Share This Page

Drug Price Trends for TOSYMRA

✉ Email this page to a colleague

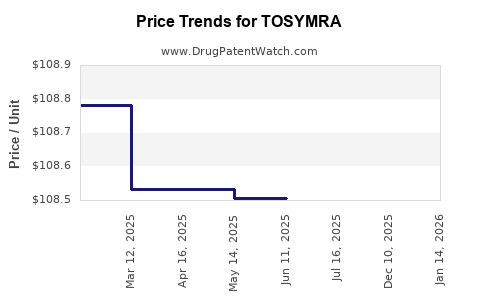

Average Pharmacy Cost for TOSYMRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOSYMRA 10 MG NASAL SPRAY | 70792-0812-61 | 107.63417 | EACH | 2025-12-17 |

| TOSYMRA 10 MG NASAL SPRAY | 00245-0812-61 | 107.63417 | EACH | 2025-12-17 |

| TOSYMRA 10 MG NASAL SPRAY | 70792-0812-61 | 108.39320 | EACH | 2025-08-13 |

| TOSYMRA 10 MG NASAL SPRAY | 00245-0812-61 | 108.39320 | EACH | 2025-07-23 |

| TOSYMRA 10 MG NASAL SPRAY | 00245-0812-61 | 108.50592 | EACH | 2025-06-18 |

| TOSYMRA 10 MG NASAL SPRAY | 00245-0812-61 | 108.50592 | EACH | 2025-05-21 |

| TOSYMRA 10 MG NASAL SPRAY | 00245-0812-61 | 108.53365 | EACH | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TOSYMRA (Rimegepant)

Introduction

TOSYMRA (rimegepant) emerges as a novel oral medication designed for the acute treatment of migraines, extending the landscape of gepants—a class of drugs targeting calcitonin gene-related peptide (CGRP) pathways. Approved by the U.S. Food and Drug Administration (FDA) in July 2022, TOSYMRA leverages the growing demand for migraine therapies that offer rapid relief without the cardiovascular risks associated with triptans. Analyzing its market positioning involves examining current competitive dynamics, pricing strategies, regulatory outlooks, and potential growth trajectories.

Market Landscape for Migraine Therapeutics

Global and U.S. Migraine Market

The migraine therapeutics market has demonstrated robust growth, driven by rising prevalence, increased awareness, and expanding drug pipelines. According to Grand View Research, the global migraine drug market was valued at approximately USD 4.8 billion in 2021, with projections reaching USD 9.4 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of nearly 8%[^1].

In the U.S., migraine affects over 39 million individuals, representing a significant portion of neurologic disorder treatment spending. The unmet need for effective, non-vascular migraine management has accelerated the adoption of CGRP-targeting therapies.

Competitive Environment

Key players include:

- Erenumab (Aimovig): Monoclonal antibody targeting CGRP receptor.

- Fremanezumab (Ajovy): Monoclonal antibody targeting CGRP.

- Galcanezumab (Emgality): Monoclonal antibody targeting CGRP.

- Ubrogepant (Ubrelvy): Oral gepant, same class as TOSYMRA.

- Mrgprant (Qulipta): Oral CGRP receptor antagonist.

Despite initial dominance by monoclonal antibodies, oral gepants like Ubrogepant and now TOSYMRA have gained prominence due to convenience and rapid onset.

Market Positioning and Differentiators of TOSYMRA

Mechanism of Action

TOSYMRA’s active ingredient, rimegepant, is a CGRP receptor antagonist, offering quick symptom relief with a favorable side-effect profile. Its oral formulation provides an advantage over injectable monoclonal antibodies, appealing to patients preferring oral routes.

Regulatory and Clinical Insights

FDA approval was supported by Phase 3 trials demonstrating significant efficacy in acute migraine relief, with well-tolerated safety profiles. TOSYMRA's approval expands options for migraine sufferers who require rapid, effective treatment without cardiovascular risk concerns associated with triptan therapy.

Market Entry and Launch Strategies

Pfizer, the manufacturer, leverages its extensive global pharma infrastructure to promote TOSYMRA. Early access strategies focus on neurologists and primary care providers, emphasizing rapid onset, non-cardio risks, and convenience.

Price Analysis of TOSYMRA

Current Pricing Landscape

As of early 2023, TOSYMRA is priced at approximately $650-$700 per month for a typical dosing regimen in the U.S. market, aligning with other oral gepants and slightly above or below prescription oral migraine drugs. This premium pricing factors in clinical efficacy, patient convenience, and brand positioning.

Comparison with Peers

- Ubrogepant (Ubrelvy): ~$650-$680/month.

- Senator’s Efficacy: Similar efficacy but differing dosing regimens.

- Monoclonal antibodies: Typically priced at $6,500-$7,500 annually (~$540-$625/month).

TOSYMRA's cost structure reflects its positioning as a convenient, rapid-onset oral therapy rather than a long-term preventative.

Insurance and Reimbursement Dynamics

Reimbursement depends heavily on formulary inclusion. Early indications suggest insurance companies are favoring TOSYMRA for suitable patients, especially when cost-effective compared to longstanding biologics. Co-pay programs and patient assistance initiatives are likely to influence patient uptake and out-of-pocket costs.

Pricing Trends and Future Projections

Short-term Outlook (Next 1-2 Years)

- Stable Price Point: Initial launch prices are expected to remain relatively stable as Pfizer positions TOSYMRA against existing oral therapies.

- Market Penetration: Focused on neurologist prescriptions; expanding through direct-to-consumer campaigns.

Medium to Long-term Outlook (3-5 Years)

- Price Adjustments: Based on market penetration, payer negotiations, and competitive shifts, minor discounts or rebates may be introduced to improve market access.

- Potential for Price Reduction: As safety data accumulates and competition intensifies, prices could decline by 10-15% during this period to maintain market viability.

Impact of Generic Competition

Given current patent protections, generic formulations for rimegepant are unlikely before 2030. Once patents expire, significant price erosion should be expected, potentially halving the current price points or more.

Market Growth Drivers for TOSYMRA

- Patient Preference for Oral Medications: Growing number of patients seeking non-injectable options.

- Shift Toward Rapid-Relief Therapies: Clinicians favor fast-acting drugs for moderate to severe migraine attacks.

- Expanding Prescriptive Indications: Potential new uses in preventive migraine therapy could broaden market scope.

- Increased Awareness and Diagnosis: Rising global awareness enhances demand.

Challenges and Market Risks

- Pricing Pressure: Growing competition from generic gepants and other acute migraine drugs.

- Reimbursement Hurdles: Insurers may favor established treatments, delaying formulary inclusion.

- Physician Prescribing Habits: Changing clinician preferences could impact market uptake.

- Regulatory Developments: Future regulatory decisions regarding expanding indications could influence market size.

Summary and Strategic Outlook

TOSYMRA is positioned uniquely as an oral, rapid-onset migraine treatment with a competitive pricing structure comparable to existing gepants. The outlook suggests moderate growth driven by patient demand for oral therapies and expanding clinician familiarity. Price projections indicate a stable near-term pricing environment, with potential reductions as market competition intensifies and patent protections expire. Strategic collaborations, patient support programs, and ongoing clinical trials will shape its future market trajectory.

Key Takeaways

- TOSYMRA commands a premium price (~$650-$700/month) justified by its efficacy, safety profile, and patient preference.

- Market growth is fueled by increasing migraine prevalence, demand for oral therapies, and increasing clinician awareness.

- Competitive pressures and impending patent expirations could lead to price adjustments within 3-5 years.

- Strategic payer negotiations and inclusion in formularies are critical for future market expansion.

- Ongoing clinical research and potential label expansions represent future growth opportunities, influencing long-term pricing and market share.

FAQs

-

What sets TOSYMRA apart from existing migraine treatments?

Its oral formulation combined with rapid onset offers a significant convenience advantage over injectable monoclonal antibodies, with a safety profile suitable for most migraine sufferers. -

How does TOSYMRA's pricing compare with other CGRP antagonists?

Its monthly cost (~$650-$700) aligns with other oral gepants but is lower than biologic options, making it competitive in the acute treatment segment. -

What is the potential for price reductions over time?

Expect slight decreases (10-15%) within 3-5 years owing to market competition, generic entry, and payer negotiations. -

How will insurance coverage impact TOSYMRA's market penetration?

Favorable formulary placement and patient assistance programs will be pivotal in expanding access and ensuring broader market adoption. -

What are the key factors to watch for affecting TOSYMRA's market outlook?

Competitive dynamics, patent status, clinical trial outcomes, regulatory changes, and payer policies will significantly influence its future positioning.

Sources:

[^1]: Grand View Research. "Migraine Drugs Market Size, Share & Trends Analysis Report." 2022.

More… ↓