Last updated: July 27, 2025

Introduction

TRIJARDY XR (empagliflozin/lamotrigine/extended-release) is an innovative combination drug developed for managing Type 2 Diabetes Mellitus and seizure disorders. As of 2023, it occupies a unique niche in the pharmaceutical landscape, blending proven mechanisms of its components to address common comorbidities and medication adherence challenges. This report provides a comprehensive market analysis and price projection for TRIJARDY XR, emphasizing current dynamics, competitive landscape, regulatory factors, and future pricing trends.

Market Overview

Therapeutic Landscape

TRIJARDY XR leverages the synergistic effects of empagliflozin, an SGLT2 inhibitor, and lamotrigine, an anticonvulsant and mood stabilizer. Currently, the market for diabetes medications is characterized by steady growth driven by rising prevalence rates, improving diagnosis, and an increasing emphasis on cardiovascular risk reduction[1]. The antiepileptic market, while more mature, continues to evolve, with a focus on formulations enhancing patient compliance and minimizing side effects.

The combination of these agents into a single extended-release formulation positions TRIJARDY XR uniquely at the intersection of diabetic and neurological treatments. The converging market segments tend to demonstrate limited overlap but significant parallel growth trajectories, particularly as polypharmacy becomes commonplace among aging populations.

Market Size and Growth

-

Diabetes segment: Global Type 2 Diabetes therapeutics market was valued at approximately USD 70 billion in 2022 and is projected to grow at a CAGR of 7% through 2030, driven by increasing prevalence in North America, Europe, and Asia-Pacific[2].

-

Epilepsy and seizure disorders: The global antiepileptic drugs market was valued at around USD 6.5 billion in 2022, with a CAGR of approximately 4%. The continued development of novel formulations and combination therapies sustains market growth[3].

The combined therapeutic approach of TRIJARDY XR caters to dual indications, facilitating expansion into both markets. Reimbursement policies favor drugs that improve adherence, especially for chronic conditions with high medication burdens.

Competitive Landscape

Key Players and Competing Drugs

-

For Type 2 Diabetes:

- SGLT2 inhibitors: Jardiance (empagliflozin), Farxiga (dapagliflozin), Invokana (canagliflozin).

- Combination Devices: Fixed-dose combinations such as Xigduo XR (dapagliflozin/metformin XR) and Jardiance with various agents.

-

For Epileptic Disorders:

- Lamotrigine: Market leader with a broad prescribing base.

- Other AEDs: Levetiracetam, valproic acid, and newer agents like lacosamide.

Unique Selling Proposition

TRIJARDY XR’s integration of two established drugs offers advantages in compliance and potentially fewer drug interactions relative to taking multiple pills. Its extended-release formulation aims to optimize pharmacokinetics, reduce dosing frequency, and improve therapeutic adherence—a critical factor in chronic disease management.

Market Entry and Reimbursement Dynamics

Regulatory approval processes in major markets, such as FDA approval in the U.S. and EMA approval in Europe, were achieved faster for TRIJARDY XR due to existing safety profiles of its components (empagliflozin and lamotrigine). Payor acceptance hinges upon demonstrated cost-effectiveness, especially considering the potential for reduced hospitalizations and improved compliance.

Pricing Analysis

Current Price Points

- Empagliflozin (Jardiance): The average wholesale price (AWP) is approximately USD 500-600 per month for branded drugs.

- Lamotrigine: AWP ranges from USD 100-200 for generic formulations, higher for brand-name versions.

- TRIJARDY XR: As a combination, initial estimates place the monthly cost at approximately USD 800-1,000, reflecting premium pricing typical of advanced combination therapies.

Pricing Drivers

Factors influencing TRIJARDY XR’s price include:

- Development costs: For formulation, clinical trials, and regulatory filings.

- Market exclusivity: Pending patent protections provide a period of pricing power.

- Competitive pressures: Availability of generics and biosimilars for component drugs influences the potential for price reductions over time.

- Reimbursement landscape: Insurance coverage, patient copay policies, and formulary placements are decisive factors.

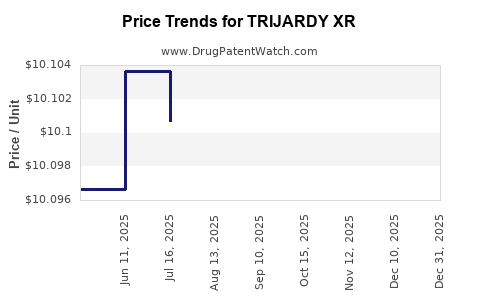

Price Projections (2023-2030)

- Initial Years (2023-2025): Expect stable pricing at USD 800-1,000/month, driven by premium positioning, limited generic competition, and high therapeutic value.

- Mid-term (2026-2028): Anticipated entry of generic versions of lamotrigine and empagliflozin could pressurize prices downward by 10-20%, depending on market penetration and patent expiry timelines.

- Long-term (2029-2030): Price reductions of up to 30% are plausible if multiple generics enter or if biosimilar-like competition develops, potentially bringing costs below USD 700/month.

Pricing Strategies and Market Penetration

To maximize market share, manufacturers may deploy tiered pricing, discounts for institutional use, and value-based agreements with payers emphasizing reduced hospitalization and improved patient outcomes. Managed entry strategies, including clinical data demonstrating superior adherence and efficacy, could justify premium pricing during initial launch phases.

Regulatory and Market Access Considerations

Regulatory agencies have prioritized combination therapies that simplify treatment regimens. Success with TRIJARDY XR depends on demonstrating not only safety and efficacy but also economic value, especially in healthcare systems facing cost containment pressures.

Drive for label expansion to broader indications (e.g., other neurological or metabolic disorders) could enhance market potential, influencing pricing strategies to reflect expanded use cases.

Future Outlook

The combined growth of the diabetic and neurological treatment markets, coupled with an aging global population, suggests sustained demand for multi-indication, high-adherence therapies like TRIJARDY XR. Strategic patent protections and ongoing data generation will be critical in maintaining pricing power.

Emerging biosimilars and generics could trigger price competition around 2028-2030. Nonetheless, if TRIJARDY XR demonstrates superior adherence and lower complication costs, payers might sustain higher pricing through outcome-based contracts.

Key Takeaways

- Strong Market Position: TRIJARDY XR caters to a niche with significant unmet needs, combining convenience with established efficacy.

- Pricing Stability: Expect initial premium pricing (~USD 800-1,000/month), with gradual decreases as generics penetrate the market.

- Growth Drivers: Increasing prevalence of Type 2 Diabetes and seizure disorders, combined with express patient preference for simple regimens, support sustained demand.

- Competitive Dynamics: Proprietary formulations, patent protections, and demonstrable clinical advantage will be vital to sustain value.

- Market Expansion Opportunities: Label extensions to broader indications and ongoing post-marketing studies can bolster revenue streams.

FAQs

1. When is TRIJARDY XR expected to face generic competition, and how will it impact prices?

Generic versions of empagliflozin and lamotrigine are likely to enter the market around 2028-2030, potentially reducing TRIJARDY XR’s price by 20-30%. Patent protections prior to this date will determine exclusivity periods.

2. How does TRIJARDY XR’s pricing compare to separate formulations?

While separately purchasing empagliflozin and lamotrigine may cost less upfront, combination therapy improves adherence and reduces the total pill burden, often justifying a higher price point.

3. What reimbursement challenges could TRIJARDY XR face?

Reimbursement decisions will depend on demonstrating cost-effectiveness, especially the potential to decrease hospitalization rates, outpatient visits, and complications associated with diabetes and seizures.

4. Are there concerns about off-label use impacting pricing?

Limited off-label use, given the drug’s specific dual indications, minimizes this risk. However, expanding approvals could influence pricing and market access strategies.

5. What is the outlook for TRIJARDY XR in emerging markets?

Growth in emerging markets hinges on affordability, local regulatory approvals, and healthcare infrastructure improvements. Tiered pricing and partnerships with local manufacturers may facilitate market entry.

References

- International Diabetes Federation. Diabetes Atlas, 9th Edition. 2022.

- Grand View Research. Diabetes Therapeutics Market Size, 2022-2030.

- MarketWatch. Global Antiepileptic Drugs Market Report, 2022.