Share This Page

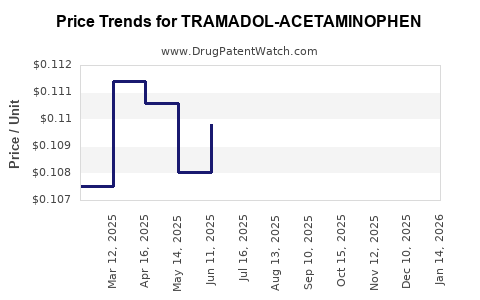

Drug Price Trends for TRAMADOL-ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for TRAMADOL-ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRAMADOL-ACETAMINOPHEN 37.5-325 MG TAB | 53746-0617-01 | 0.10639 | EACH | 2026-01-21 |

| TRAMADOL-ACETAMINOPHEN 37.5-325 MG TAB | 50268-0774-15 | 0.10639 | EACH | 2026-01-21 |

| TRAMADOL-ACETAMINOPHEN 37.5-325 MG TAB | 65862-0922-05 | 0.10639 | EACH | 2026-01-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tramadol-Acetaminophen

Introduction

Tramadol-acetaminophen, a combination analgesic, is widely prescribed for moderate to severe pain management, particularly in post-surgical, chronic, and cancer-related pain contexts. Its unique position in the analgesic market stems from its efficacy, controlled status, and targeting of specific pain management needs. This report offers a comprehensive market analysis and price projection framework, emphasizing current demand dynamics, competitive landscape, regulatory influences, and future pricing trends.

Market Overview

Global Market Size and Growth Dynamics

The global pain management market is projected to reach approximately USD 84.8 billion by 2027, growing at a CAGR of about 4.2% (Source: Fortune Business Insights). Tramadol-acetaminophen, as a prominent player, constitutes a significant segment of this market, especially in developed economies where prescription drug regulation ensures safety and efficacy.

The market expansion is primarily driven by increasing prevalence of chronic pain conditions, aging populations, and rising awareness of pain management therapies. Additionally, the COVID-19 pandemic has heightened the focus on effective pain relief, especially in post-viral recovery phases.

Regional Market Trends

- North America: Dominates the market owing to high prescription rates, advanced healthcare infrastructure, and rising opioid awareness. The U.S. has seen a steady shift towards multimodal pain management, where tramadol-acetaminophen plays a pivotal role.

- Europe: Exhibits significant growth, driven by stringent regulation limiting opioid abuse and a demand for safer analgesics.

- Asia-Pacific: Expected to witness the highest CAGR (approx. 6.0%) due to increasing healthcare investments, urbanization, and expanding pharmaceutical manufacturing.

Key Market Drivers

- Rising incidence of chronic pain syndromes.

- Increased approval and availability in emerging markets.

- An emphasis on combination therapies to reduce opioid dependency.

- Growing awareness of pain management options among physicians and patients.

Competitive Landscape

Major Manufacturers

- Mylan (now part of Viatris): One of the leading producers, offering tramadol-acetaminophen formulations globally.

- Teva Pharmaceuticals: Known for producing generic versions with competitive pricing.

- Sun Pharmaceutical: Focused on Asian markets and emerging economies.

- Others: Lupin, Dr. Reddy’s Laboratories, and Hikma Pharmaceuticals actively participate.

Market Entry Barriers

- Regulatory hurdles due to opioid classification.

- Stringent manufacturing standards to ensure safety.

- Patent exclusivities and exclusivity periods for branded formulations.

Patent Status and Generics

Many formulations are now off-patent, leading to a proliferation of generic options, intensifying price competition. Patent expiries typically occur 10-15 years post-approval, with some formulations facing patent challenges, further influencing market dynamics.

Regulatory Environment

United States

- FDA Classification: Schedule IV controlled substance, imposing strict prescribing and dispensing regulations.

- Reimbursement Trends: Favorable via Medicare and private insurance for generic formulations.

European Union

- EMA Oversight: Ensures safety and efficacy, with some countries implementing national restrictions.

- Prescription Policies: Tighter controls aim to prevent misuse, influencing prescribing patterns.

Emerging Markets

- Variability in regulatory enforcement can impact drug availability, influencing regional market growth. Countries like India permit over-the-counter sales under certain circumstances, affecting market penetration.

Pricing Analysis

Current Pricing Landscape

In developed markets, prices for tramadol-acetaminophen generics range from USD 0.10 to 0.25 per tablet, varying by dosage, formulation, and distribution channels. Branded formulations may command a 25-50% premium. Brand-name drugs, when available, typically retail at USD 0.50 to 1.00 per tablet.

Pricing Factors

- Patent Status: Off-patent drugs significantly reduce prices due to generic entries.

- Regulatory Compliance: Increased standards may slightly elevate production costs, influencing retail prices.

- Regional Variability: Pricing in emerging markets can be 20-50% lower, driven by reduced healthcare spending and domestic manufacturing.

Projected Price Trends

Over the next five years, the following trends are anticipated:

- Price Stabilization/Reduction: Continued proliferation of generics will exert downward pressure, especially in mature markets.

- Premium Pricing for Fixed-Dose Combinations: Newer formulations with improved safety profiles may command higher prices.

- Impact of Regulatory Changes: Stricter controls may limit supply channels temporarily, creating short-term price fluctuations.

Forecasted average price declines in developed markets (~2-3% annually) are expected, driven by the commoditization of generic products. Conversely, limited supply disruptions or formulation innovations could temporarily push prices upward.

Future Market Opportunities and Challenges

Opportunities

- Emerging Markets Expansion: Growing healthcare infrastructure and unmet pain management needs open avenues.

- Formulation Innovation: Development of abuse-deterrent formulations or combination variants with improved safety profiles could command premium prices.

- Combination with Delivery Devices: Integration with digital adherence tools could enhance patient compliance, justifying higher pricing.

Challenges

- Regulatory Restrictions: Heightened controls on opioid-containing medications may limit prescriber adoption.

- Generic Price Erosion: The influx of generics continues to suppress prices.

- Opioid Dependency Concerns: Growing societal awareness may influence prescribing practices, affecting volume sales.

Conclusion: Strategic Outlook

The tramadol-acetaminophen market remains robust, driven by increasing pain management needs and demographic shifts. Price competition will intensify with the proliferation of generics, although innovations and regulatory environments will influence price trajectories. Companies should focus on regional market nuances, invest in formulation development, and navigate regulatory pathways to optimize profitability.

Key Takeaways

- The global tramadol-acetaminophen market is expected to grow modestly, supported by increasing pain management needs and demographic trends.

- Generic formulations dominate the landscape, leading to downward price pressures, with average retail prices declining 2-3% annually in mature markets.

- Regulatory controls, especially concerning opioid scheduling, significantly influence market access, prescribing practices, and pricing strategies.

- Emerging markets present substantial growth opportunities, necessitating tailored regulatory and pricing approaches.

- Innovation in formulations, abuse-deterrent technologies, and delivery systems can offer premium pricing avenues, offsetting generic price erosion.

FAQs

1. What factors influence the pricing of tramadol-acetaminophen globally?

Pricing is influenced by patent status, regional regulatory policies, manufacturing costs, market competition, and whether the formulation is branded or generic. Prices tend to be lower in markets with multiple generic manufacturers and higher where branded formulations dominate or regulatory costs are higher.

2. How does regulatory classification impact the market for tramadol-acetaminophen?

As a Schedule IV controlled substance in the US and regulated under similar frameworks elsewhere, tramadol-acetaminophen faces prescribing restrictions that limit misuse and abuse, potentially constraining volume but maintaining steady demand among prescribers aware of safety protocols.

3. What is the outlook for generic drug pricing for tramadol-acetaminophen?

The generic segment will likely see continued price declines due to increased competition. Market saturation and patent expirations contribute to this downward trend, though niche formulations or innovative delivery methods could sustain premium pricing.

4. Which emerging markets show the most promise for tramadol-acetaminophen growth?

India, China, Brazil, and Southeast Asian countries exhibit strong growth potential due to expanding healthcare infrastructure, rising chronic pain prevalence, and evolving regulatory landscapes favoring access to analgesics.

5. Will formulation innovations significantly affect future prices?

Yes. Innovations such as abuse-deterrent formulations, extended-release versions, or combination therapies with added safety features can justify higher prices and capture niche markets, offsetting general price declines in standard formulations.

References

- Fortune Business Insights. "Pain Management Market Size, Share & Industry Analysis." 2022.

- U.S. Food and Drug Administration (FDA). "Schedule IV Controlled Substances." 2021.

- European Medicines Agency (EMA). "Regulatory Procedures for Pain Medications." 2022.

- IQVIA. "Global Prescription Trends." 2022.

- MarketsandMarkets. "Opioid analgesics market forecast." 2022.

More… ↓