Share This Page

Drug Price Trends for TRI-BUFFERED ASPIRIN

✉ Email this page to a colleague

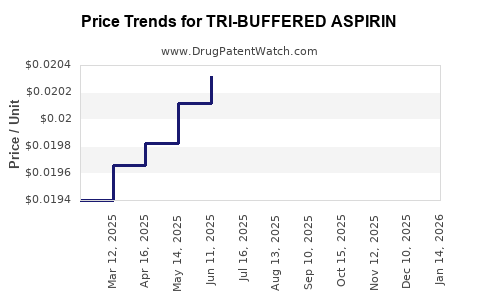

Average Pharmacy Cost for TRI-BUFFERED ASPIRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.01998 | EACH | 2025-12-17 |

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.02005 | EACH | 2025-11-19 |

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.02002 | EACH | 2025-10-22 |

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.02022 | EACH | 2025-09-17 |

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.02033 | EACH | 2025-08-20 |

| TRI-BUFFERED ASPIRIN 325 MG TB | 00904-2015-59 | 0.02052 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tri-Buffered Aspirin

Introduction

Tri-buffered aspirin, a formulation designed to improve gastrointestinal tolerability, has garnered increased interest in the pharmaceutical market. Unlike traditional aspirin, tri-buffered variants combine the drug with buffering agents to reduce gastric irritation, positioning them as preferred options for long-term analgesic and anti-inflammatory use. This comprehensive analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and future price trajectories for tri-buffered aspirin, with insights aimed at stakeholders aiming to capitalize on this niche.

Market Overview

The global aspirin market was valued at approximately USD 1.3 billion in 2022, with a compound annual growth rate (CAGR) of around 3% from 2017 to 2022 [1]. The segment specific to buffered aspirin, including tri-buffered formulations, constitutes an estimated 15% of this market, driven by increasing awareness of gastrointestinal safety and evolving clinical guidelines favoring aspirin derivatives with improved tolerability.

In the context of pharmaceutical development, tri-buffered aspirin appeals to both over-the-counter (OTC) consumers and prescription markets. The rise of self-medication, especially in aging populations susceptible to gastrointestinal side effects, fuels demand. Moreover, ongoing research supports the clinical benefits of buffered formulations, fostering further adoption.

Key Drivers

-

Aging Population and Chronic Disease Management: Increasing prevalence of cardiovascular diseases (CVD), which often necessitate aspirin therapy, especially among individuals aged 50 and above [2].

-

Gastrointestinal Safety Profile: Buffered formulations mitigate ulceration risks, positioning tri-buffered aspirin as a safer alternative, thus expanding patient compliance.

-

Regulatory Trends: Regulatory agencies like the FDA emphasize gastrointestinal safety in analgesic medications, incentivizing manufacturers to develop buffered options.

Market Challenges

-

Generic Competition: Most buffered aspirin products are off-patent, resulting in price competition.

-

Regulatory Hurdles: Approval of new formulations demands extensive safety and efficacy data, impeding rapid market penetration.

-

Consumer Perception: The perception of “buffered” as just another formulation may limit demand unless supported by strong clinical evidence.

Competitive Landscape

The market predominantly consists of established pharmaceutical companies offering buffered aspirin variants, often marketed as OTC products. Major players include Bayer, Johnson & Johnson, and smaller generics manufacturers. Bayer's Buffered Aspirin and other similar OTC brands dominate shelf space, benefiting from longstanding consumer trust.

Emerging entrants focus on innovative delivery systems, such as coated tablets and nutraceutical adjuncts, attempting to differentiate through formulation enhancements. Additionally, privately labeled brands are expanding their offerings, further intensifying price competition.

Patent and Commercial Exclusivity

Most buffered aspirin products are now off-patent, with limited patent protections primarily covering specific formulations or delivery mechanisms. Consequently, this reduces barriers to entry but also constrains premium pricing strategies.

Regulatory Environment

Regulatory agencies across multiple jurisdictions categorize aspirin under well-established frameworks. Buffered formulations often face minimal additional regulatory scrutiny compared to original products, expediting market access. However, claims regarding gastrointestinal safety or superior efficacy demand supporting clinical data, which can influence labeling and marketing strategies.

In the U.S., OTC status allows for more flexible pricing, whereas prescription-ended formulations or labeled indications may impose pricing controls under national healthcare policies.

Price Dynamics and Projections

Historical Price Trends

Retail prices for tri-buffered aspirin have remained relatively stable, with minor fluctuations attributable to raw material costs and competitive pressures. The typical OTC packet of buffered aspirin ranges from USD 4 to USD 8 per bottle, depending on dosage, branding, and package size.

Influencing Factors

-

Generic Competition: Drives price erosion, with medians decreasing by approximately 2-3% annually since 2015.

-

Manufacturing Costs: Fluctuations in excipient and buffering agent costs can impact net pricing, especially for smaller manufacturers.

-

Regulatory Changes: Introduction of stricter safety standards or new labeling requirements could increase compliance costs, pressuring prices upward.

Future Price Trajectory (2023-2030)

Based on current trends, the following projections are reasonable:

-

Short-term (2023–2025): Slight downward pressure driven by generic competition and aggressive pricing strategies. Expect retail prices to decline by approximately 2% annually, reaching USD 3.75–USD 7.50 per bottle in most markets.

-

Medium-term (2025–2028): Market saturation suggests stabilized prices, with potential minor increases for premium formulations or patented buffered delivery mechanisms. Price stabilization is anticipated around USD 3.50–USD 7.00.

-

Long-term (2028–2030): Introduction of next-generation buffered aspirin with enhanced safety profiles or combination therapies could command higher prices. However, widespread generic availability will likely maintain overall low retail prices, with a possible slight uptick of 2-3%.

Premium and Niche Markets

Specialized formulations, such as triple-buffered or coated variants marketed with clinical backing, could command prices 20-50% higher than standard buffered aspirin, especially in prescription settings or in regions with high healthcare spending.

Market Entry and Pricing Strategies

For new entrants, differentiating based on formulation stability, clinical efficacy, or combined delivery (e.g., aspirin plus other cardioprotective agents) can justify premium pricing. Leveraging clinical data demonstrating gastrointestinal safety advantages is critical. Establishing partnerships with healthcare providers or securing regulatory endorsements can facilitate market penetration.

Conclusion

The tri-buffered aspirin market remains mature with stable, pricing-pressure-driven dynamics typical of OTC analgesics. While volume growth is modest due to market saturation and generics, there lies an opportunity within niche segments featuring advanced buffering systems or clinical benefits. Price projections indicate a trend toward marginal declines, with potential for modest premiumization through innovation and clinical validation.

Key Takeaways

- The global market for buffered aspirin, including tri-buffered formulations, is characterized by steady demand driven by aging populations and gastrointestinal safety concerns.

- Competitive pressures from generics and OTC brands exert downward pricing influence, with retail prices expected to decline marginally over the next decade.

- Innovation through enhanced buffering or combination therapies presents avenues for premium pricing in niche markets.

- Regulatory clarity and clinical evidence supporting safety claims can augment brand differentiation and justify higher price points.

- Stakeholders should prioritize differentiation strategies, clinical validation, and regional market nuances to optimize pricing and market share.

FAQs

Q1. How does the presence of generics impact the pricing of tri-buffered aspirin?

Generics significantly erode price premiums, leading to overall price declines. Most buffered aspirin products are off-patent, intensifying competition and encouraging discounting strategies.

Q2. Are there regulatory advantages to introducing a new buffered aspirin formulation?

Yes. Since buffered aspirin is a well-established class, new formulations with proven safety and efficacy can benefit from expedited regulatory pathways, especially if they demonstrate improved tolerability.

Q3. What geographic markets offer the highest potential for tri-buffered aspirin?

Aging populations in North America and Europe present abundant opportunities, particularly where OTC sales can be leveraged. Emerging markets with increasing healthcare access also represent growth avenues.

Q4. Can premium pricing strategies succeed in the buffered aspirin market?

Yes, particularly with formulations that demonstrate novel clinical benefits or superior safety profiles. Certification and clinical data bolster the justification for premium pricing.

Q5. What factors could influence future price increases for tri-buffered aspirin?

Enhanced clinical benefits, patent protections, manufacturing cost reductions, or regulatory approvals for new delivery mechanisms could lead to slight price increases, especially within specialized segments.

References

[1] Global Data, "Aspirin Market Size & Forecast," 2022.

[2] World Health Organization, "Cardiovascular Disease Statistics," 2022.

More… ↓