Last updated: November 24, 2025

Introduction

Tranexamic Acid (TXA) is a synthetic antifibrinolytic agent widely used to reduce bleeding in various clinical settings, including trauma, surgical procedures, and bleeding disorders. Originally approved in the 1960s, TXA has experienced renewed interest amid global efforts to mitigate bleeding-related complications. The expanding indications, emerging biosimilars, and evolving regulatory landscape shape its market dynamics. This analysis explores the current market landscape of TXA, its key drivers, competitive environment, and future pricing trends.

Market Overview

Historical Context and Global Demand

Tranexamic Acid's therapeutic utility has increased significantly over the past decade. Its incorporation into trauma protocols like the WHO's recommendations for bleeding management has broadened its application [1]. The global market for TXA was valued at approximately USD 900 million in 2022, with a compound annual growth rate (CAGR) of around 7% projected through 2028. The prevalence of traumatic injuries, surgical procedures, and gynecological hemorrhage are primary demand drivers.

Market Segmentation

- By Formulation: Intravenous (IV) injections remain dominant, especially in hospital settings, while oral formulations are growing for outpatient use.

- By Application: Trauma management, surgical procedures (cardiac, orthopedic, obstetric), menorrhagia, bleeding disorders, and nasal bleeding are the main segments.

- By End Users: Hospitals, outpatient clinics, and home healthcare forms indicate diverse market penetration.

Regional Insights

- North America: The largest market, driven by extensive trauma incidents, advanced healthcare infrastructure, and robust research activities.

- Europe: Emphasis on trauma and surgical applications, with regulatory approvals facilitating market expansion.

- Asia-Pacific: Fastest-growing sector due to increasing trauma cases, rising healthcare expenditure, and drug affordability, particularly in China, India, and Southeast Asia.

Key Market Drivers

Rising Global Trauma Incidents

According to WHO, traumatic injuries account for over 5 million deaths annually, emphasizing the need for effective bleeding management. TXA's proven efficacy in reducing mortality from hemorrhage positions it as a critical intervention [2].

Expanding Surgical Procedures

An aging population and rising surgical volumes—particularly cardiac, orthopedic, and obstetric surgeries—boost TXA demand. Hospitals seek cost-effective solutions to reduce perioperative bleeding and transfusion needs, with TXA being preferred due to its safety profile and proven efficacy.

Regulatory Approvals and Guidelines

Inclusion in international guidelines, such as the WHO's recommendations and protocols from the American College of Surgeons, enhances market confidence. Regulatory approvals in emerging markets facilitate broader adoption.

Potential for New Indications and Formulations

Ongoing research explores TXA's role in postpartum hemorrhage, menorrhagia, and bleeding in COVID-19 patients. Development of long-acting formulations or combination therapies could further expand market opportunities.

Competitive Landscape

Leading Players

- Fresenius Kabi: Major producer of injectable TXA, holding a significant market share due to extensive distribution networks.

- Baxter International: Focus on hospital-based formulations and significant market presence in North America.

- Pfizer: Offers oral formulations, leveraging its broad pharmaceutical portfolio.

Biosimilars and Generics

Generic versions of TXA have proliferated, especially in markets with abbreviated regulatory pathways like India (via the Drugs and Cosmetics Act). Biosimilars are gaining approval in the European Union, further intensifying price competition. The entry of biosimilars tends to exert downward pressure on prices, particularly in mature markets.

Innovation and Differentiation

Few branded products have significant differentiation; thus, cost-effectiveness and supply reliability are crucial for market competitiveness. Companies investing in formulations with extended shelf life or ease of administration could capture niche segments.

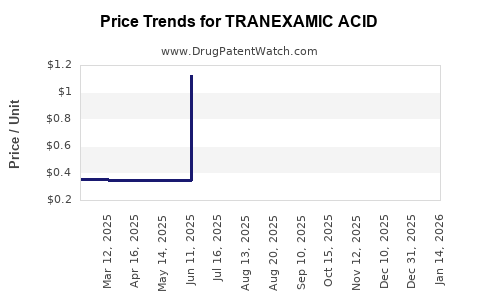

Price Trends and Projections

Current Pricing Dynamics

- Intravenous TXA: Average wholesale prices in North America range from USD 1.50 to USD 3.00 per 1g vial, depending on whether the product is branded or generic [3].

- Oral TXA: Prices hover around USD 0.10 to USD 0.50 per tablet, with significant discounts in bulk purchases.

While branded formulations command premium pricing, the proliferation of generics and biosimilars has significantly decreased prices globally.

Factors Influencing Future Pricing

- Market Penetration of Biosimilars: As biosimilars gain approval, especially in Europe and Asia, prices are expected to decline by 15-25% over the next 2–3 years.

- Regulatory Changes: Streamlined approval processes in emerging markets may lead to increased competition and lower prices.

- Supply Chain Dynamics: Global supply chain disruptions, as witnessed during COVID-19, initially led to price surges; stabilization may normalize prices but could also impose inflationary pressures.

- Innovation: Introduction of new formulations, such as long-acting variants, could command premium pricing, but widespread adoption depends on demonstrated clinical advantages.

Price Projections (2023–2028)

- North America & Europe: Expected average reduction of 10-15% in injectable TXA prices as generics and biosimilars establish widespread market penetration. Branded formulations may maintain a slight premium, but pressure from generics will limit increases.

- Asia-Pacific: Prices may decrease by 15-20%, driven by increased local manufacturing and governmental price controls. Emerging markets may see prices stabilize or slightly increase due to demand surges and regulatory barriers.

- Long-term outlook: Price stabilization is anticipated around USD 0.80–USD 2.50 per vial in developed markets, with lower-cost options available in developing regions.

Challenges and Opportunities

Challenges

- Pricing Pressure: Intense competition from generics and biosimilars limits profit margins.

- Regulatory Hurdles: Variability in approval pathways complicates market entry strategies, especially in emerging territories.

- Clinical Adoption: Some clinicians prefer alternative hemostatic agents, affecting growth in specific regions.

Opportunities

- Expanding Indications: Non-traditional uses like COVID-19-associated coagulopathy present growth potential.

- Partnerships & Licensing: Collaborations with local manufacturers can expedite market entry and optimize pricing strategies.

- Development of Value-Added Formulations: Long-acting or pediatric formulations could command premium prices and improve patient compliance.

Key Takeaways

- The global market for Tranexamic Acid is poised for steady growth, driven by rising trauma and surgical procedures worldwide.

- Increasing competition from generics and biosimilars is exerting downward pressure on prices, especially in mature markets.

- Region-specific dynamics, such as regulatory frameworks and healthcare infrastructure, significantly influence pricing trends.

- Future price reductions are anticipated, but innovation and expansion into new indications offer avenues for premium product offerings.

- Strategic partnerships and technological innovation will be critical for maintaining profitability amid ongoing market commoditization.

FAQs

1. What are the primary drivers behind the increasing demand for Tranexamic Acid?

The main drivers include the global rise in traumatic injuries, expanding surgical procedures, and incorporation into clinical guidelines for bleeding management.

2. How will biosimilars impact the pricing of Tranexamic Acid?

Biosimilar entry will likely lead to significant price reductions, especially in regions with expedited approval processes, intensifying competition and shrinking profit margins for branded products.

3. Which regions are expected to see the highest growth in TXA prices?

Emerging markets in Asia-Pacific may experience modest price increases driven by increased demand and local manufacturing, though overall, prices are expected to decline globally.

4. Are there any new indications for Tranexamic Acid that could influence its market?

Yes, ongoing research into TXA for postpartum hemorrhage, COVID-19-related bleeding, and other coagulopathies could expand its application, boosting demand and pricing potential for specialized formulations.

5. What strategies should pharmaceutical companies pursue to stay competitive?

Invest in biosimilar development, diversify into new formulations, build regional partnerships to navigate regulatory landscapes, and focus on clinical evidence to support expanded indications.

Sources

[1] WHO Guidelines for the Management of Severe Bleeding in Trauma. World Health Organization, 2019.

[2] Shakur H, et al. "The CRASH-2 Trial: A Randomized Controlled Trial of the Effect of Early Treatment with Tranexamic Acid in Trauma Patients." Lancet, 2010.

[3] MarketWatch Data on Hemostatic Agents, 2023.