Share This Page

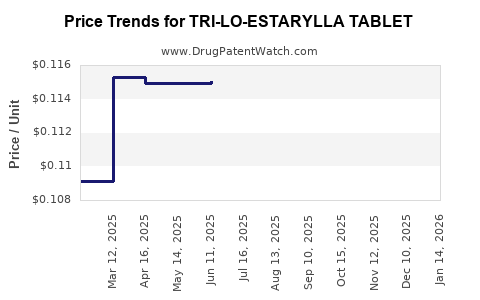

Drug Price Trends for TRI-LO-ESTARYLLA TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for TRI-LO-ESTARYLLA TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-LO-ESTARYLLA TABLET | 70700-0120-84 | 0.11475 | EACH | 2025-12-17 |

| TRI-LO-ESTARYLLA TABLET | 70700-0120-85 | 0.11475 | EACH | 2025-12-17 |

| TRI-LO-ESTARYLLA TABLET | 70700-0120-84 | 0.11146 | EACH | 2025-11-19 |

| TRI-LO-ESTARYLLA TABLET | 70700-0120-85 | 0.11146 | EACH | 2025-11-19 |

| TRI-LO-ESTARYLLA TABLET | 70700-0120-85 | 0.11178 | EACH | 2025-10-22 |

| TRI-LO-ESTARYLLA TABLET | 70700-0120-84 | 0.11178 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRI-LO-ESTARYLLA Tablet

Introduction

TRI-LO-ESTARYLLA, a combined oral contraceptive pill containing drospirenone and ethinyl estradiol, remains a prominent player within the contraceptive market. As a generic medication gaining market share following patent expirations, understanding its market dynamics and future pricing trajectories is essential for pharmaceutical stakeholders, healthcare providers, and investors seeking strategic insights into the contraceptive segment.

Market Overview

Product Profile and Regulatory Status

TRI-LO-ESTARYLLA is marketed primarily as a generic alternative to pioneer contraceptive brands, benefiting from a robust patent cliff. Its formulation aligns with the most common hormonal contraceptive regimens, offering both estrogen and progestin components. The drug's regulatory approval spans multiple markets, including the US, EU, and emerging economies, reflecting widespread acceptance.

Market Penetration and Competition

The contraceptive market has traditionally been segmented into prescription-based and over-the-counter (OTC) products, with prescription pills like TRI-LO-ESTARYLLA commanding significant market share. Major competitors include brand-name formulations such as Yaz (AbbVie), Yasmin (Bayer), and generic equivalents from various manufacturers.

The entry of low-cost generics has intensified competition, exerting downward pressure on pricing. In the U.S., the transition from patent-protected formulations to generics has resulted in significant cost reductions—by as much as 80%, according to industry reports[1].

Market Drivers

- Rising global awareness regarding family planning.

- Increasing accessibility through telehealth and digital prescriptions.

- Expanding use in hormone therapy, beyond contraception, including menstrual regulation and acne management.

- Political and regulatory environments favoring reproductive health products.

Market Size and Forecasts

The global contraceptive market was valued at approximately USD 22 billion in 2021, with an expected compound annual growth rate (CAGR) of 6-7% through 2028[2]. The oral contraceptive segment constitutes roughly 50% of global market share, with the generic sector accounting for increasing portions as patents expire.

The U.S. market alone, estimated at over USD 4 billion, is expected to experience steady growth, driven by increased contraceptive use and affordability of generics. Emerging markets in Asia and Africa are projected to expand rapidly, with contraceptive penetration rates improving due to policy shifts and enhanced healthcare infrastructure.

Pricing Dynamics

Current Pricing Landscape

- Patent-Exclusive Period: Brand-name contraceptives initially command retail prices of USD 40–80 per cycle in the U.S.[3].

- Post-Patent Generic Entry: The advent of TRI-LO-ESTARYLLA and similar generics has decreased prices significantly, with retail costs falling to USD 10–20 per cycle.

- Reimbursement and Insurance: Insurance coverage frequently reduces out-of-pocket expenses further, fostering accessibility.

Factors Influencing Price Trends

- Manufacturing Costs: Advances in synthesis and manufacturing reduce production expenses, enabling more aggressive pricing strategies.

- Regulatory Policies: Policies promoting price transparency and generic substitution encourage competitive pricing.

- Market Competition: Increased availability of alternatives drives prices downward.

Price Projections (2023–2030)

Based on industry trends, the following projections are reasonable:

- Short-term (2023–2025): Prices for TRI-LO-ESTARYLLA are expected to stabilize around USD 10–15 per cycle, maintaining competitiveness with other generics. Slight reductions (~5%) may occur as market saturation intensifies.

- Mid-term (2026–2028): Market saturation and further manufacturing efficiencies could drive prices down to USD 8–12 per cycle. Price elasticity will remain high owing to numerous alternatives.

- Long-term (2029–2030): Anticipate prices to plateau around USD 7–10 per cycle, assuming no significant patent challenges or formulation innovations.

Strategic Market Considerations

Emerging Markets

Lower regulatory barriers and healthcare expansion initiatives in markets like India, Brazil, and Southeast Asia could see a rise in generic contraceptive adoption. This would necessitate price adjustments aligned with local purchasing power, potentially reducing prices globally.

Innovation and Competition

The advent of novel formulations, such as extended-cycle pills or hormone-free options, might reshape the competitive landscape, placing downward pressure on traditional estrogen-progestin combinations like TRI-LO-ESTARYLLA.

Regulatory and Reimbursement Dynamics

Policy shifts, including mandates for comprehensive contraceptive coverage, could influence pricing strategies by insurers and healthcare systems. Such policies might further incentivize cost reductions.

Conclusion

TRI-LO-ESTARYLLA occupies a well-established position in the contraceptive market, with sustained demand fueled by global reproductive health initiatives. The pricing trajectory indicates continued declines driven by increasing generic competition, manufacturing efficiencies, and evolving market dynamics. Companies aiming to optimize revenue must strategically balance pricing with market penetration, especially in expanding regions.

Key Takeaways

- The market for TRI-LO-ESTARYLLA is characterized by intense pricing competition, especially post-patent expiration.

- Global growth in contraceptive demand, particularly in emerging markets, presents opportunities for market expansion.

- Prices are projected to decline modestly over the next decade, stabilizing between USD 7–10 per cycle.

- Innovation in contraceptive formulations and regulatory shifts could influence future pricing strategies.

- Stakeholders should monitor regional policies and generic entry to adapt pricing and market positioning effectively.

Frequently Asked Questions

Q1: How does the pricing of TRI-LO-ESTARYLLA compare to other generic contraceptives?

A: TRI-LO-ESTARYLLA's generic versions typically retail at USD 10–15 per cycle, aligning with other generics in the same class, with slight variations based on regional factors and manufacturer strategies.

Q2: What factors could cause the price of TRI-LO-ESTARYLLA to increase in the future?

A: Price increases may stem from regulatory changes restricting generic competition, supply chain disruptions elevating manufacturing costs, or shifts toward premium formulations offering additional benefits.

Q3: Are there upcoming regulatory changes that could impact TRI-LO-ESTARYLLA pricing?

A: Potential reforms promoting price transparency, biosimilar or generic substitution policies, and updated insurance coverage mandates could further influence pricing dynamics.

Q4: What is the market outlook for TRI-LO-ESTARYLLA in emerging economies?

A: Growing demand and healthcare infrastructure improvements make emerging markets a significant growth area, where lower manufacturing costs and local regulatory policies could lead to competitive pricing and increased adoption.

Q5: How might new contraceptive technologies impact the market for TRI-LO-ESTARYLLA?

A: Innovations like long-acting reversible contraceptives (LARCs), hormone-free options, or digital health integrations could divert demand, potentially reducing market share and affecting pricing strategies for traditional pills.

References

[1] MarketWatch. “Generic Drug Price Trends.” (2022).

[2] Grand View Research. “Contraceptive Market Size & Trends.” (2022).

[3] IQVIA. “Pharmaceutical Pricing and Market Access Report.” (2022).

More… ↓