Last updated: July 28, 2025

Introduction

Trihexylphenidyl (THP), a central anticholinergic agent primarily prescribed for managing Parkinson’s disease and certain extrapyramidal symptoms, occupies a niche yet significant position within the neuropharmacology landscape. As a derivative of phenidyl, THP inhibits acetylcholine’s parasympathetic activity in the central nervous system, alleviating drug-induced movement disorders. This analysis explores the current market dynamics, competitive landscape, regulatory factors, manufacturing considerations, and future pricing trends influencing Trihexylphenidyl.

Market Overview

Global Demand and Therapeutic Use

The global Parkinson’s disease therapeutics market was valued at approximately $3.05 billion in 2022 and is projected to reach $7.34 billion by 2030, growing at a compound annual growth rate (CAGR) of 11.4%.[1] Although levodopa remains the dominant treatment, the use of anticholinergic agents like Trihexylphenidyl persists, especially for early-stage or adjunct therapy, due to its ability to counteract tremor and rigidity.

In regions such as North America and Europe, the utilization of Trihexylphenidyl is more pronounced owing to established healthcare infrastructure and higher prevalence of Parkinsonian disorders. Conversely, in emerging markets, increased diagnosis rates and expanding healthcare access contribute to rising demand.

Market Penetration and Usage Trends

Despite its longstanding use, THP’s market share is limited by side effect profiles—such as dry mouth, blurred vision, and cognitive impairment—that restrict long-term utilization. The emergence of newer agents, including dopamine agonists and MAO-B inhibitors, gradually diminishes reliance on traditional anticholinergics. Nonetheless, THP's role persists in specific cases, especially where contraindications to alternative therapies exist.

Current Suppliers and Patent Status

Trihexylphenidyl is predominantly available as a generic compound, with no recent patent restrictions. This facilitates broad manufacturing and supply but introduces pricing competition. Key suppliers include generic manufacturers in India, China, and Europe, with limited branded versions primarily used for research or in specific regions.

Competitive Landscape and Market Drivers

Market Drivers

- Aging Population: Increasing prevalence of Parkinson’s disease among the elderly populations amplifies distributed demand.

- Healthcare Accessibility: Improving healthcare systems in emerging economies correlate with heightened diagnosis and treatment rates.

- Adjunct Application: Usage in managing drug-induced extrapyramidal symptoms sustains its clinical relevance.

Market Challenges

- Side Effect Profile: Cognitive adverse effects constrain widespread, long-term application.

- Availability of Alternatives: The advent of newer, more tolerable therapies reduces the reliance on THP.

- Regulatory Variability: Divergent approval status and formulary listings across markets influence demand patterns.

Manufacturing and Cost Factors

Production Cost Dynamics

As a generic compound, Trihexylphenidyl manufacturing hinges on raw material costs, process efficiency, and regulatory compliance. Active Pharmaceutical Ingredient (API) synthesis involves multiple steps, demanding high purity standards to meet pharmacopeia requirements.

Regulatory Environment

Stringent Good Manufacturing Practice (GMP) standards enforce quality, influencing production costs. Regulatory approvals are relatively straightforward for existing compounds, but changing standards in different jurisdictions impact the expense structure.

Price Trends and Projections

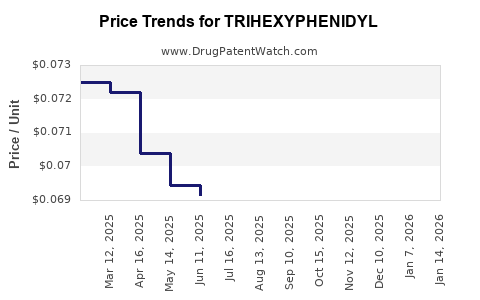

Current Pricing Landscape

In developed markets, the average retail price of Trihexylphenidyl ranges approximately from $0.10 to $0.50 per tablet (dosage-dependent). Bulk wholesale prices for APIs typically hover around $50 to $150 per kilogram, depending on purity and sourcing (industry estimates). Variability arises due to regional pricing, patent status, and supply chain logistics.

Projected Price Trends (Next 5-10 Years)

- Stability in API Pricing: With robust manufacturing capacity from multiple generic producers, API costs are expected to remain relatively stable, barring raw material shortages or geopolitical disruptions.

- Market-Driven Price Adjustments: Increased competition among generics will exert downward pressure, possibly reducing tablet prices by approximately 10-20%.

- Potential for Price Increases: Regulatory compliance, supply chain constraints, or reformulation efforts could temporarily drive costs upward. Additionally, if newer formulations improve tolerability, existing THP formulations might see price adjustments to maintain competitiveness.

Influence of Global Trends

The ongoing shift toward personalized medicine and the development of combination therapies may impact the demand for standalone THP formulations. Moreover, government initiatives to lower drug costs and promote generics further incentivize price reductions. Conversely, potential shortages of raw materials or manufacturing disruptions could temporarily elevate prices.

Regulatory and Market Dynamics Impacting Prices

The regulatory landscape directly influences pricing strategies. In markets where Trihexylphenidyl remains off-patent and widely approved, price competition will predominantly dictate cost reductions. For markets requiring additional regulatory approval or quality assurance, higher prices might persist.

The trend toward biosimilars is less applicable here, but ongoing pharmacovigilance may prompt formulation modifications, impacting costs. International harmonization of regulatory standards could also streamline manufacturing, facilitating more competitive pricing.

Future Outlook and Market Opportunities

While the role of Trihexylphenidyl might diminish as newer therapies gain prominence, niche applications, particularly in settings with limited access to advanced therapeutics, sustain its demand. Opportunities exist for developing novel formulations with improved tolerability, which could command premium pricing.

Emerging markets offer expansion potential, especially where regulatory barriers are less stringent, and healthcare infrastructure is receptive. However, competition from branded and unbranded generics necessitates continuous cost optimization.

Key Takeaways

- Market demand remains stable but pressured: The primary market for Trihexylphenidyl is transitioning from growth to stabilization, constrained by newer therapeutic options. Nonetheless, specific patient populations sustain steady demand.

- Price stability with downward bias: API and finished product prices are likely to decline gradually, driven by competition among generic manufacturers and healthcare policy initiatives.

- Regional variations influence pricing: Prices will vary significantly based on geographic market maturity, regulatory environment, and healthcare infrastructure.

- Limited innovation impacts pricing strains: Without significant reformulation or new patent protections, price increases are unlikely, emphasizing cost competition’s dominance.

- Niche and emerging markets hold growth potential: In regions with limited access or preference for older medications, Trihexylphenidyl retains relevance and profitability.

FAQs

-

What factors influence the pricing of Trihexylphenidyl?

The primary factors include raw material costs, manufacturing efficiency, competition from generic producers, regulatory compliance, and market demand.

-

Is Trihexylphenidyl likely to see significant price reductions in the next decade?

Yes. Given its status as a generic drug with multiple producers, prices will likely decrease gradually due to increased competition and policy pressures to lower healthcare costs.

-

How does regulatory approval affect the pricing of Trihexylphenidyl?

Regulatory approval ensures market access but can also increase costs through compliance requirements. Simpler approval pathways for existing generics support stable pricing, while strict or delayed approval processes could inflate costs.

-

Are there emerging markets that could influence future Trihexylphenidyl demand?

Yes. Countries with expanding healthcare infrastructure and aging populations, such as India, China, and parts of Africa and Southeast Asia, could see rising demand for affordable Parkinson’s treatments, including THP.

-

Could reformulations or combination therapies impact the future pricing of Trihexylphenidyl?

Potentially. Innovations that improve tolerability or efficacy may command higher prices. However, unless such changes are protected by patents, they may also face generic competition, limiting pricing flexibility.

References

- Grand View Research. "Parkinson's Disease Therapeutics Market Size, Share & Trends Analysis Report." 2022.

- Statista. "Global Parkinson’s Disease Drugs Market Forecast." 2023.

- Evaluate Pharma. "Generic Drug Pricing Trends." 2022.

- World Health Organization. "Global Burden of Parkinson's Disease." 2021.

- Pharmaceutical Commerce. "Emerging Markets in Neuropharmacology." 2022.

In summary, Trihexylphenidyl’s market remains steady but faces decline pressures from newer, better-tolerated therapies. Pricing will consolidate around competitive, low-cost generics in the coming years, with regional dynamics playing a decisive role. For manufacturers and investors, maintaining cost efficiencies and exploring niche markets could optimize profitability and ensure sustained market relevance.