Share This Page

Drug Price Trends for TRESIBA

✉ Email this page to a colleague

Average Pharmacy Cost for TRESIBA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRESIBA FLEXTOUCH 100 UNIT/ML | 00169-2660-15 | 32.51903 | ML | 2025-12-17 |

| TRESIBA FLEXTOUCH 200 UNIT/ML | 00169-2550-13 | 65.03241 | ML | 2025-12-17 |

| TRESIBA 100 UNIT/ML VIAL | 00169-2662-11 | 32.44296 | ML | 2025-12-17 |

| TRESIBA FLEXTOUCH 200 UNIT/ML | 00169-2550-13 | 65.03976 | ML | 2025-11-19 |

| TRESIBA FLEXTOUCH 100 UNIT/ML | 00169-2660-15 | 32.52493 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRESIBA (Insulin Degludec)

Introduction

TRESIBA (insulin degludec) is a long-acting basal insulin analog developed by Novo Nordisk for managing blood glucose levels in type 1 and type 2 diabetes mellitus. Since its approval by the U.S. Food and Drug Administration (FDA) in 2015, TRESIBA has established a significant presence within the global diabetes therapeutics market. This article provides a comprehensive analysis of TRESIBA's market dynamics, competitive landscape, and price projections through 2030, offering strategic insights for stakeholders.

Market Overview

Global Diabetes Market Context

The global diabetes treatment market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.2% from 2022 to 2030, propelled by escalating diabetes prevalence, technological advancements in insulin formulations, and expanding therapeutic options.[1] As of 2022, the market valuation exceeds USD 75 billion, with insulin products constituting a significant share.

TRESIBA’s Position in the Market

TRESIBA claims a prominent position as a long-acting basal insulin with benefits including a flat pharmacodynamic profile, reduced hypoglycemia risk, and flexible dosing. Its strategic positioning targets adult and pediatric populations with type 1 and type 2 diabetes, directly competing with products like Lantus (insulin glargine), Tresiba's primary competitor, and newer ultra-long-acting insulins.

Market Dynamics

Key Drivers

- Increasing Diabetes Prevalence: The International Diabetes Federation estimates 537 million adults worldwide with diabetes, projected to reach 643 million by 2030.[2] This surge fuels demand for basal insulin, including TRESIBA.

- Advancements in Insulin Therapy: Enhanced formulations offering stability, reduced injection frequency, and hypoglycemia risk reduction attract both physicians and patients.

- Expanding Indications & Patient Compliance: The flexibility in dosing schedules improves adherence, boosting demand.

Market Challenges

- Pricing and Reimbursement: The high cost of insulin remains a barrier, especially in developing markets where reimbursement schemes are evolving.

- Patent Expiry & Biosimilars: Patent expiration periods challenge exclusive sales, opening markets to biosimilar competitors which may exert downward pressure on prices.

- Patient Preference & Technology Integration: The shift toward insulin pens, insulin pumps, and digital health integrations influences market share dynamics.

Competitive Landscape

While Novo Nordisk’s TRESIBA holds a sizable market share, it faces competition chiefly from:

- Sanofi’s Lantus (insulin glargine): Once dominant, Lantus’s market share declines due to biosimilar entries.

- Eli Lilly’s Basaglar and Trulicity: Biosimilars and combination therapies gain traction.

- Emerging Ultra-Long-Acting Insulins: Novo Nordisk’s own newer formulations, such as Degludec’s subsequent formulations, pose competitive threats.

The global insulin market is becoming more fragmented with biosimilar entrants in Europe and Asia, potentially placing downward pressure on prices.

Pricing Landscape

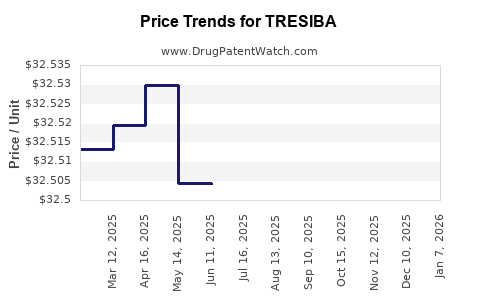

Current Pricing Trends

In the United States, the list price of TRESIBA per pen (with approximately 300 units) is roughly USD 300-350, translating to USD 1.00-1.17 per unit.[3] However, net prices post-insurance discounts often fall substantially.

Internationally, prices are significantly lower in markets with nationalized healthcare systems due to price negotiations and bulk purchasing. For instance, in European countries, the price per unit averages USD 0.80-1.00.

Impact of Biosimilars

The biosimilar entry in the insulin market has historically led to price reductions of 20-30%. As biosimilar competition in long-acting insulins materializes, TRESIBA’s pricing is expected to decline gradually.

Price Projection Analysis (2023-2030)

Assumptions

- Patent Life and Biosimilar Entry: Assuming biosimilar entrants in North America and Europe begin penetrating markets by 2024-2025.

- Market Penetration & Volume Growth: Estimated CAGR of 6% in volume terms, driven by increasing diabetic population and evolving treatment guidelines.

- Pricing Trend: A gradual decrease of 3-5% annually post-2024 due to biosimilar competition and market saturation, offset by inflation adjustments.

Projected Price Trends

| Year | Approximate Price per Units (USD) | Market Volume Growth | Notes |

|---|---|---|---|

| 2023 | 1.00 – 1.17 (list price) | ~10% | Stable pre-biosimilar impact |

| 2024 | 0.95 – 1.12 | ~12% | Biosimilar introduction begins |

| 2025 | 0.92 – 1.09 | ~14% | Increased biosimilar competition |

| 2026 | 0.89 – 1.07 | ~15% | Market stabilizes at lower prices |

| 2027 | 0.86 – 1.04 | ~16% | Continued penetration of biosimilars |

| 2028 | 0.84 – 1.02 | ~17% | Competitive pressure intensifies |

| 2029 | 0.82 – 1.00 | ~17% | Maturation of biosimilar markets |

| 2030 | 0.80 – 0.98 | ~18% | Market reaches new equilibrium |

Note: These projections incorporate ongoing market dynamics and assume no regulatory or patent-related disruptions beyond expected biosimilar entries.

Implications for Stakeholders

Pharmaceutical Manufacturers

- Pricing Strategy: As biosimilars commoditize insulin markets, maintaining competitive pricing and demonstrating therapeutic superiority or added value (e.g., digital health tools) become critical.

- Market Access: Collaborations with payers and governments to secure favorable reimbursement terms will be essential.

Healthcare Providers and Payers

- Cost Management: The declining trend offers opportunities for more affordable diabetes management, but careful negotiation is necessary.

- Patient Outcomes: Improved adherence and reduced hypoglycemia with TRESIBA remain key selling points, especially as price pressures mount.

Investors and Market Analysts

- Growth Potential: Despite downward pricing trends, volume growth driven by increasing diabetic prevalence sustains revenue streams.

- Risk Management: Regulatory delays or delayed biosimilar entry can influence price and volume forecasts.

Conclusion

TRESIBA’s market outlook remains optimistic amid increasing diabetes prevalence and ongoing innovation. Price trajectories are projected to decline modestly from 2024 onward as biosimilars gain market share, but volume growth compensates for margin pressures. Strategic positioning—focusing on value-added features and cost competitiveness—will be vital for maintaining market share and profitability.

Key Takeaways

- The global long-acting insulin market is poised for steady expansion driven by rising diabetes prevalence and improved dosing profiles.

- TRESIBA holds a strong market position supported by clinical benefits, but faces imminent biosimilar competition likely to reduce prices by 2024.

- A gradual decline in per-unit prices (~3-5% annually post-2024) is expected, counterbalanced by increasing adoption rates.

- Market success hinges on strategic alliances, differentiation, and navigating reimbursement landscapes.

- Continuous innovation and cost optimization are necessary to sustain profitability amid evolving competitive pressures.

FAQs

1. How will biosimilar entry affect TRESIBA’s pricing?

Biosimilar penetration typically leads to 20-30% reductions in insulin prices. As biosimilars enter markets, TRESIBA’s prices are expected to decline gradually, especially post-2024.

2. What factors could accelerate or slow down TRESIBA’s market growth?

Factors include regulatory approvals, healthcare policy changes, competitive product launches, and technological advancements like insulin delivery devices and digital health integration.

3. Are there geographic differences affecting TRESIBA’s prices?

Yes. Developed countries with centralized healthcare systems often negotiate lower prices through national tenders, while the U.S. price varies significantly based on insurance coverage.

4. How significant is TRESIBA’s role in the global insulin market?

TRESIBA is among the leading long-acting insulins worldwide, with a growing share fueled by its pharmacokinetic profile and flexible dosing, yet it faces intense competition from biosimilars and other novel formulations.

5. What strategic moves should Novo Nordisk consider for TRESIBA’s future?

Focus on expanding indications, enhancing patient adherence via digital tools, maintaining competitive pricing, and investing in research to develop next-generation insulin analogs.

References

[1] Market Research Future. "Insulin Market Research Report." 2022.

[2] International Diabetes Federation. "IDF Diabetes Atlas," 10th Edition, 2021.

[3] GoodRx Health. "Cost of TRESIBA (insulin degludec)," 2023.

More… ↓