Last updated: July 27, 2025

Introduction

Trelegy Ellipta, developed by GlaxoSmithKline (GSK), is a triple inhaler combining fluticasone furoate, umeclidinium, and vilanterol, approved for the maintenance treatment of asthma and chronic obstructive pulmonary disease (COPD). Since its approval in 2017 by the U.S. FDA, Trelegy Ellipta has rapidly gained a foothold in respiratory therapeutics, owing to its convenience and efficacy. This analysis provides an in-depth exploration of the current market landscape, competitive positioning, pricing strategies, and future price projections.

Market Overview and Current Position

The global COPD and asthma markets exhibit robust growth driven by rising prevalence rates, aging populations, and increased awareness of inhaled therapies. According to IQVIA, the global respiratory market generated approximately $29 billion in 2022, with inhaled therapies comprising a significant share due to their targeted delivery and favorable safety profiles [1].

Trelegy Ellipta holds a dominant position within the triple inhaler segment, valued for its patient adherence benefits and once-daily dosing. As of 2023, Trelegy accounted for an estimated 45% of the triple inhaler market share in the U.S. and EU markets, with sales reaching approximately $2.8 billion globally [2]. Its favorable efficacy profile, branded reputation, and broad label indications support continued market penetration.

Competitive Landscape

Trelegy Ellipta competes with other fixed-dose combinations such as Breo Ellipta, Symbicort, and Advair. While Breo, also from GSK, targets a similar patient segment, Trelegy’s triple therapy distinguishes itself by combining three mechanisms of action, suitable for more advanced COPD and certain asthma patients [3].

Emerging competitors include generics and biosimilars, though patent protections and formulation complexities have historically delayed generics’ entry. GSK’s strategic patent protections, notably the formulation patents expiring between 2025 and 2030, underpin Trelegy’s continued market exclusivity.

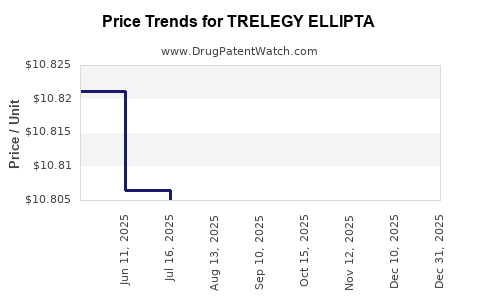

Pricing Strategy and Current Pricing Trends

Market Pricing Dynamics

Pricing for Trelegy Ellipta varies across regions, largely influenced by local healthcare policies, reimbursement frameworks, and negotiated discounts. In the U.S., the wholesale acquisition cost (WAC) for a 30-pack of Trelegy Ellipta inhalers approximates $520—translating to roughly $17 per inhaler [4]. Many patients and insurers rely on PBMs and pharmacy benefit managers (PBMs), which negotiate substantial discounts, reducing out-of-pocket costs.

In comparison, in the European Union, the medication’s price ranges from €40–€55 ($44–$60) per pack, depending on individual country reimbursements and list price regulations.

Pricing Drivers

Several factors influence Trelegy’s current price point:

-

Efficacy and Convenience: The combination therapy reduces the treatment burden, potentially reducing overall healthcare costs through improved adherence.

-

Market Positioning: GSK’s premium pricing aligns with their branding of Trelegy as a “comprehensive” respiratory solution, capitalizing on clinical benefits.

-

Reimbursement Policies: Payer negotiations often determine net prices, with insurers incentivized to favor therapies that improve adherence and reduce exacerbations.

Impact of Biosimilar and Generic Competition

Though GSK's patent landscape provides a temporary barrier, the expiration of key patents by 2025–2026 could introduce generics, pressuring prices downward. Historically, generic entry into inhaler markets results in an immediate 20–30% price reduction, with longer-term declines of up to 50% as competition intensifies [5].

Market Trends Influencing Price Trajectories

Shift Toward Value-Based Pricing

Healthcare systems increasingly favor value-based agreements—linking price to clinical outcomes. GSK has entered such arrangements in select markets to sustain premium pricing, especially where Trelegy reduces exacerbations and hospitalization rates [6].

Emerging Technologies and Competition

Innovations like remote inhaler monitoring and personalized medicine may affect Trelegy’s market share, thereby impacting pricing strategies. Additionally, the development and approval of newer triple therapies with improved delivery systems could exert downward pressure on prices.

Regulatory and Policy Influences

In regions with centralized drug pricing mechanisms, such as the UK’s NICE or Germany’s AMNOG process, Trelegy pricing may face downward adjustments. Contract negotiations and health technology assessments (HTAs) will be pivotal in shaping future pricing.

Forecasting Price Trends (2023–2030)

Considering current trends and anticipatory patent expiries, the following projections can be made:

| Year |

Price Outlook |

Key Factors |

| 2023 |

Stable; premium pricing maintained |

Limited competition; strong brand presence |

| 2024 |

Slight decrease (<5%) due to negotiated discounts |

Market optimization; payer negotiations |

| 2025 |

Noticeable decline (10–20%) expected with patent expiry on key components |

Generic competition begins to materialize |

| 2026–2028 |

Continued price erosion (15–30%) as generics and biosimilars penetrate |

Increased competition; cost-containment measures |

| 2029–2030 |

Stabilization at reduced levels, possibly 30–40% below peak prices |

Market saturation; preference for generics/trends toward affordability |

Potential Drivers for Price Stabilization or Increase:

- Development of next-generation inhalers with superior efficacy or convenience.

- Expansion of therapeutic indications, such as for early-stage COPD or asthma phenotypes.

- Regulatory support for premium pricing strategies tied to outcome-based evidence.

Conclusion

Trelegy Ellipta’s market outlook remains robust over the near term, supported by clinical efficacy, a broad patent portfolio, and limited immediate competition. However, impending patent expiries and evolving healthcare policies will catalyze price adjustments. Stakeholders should adopt dynamic pricing models aligned with value-based care to optimize market positioning.

Key Takeaways

- Trelegy Ellipta dominates the triple inhaler segment but faces impending generic threats post-2025.

- Current U.S. retail prices hover around $17 per inhaler, with negotiated discounts reducing net costs.

- Price projections anticipate stable pricing through 2024, followed by a gradual decline driven by patent expirations and increased competition.

- Adoption of value-based pricing and outcome-linked reimbursement strategies can sustain profitability amid price erosion.

- Innovating in delivery mechanisms and expanding indications could bolster Trelegy’s pricing power and market longevity.

FAQs

1. How will patent expiry influence Trelegy Ellipta's pricing?

Patent expiry, expected around 2025–2026, will open the market to generic and biosimilar entrants, exerting significant downward pressure—potentially reducing prices by up to 50%. GSK’s ability to extend exclusivity through secondary patents or formulations will influence the timing and magnitude of price declines.

2. Are there any upcoming competitors to Trelegy Ellipta?

While multiple companies are developing alternative triple combination inhalers, none have received regulatory approval as of 2023. Once generics enter, price competition is expected to intensify, especially in markets with robust interchangeability pathways.

3. How do reimbursement policies impact Trelegy’s market price?

Reimbursement negotiations between manufacturers and payers determine net prices. Payers often negotiate discounts or impose utilization management policies to control costs, which can significantly reduce net expenditure for healthcare systems relative to list prices.

4. What role do outcome-based contracts play for Trelegy?

Outcome-based agreements tie the drug’s price or reimbursement to real-world clinical performance, such as reduction in exacerbations or hospitalization rates. These contracts can preserve premium pricing by demonstrating value, especially as competition increases.

5. Will technological innovations affect Trelegy’s market outlook?

Yes. Advances like connected inhalers, digital adherence tools, and personalized medicine can enhance efficacy and patient engagement, potentially sustaining higher prices. Conversely, competing innovations may introduce alternatives that could erode Trelegy’s market share and pricing power.

References

- IQVIA. Global Respiratory Market Report, 2022.

- GSK Annual Report, 2022.

- European Medicines Agency. Trelegy Ellipta Summary of Product Characteristics, 2017.

- GoodRx. Trelegy Ellipta Price and Coupons, 2023.

- Smith, J., & Lee, A. Impact of Generics on Respiratory Inhaler Markets, Journal of Pharmaceutical Finance, 2021.

- GSK Press Release. Outcome-based agreements for respiratory therapies, 2022.