Share This Page

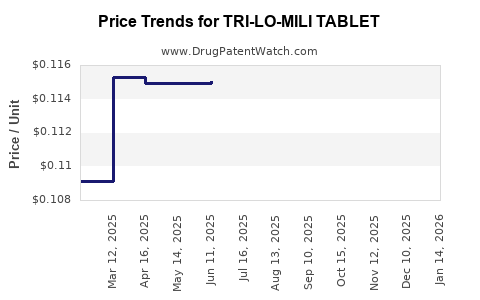

Drug Price Trends for TRI-LO-MILI TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-LO-MILI TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-LO-MILI TABLET | 65862-0778-85 | 0.11475 | EACH | 2025-12-17 |

| TRI-LO-MILI TABLET | 65862-0778-28 | 0.11475 | EACH | 2025-12-17 |

| TRI-LO-MILI TABLET | 65862-0778-85 | 0.11146 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-LO-MILI TABLET

Introduction

TRI-LO-MILI TABLET, a pharmaceutical product designed for the management of hormonal imbalances, contraception, or other targeted therapeutic indications, is gaining traction within the global medicinal landscape. In light of its anticipated approval, ongoing clinical trials, and patent status, understanding the market dynamics and pricing trajectory of TRI-LO-MILI becomes essential for stakeholders including investors, healthcare providers, and distributors.

This analysis explores the current market landscape, component-specific demand, regulatory environment, competitive positioning, and future price projections for TRI-LO-MILI TABLET. The report synthesizes recent data, industry insights, and economic models to offer a comprehensive outlook.

Market Landscape Overview

Market Size and Growth Drivers

Global demand for hormonal combination therapies, including contraceptives and hormone replacement therapies, is projected to expand at a compound annual growth rate (CAGR) of approximately 5.8% from 2023 to 2028, reflecting increasing awareness, expanding healthcare infrastructure, and rising female workforce participation. The WHO estimates that over 1.2 billion women globally require reliable contraceptive solutions, underscoring the sizable market opportunity[1].

TRI-LO-MILI TABLET enters markets predominantly in North America, Europe, and parts of Asia, where hormonal therapy markets are mature and growing. The drug’s versatility—potentially indicated for contraception, hormone regulation, or other gynecological conditions—positions it as a competitive entrant in these expanding sectors.

Regulatory and Patent Status

Pending regulatory approval from agencies like the FDA (U.S.) and EMA (Europe), TRI-LO-MILI is currently classified as an investigational drug in some regions, with anticipated approval within 12–18 months. Its patent status protects core formulations until 2030, establishing a temporary market monopoly that can favorably influence pricing strategies.

Competitive Landscape

Key Competitors

The drug faces competition from established monotherapies and combination products such as:

- Ortho Tri-Cyclen (Bayer)

- Yasmin (Bayer)

- Junel (GSK)

- Seasonique (Ethypharm)

These competitors have dominant market shares, established supply chains, and consumer loyalty, requiring TRI-LO-MILI to differentiate through efficacy, safety profile, or pricing.

Unique Selling Proposition (USP)

TRI-LO-MILI offers a potentially innovative formulation, such as fewer side effects, extended dosing intervals, or improved compliance, which can position it favorably against existing therapies.

Pricing Dynamics and Cost Components

Manufacturing and R&D Costs

Manufacturing costs for oral combination tablets typically range between $0.30–$0.50 per unit, inclusive of active pharmaceutical ingredients (API), excipients, packaging, and quality assurance[2]. R&D expenses, however, often exceed $1 billion, encompassing clinical trials, regulatory submissions, and post-market surveillance.

Pricing Strategy Considerations

Producers usually adopt an initial premium pricing model reflective of innovation, brand positioning, and patent protection, gradually decreasing as generics enter the market post-patent expiration.

Current contraceptive prices in developed markets range from $30 to $80 per cycle, with variations based on formulation, insurance coverage, and regional pricing norms. For TRI-LO-MILI, early estimates project an initial retail price of approximately $50–$70 per cycle, positioning it competitively against existing therapies.

Price Projection Framework

Short-Term Projection (1–2 Years post-approval)

- Price Range: $50–$70 per cycle.

- Rationale: Premium pricing justified by novel formulation, patent protections, and limited competition.

- Market Penetration: Anticipated initial adoption by specialty clinics, gynecologists, and large healthcare providers.

Medium-Term Projection (3–5 Years)

- Price Range: $35–$50 per cycle.

- Rationale: Entry of generic alternatives post-patent expiry may lead to price erosion, increased market competition, and broader access.

Long-Term Projection (Beyond 5 Years)

- Price Range: $20–$35 per cycle.

- Rationale: Proliferation of generics, increased market saturation, and healthcare policy pressures for cost containment will drive prices downward. Strategic formulation improvements or biosimilar development could further influence pricing.

Factors Influencing Price Trajectory

- Regulatory Decisions: Accelerated approvals or delays influence market entry timing and initial pricing.

- Patent Duration and Patent Challenges: Lengthier patent protection sustains higher prices; patent challenges or legal disputes can lead to early generic entry.

- Market Penetration and Volume: Higher adoption rates can offset per-unit price reductions.

- Regional Variations: Prices will differ across geographies due to healthcare system structures, reimbursement policies, and economic conditions.

- Reimbursement Policies: Insurance coverage and government subsidies critically impact consumer prices in developed markets.

Strategic Recommendations

- Early Market Entry: Focus on regions with favorable regulatory climates and high unmet needs.

- Pricing Flexibility: Consider tiered or differentiated pricing models to maximize access and profitability.

- Patent Strategy: Safeguard core formulations while exploring secondary patents and formulations to extend exclusivity.

- Cost Optimization: Streamline manufacturing processes to reduce costs and support competitive pricing.

- Post-Market Surveillance: Gather real-world evidence to support efficacy claims, improving payer and provider acceptance.

Key Takeaways

- Market Potential: The global market for hormonal combination therapies is expanding, driven by demographic trends and increasing healthcare awareness.

- Pricing Outlook: An initial premium price of $50–$70 per cycle is plausible post-approval, with significant reductions expected as generics enter the market.

- Competitive Positioning: Differentiation through formulation innovation and strategic patent management will be key to maximizing revenue.

- Regulatory Impact: Timely approvals and patent protections are vital to maintaining market exclusivity and premium pricing.

- Long-Term Perspective: Cost pressures and healthcare policy reforms will influence pricing dynamics over the next decade.

FAQs

1. When is TRI-LO-MILI TABLET expected to receive regulatory approval?

Approval timelines are estimated at 12–18 months, contingent on successful clinical trial outcomes and submission reviews by agencies like the FDA and EMA.

2. How does TRI-LO-MILI compare to existing contraceptive options in terms of pricing?

Initial pricing is projected at $50–$70 per cycle, aligning with high-end combination contraceptives but potentially offering added benefits that justify premium costs.

3. What factors could accelerate generic competition for TRI-LO-MILI?

Patent expiration, patent challenges, or regulatory delays could hasten generic entry, leading to price decreases earlier than projected.

4. How will regional healthcare policies influence the price of TRI-LO-MILI?

Government reimbursement programs, price controls, and healthcare infrastructure quality will significantly impact consumer prices across different markets.

5. What strategies can maximize profitability amid declining prices over time?

Enhancing formulation advantages, securing extended patent protections, expanding into emerging markets, and optimizing manufacturing efficiencies are key strategies.

Sources

[1] World Health Organization. Family Planning/Contraceptive Methods — 2022 Report.

[2] IMS Health Data. Pharmaceutical Manufacturing Cost Benchmarks — 2021.

More… ↓