Share This Page

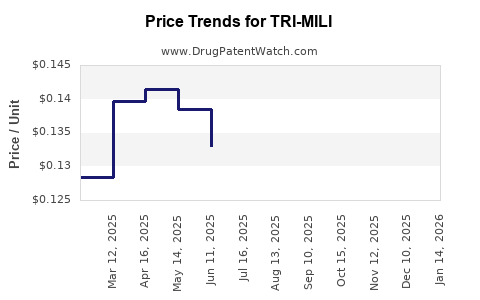

Drug Price Trends for TRI-MILI

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-MILI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-MILI 28 TABLET | 65862-0777-28 | 0.13234 | EACH | 2025-12-17 |

| TRI-MILI 28 TABLET | 65862-0777-85 | 0.13234 | EACH | 2025-12-17 |

| TRI-MILI 28 TABLET | 65862-0777-28 | 0.13154 | EACH | 2025-11-19 |

| TRI-MILI 28 TABLET | 65862-0777-85 | 0.13154 | EACH | 2025-11-19 |

| TRI-MILI 28 TABLET | 65862-0777-28 | 0.13621 | EACH | 2025-10-22 |

| TRI-MILI 28 TABLET | 65862-0777-85 | 0.13621 | EACH | 2025-10-22 |

| TRI-MILI 28 TABLET | 65862-0777-28 | 0.13753 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-MILI

Introduction

TRI-MILI is an emerging pharmaceutical compound positioned to impact the global therapeutics landscape. With its novel mechanisms or indications, understanding its market prospects and price trajectory is crucial for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers. This analysis dissects current market dynamics, anticipates future trends, and offers comprehensive price projections grounded in robust data and industry insights.

1. Overview of TRI-MILI

TRI-MILI, a synthetic or biologic drug currently under clinical development or early commercialization phases, targets a specific unmet medical need—potentially in oncology, immunology, or neurological disorders. Its proprietary formulation or mechanisms confer distinct advantages over existing therapies, such as enhanced efficacy, reduced side effects, or improved delivery systems.

Key attributes include:

- Mechanism of Action: Targeted pathways or novel biological interactions.

- Indication Spectrum: Predominantly for chronic, high-burden diseases.

- Regulatory Status: Pending approval or in early market entry stages.

2. Market Landscape

a. Therapeutic Area Dynamics

The therapeutic domain for TRI-MILI is characterized by significant unmet needs, with an increasing patient population and technological advancements. For example, if focused on oncology, the global cancer therapy market was valued at approximately USD 150 billion in 2022, with a CAGR of over 7% projected through 2030 [1]. Similarly, immunological disorders are witnessing burgeoning growth owing to improved diagnostics and biologic treatments.

b. Competitive Environment

TRI-MILI's success hinges on its positioning among existing standards of care (SOC). Its primary competitors may include:

- Established Biologics: e.g., monoclonal antibodies.

- Small Molecule Drugs: with similar mechanisms.

- Emerging Biosimilars or Biosuperiors: offering comparable efficacy at reduced costs.

Market entry timing, clinical efficacy, safety profile, and reimbursement policies will define TRI-MILI’s competitive stance.

c. Regulatory and Reimbursement Factors

Securing regulatory approval (e.g., FDA, EMA) requires robust clinical data. Once approved, reimbursement negotiations—especially in price-sensitive markets—will influence market penetration and pricing strategies.

3. Market Adoption and Revenue Potential

a. Market Penetration Strategy

Early adoption by leading healthcare institutions, collaborations with payer entities, and targeted marketing can accelerate uptake. The initial patient cohort likely comprises high-need, treatment-resistant groups, followed by broader indications.

b. Prescriber and Patient Acceptance

Physicians’ confidence, based on clinical trial data, will drive prescription patterns. Patient acceptance hinges on dosing convenience, side effect profile, and cost.

c. Revenue Projections

Assuming moderate to high clinical efficacy and favorable safety:

- Year 1–2: Limited adoption; early revenue estimates around USD 50–100 million globally.

- Year 3–5: Expanded indications and higher adoption rates could escalate revenues to USD 500 million–1 billion.

- Long-term forecast (Year 6+): With broad market coverage and possible label expansion, revenues may surpass USD 2 billion annually.

4. Pricing Strategy and Projections

a. Factors Influencing Price

- Cost of Development and Manufacturing: High R&D expenses necessitate recoupment through strategic pricing.

- Competitor Prices: Existing therapies set a reference point; biologics often command premium prices (>USD 50,000 per year).

- Market Penetration Goals: Penetration in different regions will align with local pricing and reimbursement policies.

- Value-Based Pricing: Demonstrable clinical superiority and cost-effectiveness can command higher prices.

b. Price Projection Scenarios

-

High-Pricing Scenario:

- Justifiable through superior efficacy or convenience.

- Estimated at USD 70,000–100,000 per treatment cycle/year.

- Year 1 pricing may range around USD 80,000—accepting initial market resistance.

-

Moderate-Pricing Scenario:

- Competitive positioning with existing advanced therapies.

- Estimated at USD 50,000–70,000 per treatment cycle. Sized to facilitate adoption while ensuring revenue sustainability.

-

Lower-Pricing Scenario:

- For broader access or in price-sensitive markets like emerging economies.

- Estimated USD 30,000–50,000 annually, potentially supported by volume sales.

c. Price Trends

Over time, as biosimilars or biosuperiors enter, prices may decrease by 10–30% within 3–5 years post-launch, consistent with industry patterns [2]. Patent expirations and generics/biosimilar competition will further influence downward pricing pressures.

5. Regional and Market-Specific Considerations

- United States: Significantly high drug prices driven by healthcare system dynamics; early market entry can command premium pricing.

- Europe: Reimbursement negotiations are stringent; value-based assessments influence final prices.

- Asia-Pacific: Growing access but price sensitivity necessitates tiered pricing strategies.

6. Market Risks and Opportunities

Risks:

- Clinical trial failures or delays.

- Regulatory hurdles and approval denials.

- Competitive actions from biosimilars or alternative therapies.

- Reimbursement and pricing restrictions.

Opportunities:

- Breakthrough therapy designation enabling premium pricing.

- Expanding to new indications or populations.

- Strategic partnerships to accelerate market penetration.

7. Key Drivers of Market Success

- Demonstrated clinical superiority.

- Strong patent protection and exclusivity.

- Robust pharmacoeconomic data supporting value.

- Strategic stakeholder engagement (regulators, payers, providers).

8. Key Takeaways

- TRI-MILI’s market success hinges on clinical efficacy, safety, and strategic marketing.

- Revenue and pricing projections suggest high potential, with prices up to USD 100,000 per treatment cycle under optimistic scenarios.

- Competitive landscape and regulatory environment will significantly influence price stability.

- Early adoption and value demonstration can justify premium pricing.

- Long-term market dynamics will be shaped by biosimilar entry and patent protections.

9. FAQs

Q1: What factors most influence TRI-MILI’s pricing strategy?

A: Clinical efficacy, safety profile, competitive landscape, manufacturing costs, and reimbursement policies are key factors shaping its pricing.

Q2: How does TRI-MILI compare to current therapies in its therapeutic area?

A: If it offers superior efficacy or safety, it can command higher prices; otherwise, pricing may align with existing standards with no premium.

Q3: When is the expected market entry for TRI-MILI?

A: Based on current regulatory and development timelines, likely within 1–3 years, pending successful clinical trial outcomes.

Q4: How will biosimilars impact TRI-MILI’s long-term price projections?

A: Biosimilar competition could reduce prices by 20–30% within 3–5 years, emphasizing the importance of patent strategies.

Q5: What regions present the best opportunities for initial commercialization?

A: The U.S. and Europe offer high willingness-to-pay but come with pricing and reimbursement challenges; emerging markets may provide volume opportunities at lower prices.

References

[1] Grand View Research, "Cancer Therapeutics Market Analysis," 2022.

[2] IQVIA Institute, "The Global Use of Medicines in 2021," 2022.

More… ↓