4 billion in 2021 and is projected to expand with a compound annual growth rate (CAGR) of about 4-6% through 2028 [1]. TRILEPTAL contributes a significant share within this landscape, buoyed by its proffered safety profile and expanded indications.

Market Drivers

- Increasing Epilepsy Prevalence: The WHO estimates over 50 million people worldwide suffer from epilepsy, underscoring steady demand for effective management options [2].

- Rising Bipolar Disorder Diagnoses: TRILEPTAL's FDA approval for bipolar disorder further broadens its application, driven by the rising recognition of mood disorders globally.

- Shift Toward Safer, Tolerable AEDs: With adverse drug reactions hampering older therapies, prescribers increasingly favor drugs like TRILEPTAL with better tolerability.

Market Segmentation

- By Region: North America accounts for the largest market share, driven by healthcare infrastructure and high diagnosis rates. Europe follows, with Asia-Pacific showing rapid growth due to expanding healthcare access and generational epidemiologic shifts.

- By Application: Partial seizures dominate prescription volume, but off-label and new indications, such as bipolar disorder, contribute significantly to sales.

Competitive Dynamics

TRILEPTAL faces competition from several key formulations:

- Brivaracetam (BRIVITY) and levetiracetam (Keppra): These newer AEDs offer alternative mechanisms and are often preferred for specific patient profiles.

- Generic Oxcarbazepine: Existing patents for TRILEPTAL expired in many regions, leading to the advent of generics that have substantially eroded the brand’s market share but still face preference barriers in certain healthcare systems.

- Other Branded PDEs: Including carbamazepine (Tegretol), lamotrigine (Lamictal), and newer agents like eslicarbazepine.

The competitive landscape accentuates pricing pressures, especially from generics, prompting manufacturers to deploy strategic pricing and marketing to maintain margins.

Pricing Dynamics

Current Pricing Landscape

- Brand vs. Generic: The cost of branded TRILEPTAL is approximately 3-4 times higher than generic oxcarbazepine in the U.S., with prices varying from USD 300-500 for a 30-day supply (oral tablets), depending on dosage and pharmacy discounts.

- Reimbursement Trends: Insurance coverage and formularies influence actual patient out-of-pocket costs. In regions with restrictive formularies or high copayments, generic substitution is prevalent.

- Geographical Variance: Prices tend to be higher in North America and parts of Europe, with Asian markets offering lower-cost alternatives due to lower healthcare expenditure.

Factors Impacting Price Trends

- Patent Expiry and Generic Competition: Patent lifespans for TRILEPTAL expired in the U.S. around 2018. Increased availability of generics has led to downward pressure on prices.

- Pricing Reforms and Policy: Governments and insurers’ policies aiming to contain costs influence retail and wholesale pricing structures.

- Manufacturing and Supply Chain Costs: Fluctuations in raw materials and manufacturing dynamics can temporarily impact drug pricing.

- Market Penetration and Prescribing Trends: Shifts toward newer AEDs may diminish TRILEPTAL’s market share, prompting strategic price adjustments to sustain revenue.

Price Projection Analysis (2023-2030)

Near-Term Outlook (2023-2025)

- Continued Price Erosion: With the accelerating proliferation of generic versions, the average price of TRILEPTAL is likely to decrease by an estimated 10-15% annually in mature markets.

- Market Penetration Stabilization: As generic markets saturate, reductions tend to plateau, with prices stabilizing at low margins.

- Reimbursement Adjustments: Payer negotiations and formulary management will continue to suppress list prices, especially in cost-sensitive regions.

Mid to Long-Term Outlook (2026-2030)

- Market Maturity: Generics will dominate, often driving TRILEPTAL’s prices closer to production costs.

- Potential Price Rebounds: Introduction of improved formulations or biosimilars may catalyze price competition, alongside negotiated discounts and value-based pricing constructs.

- Impact of New Indications & Innovations: Any novel delivery mechanisms or new indications (e.g., expanded bipolar disorder management) could support premium pricing temporarily.

- Emerging Markets: Rapid growth in Asia-Pacific and Latin America might see a different pricing trajectory, with a focus on affordability and volume sales consolidating market presence.

Overall, the global price of TRILEPTAL branded formulations is expected to decline modestly until 2025, followed by stabilization at significantly lower levels, barring disruptive innovations or regulatory changes.

Market Opportunities and Challenges

-

Opportunities:

- Expansion into emerging markets with affordable formulations.

- Development of fixed-dose combinations and novel delivery forms to differentiate offerings.

- Leveraging biopharmaceutical innovations to extend patent protections or develop more tolerable analogs.

-

Challenges:

- Price erosion due to generic entries.

- Competition from newer AEDs with marketed advantages.

- Regulatory and reimbursement hurdles in emerging jurisdictions.

Key Takeaways

- The global TRILEPTAL market is driven by rising epilepsy and bipolar disorder prevalence, with substantial growth potential in emerging markets.

- Generic competition has led to significant price pressure, causing continued downward trends in retail and wholesale prices.

- Near-term projections anticipate a 10-15% annual decline in branded drug prices, stabilizing at low levels by 2025.

- Price resilience depends on innovations, regional market conditions, and evolving therapeutic landscapes—particularly in regions with limited generic penetration.

- Strategic investments should focus on expanding indications, optimizing supply chains, and differentiating product offerings in competitive markets.

5 Unique FAQs

1. How has patent expiration affected TRILEPTAL's pricing and market share?

Patent expiry in many regions around 2018 facilitated the entry of generics, drastically reducing TRILEPTAL’s list prices and capturing a larger share of the market. This shift increased affordability but pressured the profitability of the branded formulation.

2. What factors might influence the price trajectory of TRILEPTAL over the next decade?

Key factors include patent status, availability of biosimilars or generics, regional healthcare policies, adoption of alternative therapies, and innovation in formulations or indications.

3. Are there any emerging markets where TRILEPTAL's price remains stable or increasing?

In regions with limited generic penetration or where healthcare systems prioritize branded medications for quality assurance (e.g., some Middle Eastern or Southeast Asian countries), prices may remain relatively stable or decline at a slower rate.

4. How do biosimilars or newer AEDs impact TRILEPTAL's market viability?

The advent of biosimilars for its key competitors and newer AEDs with advanced mechanisms could erode TRILEPTAL’s market share, compelling price adjustments and strategic repositioning.

5. What strategies can pharmaceutical companies adopt to mitigate pricing pressures?

Companies can pursue differentiation through extended indications, develop combination therapies, focus on patent extensions or exclusivity rights, and optimize market access through price negotiations and value-based contracts.

Sources

[1] Market Research Future, “Global Antiepileptic Drugs Market,” 2022.

[2] World Health Organization, “Epilepsy Fact Sheet,” 2021.

More… ↓