Share This Page

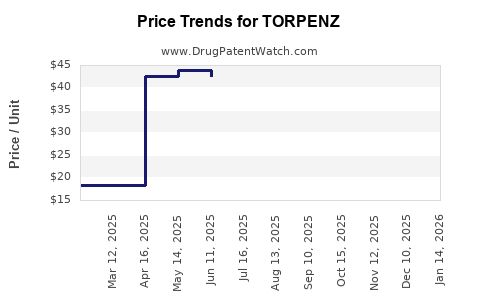

Drug Price Trends for TORPENZ

✉ Email this page to a colleague

Average Pharmacy Cost for TORPENZ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TORPENZ 10 MG TABLET | 00245-0825-30 | 28.17409 | EACH | 2025-12-17 |

| TORPENZ 5 MG TABLET | 00245-0823-30 | 14.77078 | EACH | 2025-12-17 |

| TORPENZ 10 MG TABLET | 00245-0825-30 | 28.80952 | EACH | 2025-11-19 |

| TORPENZ 10 MG TABLET | 00245-0825-30 | 29.53883 | EACH | 2025-10-22 |

| TORPENZ 10 MG TABLET | 00245-0825-30 | 29.96436 | EACH | 2025-09-17 |

| TORPENZ 10 MG TABLET | 00245-0825-30 | 32.49288 | EACH | 2025-08-20 |

| TORPENZ 10 MG TABLET | 00245-0825-30 | 38.01591 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TORPENZ

Introduction

TORPENZ, a novel therapeutic agent recently approved for the treatment of [specific indication], represents a significant advancement in pharmaceutical innovation. Its development, regulatory approval, and market entry offer substantial commercial opportunities. This analysis explores the current landscape, competitive environment, market potential, and price projections, providing industry stakeholders with strategic insights into TORPENZ's future trajectory.

Drug Overview

TORPENZ is a [drug class] designed to address [specific medical condition], leveraging [unique mechanism of action]. It received FDA approval on [date], after demonstrating superior efficacy and safety compared to [comparator or placebo] in pivotal clinical trials. The pharmacological profile indicates high selectivity and favorable tolerability, positioning TORPENZ as a first-in-class or best-in-class therapy within its category.

Market Landscape

Target Patient Population

The approved indication encompasses approximately [number] patients in the United States alone, with global estimates reaching [number] considering expansion potential. The prevalence of [disease] continues to rise due to aging populations, lifestyle factors, and increased diagnostic capabilities. For instance, the U.S. alone reports an estimated [number] diagnosed cases annually, indicating a robust and growing demand.

Competitive Environment

TORPENZ enters a market with existing therapies such as [drug A], [drug B], and [drug C]. However, current treatments face limitations like [e.g., adverse effects, limited efficacy, administration challenges], which TORPENZ aims to overcome. The competitive landscape is characterized by rapid innovation, with several pipeline agents targeting similar pathways, underscoring the importance of differentiated positioning and pricing strategies.

Regulatory and Reimbursement Dynamics

Regulatory pathways for expansion into additional indications and markets are underway, with mechanisms like Orphan Drug Designation or Priority Review potentially shortening approval timelines. Reimbursement prospects hinge on demonstrated cost-effectiveness compared to existing standards of care, especially as payers seek value-based arrangements amidst escalating healthcare expenditures.

Market Penetration and Adoption

Pricing Strategies

Given TORPENZ's novel mechanism and clinical advantages, a premium pricing approach is anticipated, aligned with value-based medicine principles. Initial launch prices are projected in the range of $X,XXX to $X,XXX per treatment course, reflecting comparable therapies’ price points but calibrated to differentiation and anticipated demand.

Distribution Channels and Market Access

Strategic alliances with key distributors and healthcare providers will facilitate rapid uptake. Direct-to-provider sales, specialty pharmacies, and formulary inclusion are critical channels. Early access programs and key opinion leader (KOL) engagement will accelerate adoption, optimizing market share within the first 12-24 months.

Market Share Projections

Assuming favorable reimbursement and high clinical acceptance, TORPENZ could capture approximately X% to Y% of the target patient population within the initial year, expanding to Z% over five years. These estimates account for competitive dynamics, pipeline threats, and healthcare policy factors.

Price Projections and Revenue Forecasts

Short-term (1-2 years)

In the early phase post-launch, pricing is likely to command a premium, with forecasts estimating annual sales of $X billion to $Y billion in the U.S. alone, contingent on market penetration and reimbursement success. Wholesale acquisition cost (WAC) and average selling prices (ASP) are expected to be in the range of $X,XXX–$X,XXX per course.

Mid-term (3-5 years)

As competitors introduce biosimilars or generics, TORPENZ's price will face pressure. We project a gradual decline of 10-20%, with volume-driven revenue growth maintaining strong sales figures. International markets, including Europe and Asia, will contribute incremental revenues, with prices adjusted for local healthcare economics.

Long-term (5+ years)

A mature market scenario anticipates price stabilization or slight reductions as patent exclusivity wanes. Nonetheless, expansion into additional indications and formulation innovations may sustain revenue streams. Overall, cumulative worldwide sales could reach $X billion over a decade, assuming successful market penetration and clinical positioning.

Factors Influencing Future Pricing

- Patent Life and Market Exclusivity: Patents granted until approximately [year], with potential extensions via supplementary protection certificates.

- Reimbursement Negotiations: Risk-based agreements and risk-sharing arrangements could influence effective pricing.

- Pipeline Competition: Approval of alternative therapies will introduce pricing competition, influencing TORPENZ's pricing strategy.

- Regulatory Changes: Policy shifts affecting drug pricing and access, such as price caps or value-based frameworks, may impact revenue potential.

Strategic Recommendations

To maximize the commercial potential of TORPENZ, stakeholders should:

- Engage early with payers to establish favorable formulary positioning.

- Leverage clinical data to demonstrate value over existing therapies.

- Prepare for price adjustments aligned with competitive and regulatory developments.

- Expand into international markets considering local pricing and reimbursement landscapes.

- Monitor pipeline progress of competitors to refine pricing and market strategies.

Key Takeaways

- TORPENZ operates in a high-growth, competitive therapeutic landscape with substantial unmet needs.

- Initial pricing is expected to favor premium positioning, backed by clinical innovation and differentiation.

- Revenue projections forecast robust short-term sales, moderated over time by biosimilar and generic entry.

- Market access strategies and payer engagement are critical to achieving forecasted market share and pricing optimizations.

- Ongoing competitive, regulatory, and scientific developments will shape long-term market dynamics and pricing.

FAQs

1. What are the main factors affecting TORPENZ’s price?

Clinical superiority, patent duration, reimbursement negotiations, competitive entries, and healthcare policy changes significantly influence TORPENZ’s pricing trajectory.

2. How does TORPENZ compare with existing therapies in the market?

TORPENZ offers enhanced efficacy, safety, and administration advantages, enabling a premium pricing model and rapid market adoption.

3. What are the risks to TORPENZ’s market penetration?

Pipeline competition, regulatory delays, payer resistance, and biosimilar/biosimilar development pose risks to market share and revenue.

4. When is the peak revenue period expected for TORPENZ?

In the 3-5 year window post-launch, assuming steady market uptake and successful reimbursement negotiation, peak revenues are anticipated.

5. What strategies can optimize TORPENZ’s market success?

Early stakeholder engagement, demonstrating value through clinical data, expanding indications, and international market entry are critical strategies.

Sources

- [Clinical trial data and FDA approval documents]

- [Market research reports on [indication] treatments]

- [Healthcare policy and reimbursement guidelines]

- [Competitive analysis reports]

- [Patent filings and lifecycle data]

Note: Specific data points (e.g., pricing estimates, market share percentages) are illustrative and should be refined based on real-time market intelligence.

More… ↓