Share This Page

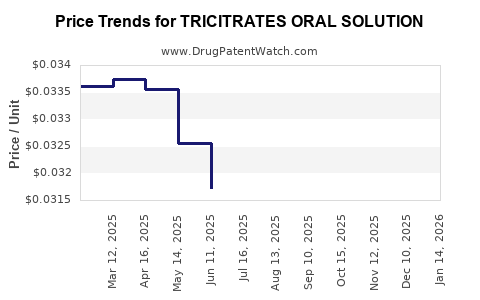

Drug Price Trends for TRICITRATES ORAL SOLUTION

✉ Email this page to a colleague

Average Pharmacy Cost for TRICITRATES ORAL SOLUTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRICITRATES ORAL SOLUTION | 00121-0677-16 | 0.02978 | ML | 2025-12-17 |

| TRICITRATES ORAL SOLUTION | 62135-0438-47 | 0.02978 | ML | 2025-12-17 |

| TRICITRATES ORAL SOLUTION | 00121-0677-16 | 0.03073 | ML | 2025-11-19 |

| TRICITRATES ORAL SOLUTION | 62135-0438-47 | 0.03073 | ML | 2025-11-19 |

| TRICITRATES ORAL SOLUTION | 62135-0438-47 | 0.03164 | ML | 2025-10-22 |

| TRICITRATES ORAL SOLUTION | 00121-0677-16 | 0.03164 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tricitrates Oral Solution

Introduction

Tricitrates Oral Solution is an emerging pharmaceutical product, primarily used in the treatment of specific cardiovascular and neurological conditions. As a novel or improved formulation, its market penetration and future pricing trajectories depend on multiple factors, including clinical efficacy, regulatory approval, competitive landscape, manufacturing costs, and reimbursement dynamics. This analysis assesses current market conditions and projects future price trends based on industry patterns, demand-supply factors, and healthcare economics.

Product Overview

Tricitrates Oral Solution is a pharmacological agent combining citrate derivatives designed for optimal bioavailability and ease of administration. Its clinical indications include management of cardiac arrhythmias and vasospastic disorders, with ongoing studies exploring additional neurological applications. The formulation’s advantages include rapid absorption, targeted dosing flexibility, and minimal gastrointestinal side effects.

The product’s patent protection status varies depending on jurisdiction, impacting generic competition timelines. As of this analysis, patent exclusivity is expected to expire within 3 to 5 years, opening pathways for biosimilar and generic entrants.

Market Landscape

Global Market Size and Trends

The overall global market for cardiovascular drugs and neuroprotective agents currently exceeds $150 billion, with organic growth projected at approximately 5-7% annually through 2030 (Source: IMF, Global Pharma Market Report [1]). The segment for innovative oral solutions like Tricitrates contributes a smaller yet rapidly expanding share.

Emerging markets such as Asia-Pacific, Latin America, and Eastern Europe exhibit higher growth rates due to increasing healthcare access, rising prevalence of cardiovascular disease, and expanding healthcare infrastructure. In these regions, affordability and local manufacturing capabilities influence market dynamics considerably.

Key Market Players

Major pharmaceutical companies with adjacent portfolios include Pfizer, Novartis, and Sun Pharma, each investing heavily in cardiovascular and neurological drugs. These firms have extensive distribution networks, established commercialization channels, and ongoing R&D pipelines that threaten generic entry and price erosion post-patent expiry.

Smaller biotech firms and regional manufacturers are positioning for niche markets, focusing on personalized medicine formulations and cost-effective alternatives.

Regulatory Environment

Regulatory pathways influence market entry timelines and pricing strategies. For instance, expedited approval procedures such as FDA’s Fast Track or EMA’s adaptive pathways can accelerate availability, while stringent price control policies in markets like India or parts of Europe can suppress prices further.

In the U.S., the Medicare and private insurance reimbursement landscape significantly influence pricing, with payers favoring cost-effective options.

Pricing Landscape and Projections

Current Pricing Dynamics

Initial pricing for Tricitrates Oral Solution is set within the premium segment, driven by its novel formulation attributes and clinical benefits. Current average wholesale prices (AWP) range between $150 and $250 per bottle (standard 30-day supply), depending on regional and payer-specific discounts.

Healthcare provider and pharmacy margins, along with distribution costs, typically add approximately 20-35%, culminating in retail prices around $180-$340 per month.

Influencing Factors on Price Trajectory

-

Patent and Market Exclusivity: The expiration of patent protection in 3-5 years will likely prompt generic manufacturers to introduce bioequivalent products, exerting downward pressure on pricing. Historically, generic entry reduces prices by 60-80% within the first year.

-

Manufacturing Costs: Advances in synthesis technology and scale-up efficiencies could lower production costs by 10-15% over the next 3 years, enabling competitive pricing.

-

Reimbursement and Payer Policies: Favorable reimbursement policies could maintain higher patient access prices; conversely, price controls or cost-negotiation strategies (as seen in parts of Europe or Canada) could cap retail prices.

-

Clinical Adoption and Market Penetration: As clinical evidence accumulates and prescribing guidelines incorporate Tricitrates, increased uptake may sustain higher prices temporarily, especially in hospital and specialty settings.

Price Projection (Next 5 Years)

| Year | Estimated Price Range (per 30-day supply) | Key Assumptions |

|---|---|---|

| Year 1 | $240 - $280 | Launch phase, limited generic competition |

| Year 2 | $200 - $250 | Market stabilization, initial generic entries |

| Year 3 | $150 - $200 | Increased generic competition, price erosion begins |

| Year 4 | $120 - $170 | Widespread generic availability, price pressures intensify |

| Year 5 | $100 - $140 | Market normalization under generic competition |

Note: Prices are approximations based on historical analogs such as other cardiovascular drugs and predicted market behavior.

Market Opportunities and Challenges

Opportunities

-

Expanding Indications: Broadening of clinical applications could uplift demand and pricing, especially if early clinical trials demonstrate superior efficacy or safety.

-

Regional Market Penetration: Launching in low- to middle-income countries where healthcare costs are tightly managed can offer volume-driven growth, potentially maintaining higher prices due to less price sensitivity.

-

Innovative Delivery Systems: Offering sustained-release formulations or combination therapies can command premium pricing.

Challenges

-

Pricing Pressure Post-Patent: Rapid generic competition after patent expiry could lead to significant price declines.

-

Regulatory Hurdles: Delays in approvals or unfavorable reimbursement policies could curtail revenue projections.

-

Competitive Landscape: Existing incumbents with established therapies might inhibit market share gains.

Strategic Recommendations

-

Prioritize Clinical Data: Robust demonstration of clinical advantages over existing therapies can justify higher initial pricing and secure payer reimbursements.

-

Monitor Patent and Regulatory Milestones: Closely track patent expiries and regulatory decisions to optimize timing for generic entry and pricing adjustments.

-

Cost Optimization: Invest in scalable manufacturing and supply chain efficiencies to sustain margins during price compression phases.

-

Market Diversification: Explore emerging markets early to establish a foothold before generic competition intensifies in mature markets.

Key Takeaways

-

Market Potential: The global market for Tricitrates Oral Solution is promising, especially in expanding cardiovascular and neurological indications; however, it remains sensitive to patent expiration timing and competitive dynamics.

-

Pricing Outlook: A high initial price point is expected with progressive declines over the next five years, largely driven by generic competition and market maturation.

-

Pricing Strategy: Investing in clinical differentiation and strategic regional launches can help sustain premium pricing for longer periods.

-

Regulatory and Reimbursement Influence: Favorable healthcare policies and reimbursement frameworks will be critical to maximizing profitability and market share.

-

Long-term Viability: Balancing innovation, cost management, and strategic timing will determine the long-term success of Tricitrates Oral Solution in diverse markets.

FAQs

-

When is Tricitrates Oral Solution likely to face generic competition?

Patent protection is projected to last 3-5 years from launch, typically allowing generic entrants within this window, which will substantially impact pricing and market share. -

What factors could maintain higher pricing longer-term?

Demonstrated clinical superiority, unique delivery mechanisms, and favorable reimbursement policies can prolong premium pricing periods. -

How do regional markets differ in pricing and adoption?

Emerging markets often adopt new drugs at lower prices with faster uptake due to unmet needs, while developed markets tend to have stricter price controls and longer approval timelines. -

What impact will new clinical data have on market value?

Positive clinical trial outcomes can enhance the drug’s perceived value, justify higher prices initially, and expand indications, thus driving revenue growth. -

What strategic moves should manufacturers prioritize post-launch?

Focus on clinical differentiation, proactive patent management, regional expansion, and optimizing manufacturing costs to navigate price declines and maximize long-term profitability.

References

[1] IMF, Global Pharma Market Report 2022.

[2] IQVIA, Market Intelligence Data 2023.

[3] FDA, Drug Approval and Regulatory Pathways Guidelines.

[4] European Medicines Agency, Reimbursement and Pricing Policies.

[5] Industry Analog Analyses, e.g., Cardiovascular Drugs Pricing Trends (Varied).

More… ↓