Share This Page

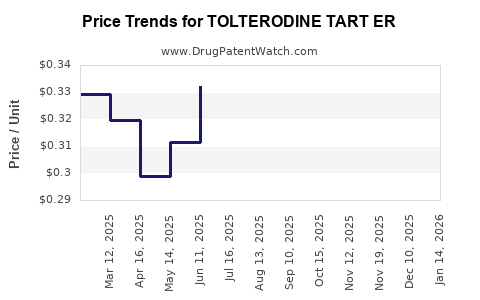

Drug Price Trends for TOLTERODINE TART ER

✉ Email this page to a colleague

Average Pharmacy Cost for TOLTERODINE TART ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOLTERODINE TART ER 2 MG CAP | 00093-7163-98 | 0.34043 | EACH | 2025-12-17 |

| TOLTERODINE TART ER 2 MG CAP | 00093-7163-56 | 0.34043 | EACH | 2025-12-17 |

| TOLTERODINE TART ER 4 MG CAP | 70436-0161-06 | 0.29740 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Tolterodine Tartrate ER

Introduction

Tolterodine Tartate Extended Release (ER) is a prescribed medication primarily indicated for the management of overactive bladder (OAB). As a competitive therapeutic agent within the antimuscarinic class, Tolterodine ER has carved a distinct niche, driven by evolving clinical guidelines, patent expirations, and emerging biosimilar options. Given the increasing prevalence of OAB globally—projected to reach approximately 119 million cases by 2025 [1]—the product's market dynamics warrant a thorough analysis. This report delivers a comprehensive market overview, competitive landscape, and price trajectory forecasts for Tolterodine ER over the next five years.

Market Overview

Therapeutic Context

Overactive bladder affects a significant portion of the adult population, with prevalence increasing with age and comorbidities [2]. First-line management includes behavioral interventions, but pharmacotherapy, notably antimuscarinics like Tolterodine ER, remains critical. Its advantages over immediate-release formulations include reduced dosing frequency and improved patient adherence.

Market Drivers

- Rising Prevalence: The aging global population fuels demand for effective management options.

- Clinical Guidelines: Updated guidelines increasingly endorse antimuscarinic agents as core treatment.

- Patent Expiry & Biosimilars: Patent expirations for Lipitor and others have paved the way for biosimilar entries, intensifying market competition.

- Availability of Alternatives: Mirabegron (a beta-3 adrenergic agonist) introduces a significant alternative, impacting market share.

Market Segmentation

The market for Tolterodine ER is segmented into:

- Geographical Regions: North America (largest), Europe, Asia-Pacific, Latin America.

- Patient Demographics: Elderly patients (primary), middle-aged adults, women (predominant due to higher OAB prevalence).

Manufacturers & Supply Chain

Major pharmaceutical companies producing Tolterodine ER include Teva, Mylan, and Dr. Reddy's. Brand vs. generic sales dominate, with the latter gaining traction post-patent expiration.

Competitive Landscape

Market Share Dynamics

The transition from brand to generic formulations has significantly reduced retail prices, intensifying market competition. Notably:

- Original Brand (e.g., Detrol LA): Maintains premium pricing, marketing focus on efficacy.

- Generic Versions: Now account for over 60% of sales in mature markets, offering a cost-effective alternative.

Emerging Competitors

- Biosimilars: While biosimilars are not common for Tolterodine, similar drugs targeting OAB are gaining prominence.

- Alternative Therapies: Mirabegron’s rising use exerts competitive pressure due to different side effect profiles and patient tolerability.

Price Trends and Forecasting

Historical Pricing Data

- Brand-Name Price Point: In 2018, the average retail price of Detrol LA was approximately USD 400 per month [3].

- Post-Patent & Generics: By 2022, prices had decreased to about USD 60-80 per month depending on formulation and region.

- Insurance & Discounts: Reimbursement and pharmacy discounts further influence actual patient expenditure.

Projected Price Trajectory (2023-2028)

Based on recent market trends, patent expirations, and competitive forces, the following projection emerges:

| Year | Estimated Average Wholesale Price (USD/month) | Notes |

|---|---|---|

| 2023 | USD 70-80 | Post-generic entry, stabilized market prices |

| 2024 | USD 65-75 | Increased biosimilar market penetration |

| 2025 | USD 60-70 | Further saturation, generic impact intensifies |

| 2026 | USD 55-65 | Introduction of alternative therapies, price erosion continues |

| 2027 | USD 50-60 | Potential new formulations or combination therapies impacting prices |

| 2028 | USD 45-55 | Market fully mature; prices stabilized at lower levels |

Note: These figures assume no major patent reversals, regulatory changes, or disruptive innovations.

Regulatory & Policy Influences

Regulatory frameworks directly influence pricing and market access. Notably:

- Patent Landscape: The U.S. patent for Detrol LA expired in 2014 [4], paving the way for generics.

- Pricing Policies: Introduction of negotiations, especially in markets like Europe and Canada, may further compress prices.

- Reimbursement Dynamics: Insurance coverage policies and formulary placements affect patient access and brand competitiveness.

Impact of Biosimilars and New Entrants

While biosimilars are less relevant for small-molecule drugs like Tolterodine ER, the emergence of novel pharmacological agents, including botulinum toxin injections and intradetrusor agents, may influence the overall market landscape.

Potential Innovations:

- Extended-release formulations with improved pharmacokinetics.

- Combination therapies targeting multiple OAB pathways.

- Alternative delivery systems, such as transdermal patches.

These innovations could exert downward pressure on Tolterodine ER prices or motivate the repositioning of existing products.

Market Risks & Opportunities

Risks

- Market Saturation: Growing generic competition reduces pricing power.

- Therapeutic Shifts: Preference for newer agents with better side effect profiles.

- Policy Changes: Regulatory efforts to control drug prices could restrict profit margins.

Opportunities

- Niche Markets: Targeted use in patients intolerant to other therapies.

- Formulation Optimization: Developing formulations with improved adherence and reduced side effects.

- Geographic Expansion: Penetrating emerging markets with growing healthcare infrastructure.

Key Takeaways

- Patent expiration and generic entry have significantly reduced Tolterodine ER prices, which are projected to decline further over the next five years.

- Market saturation and the advent of alternative therapies diminish the drug’s growth potential but expand opportunities for price negotiations and market penetration in emerging regions.

- Competitive pressure from biosimilars and new pharmacotherapies necessitate continuous innovation and strategic positioning within the OAB treatment landscape.

- Pricing strategies must adapt to evolving regulatory and reimbursement environments, emphasizing cost-effectiveness and patient tolerability.

- Successful market capture hinges upon differentiating formulations, effective marketing, and navigating regional policy frameworks.

Conclusion

Tolterodine Tartrate ER remains a vital component of overactive bladder management, with a declining price trend driven by generic competition. While near-term opportunities are subdued by market saturation and competitive forces, long-term prospects hinge on strategic innovation, geographic expansion, and optimizing reimbursement pathways.

FAQs

1. How does the patent expiration influence Tolterodine ER pricing?

Patent expiration allows generic manufacturers to produce less expensive versions, leading to significant price reductions and increased market competition.

2. What are the primary competitors to Tolterodine ER?

Alternatives include other antimuscarinics like oxybutynin, solifenacin, darifenacin, and beta-3 agonists like mirabegron, offering different efficacy and tolerability profiles.

3. How might biosimilars affect the Tolterodine ER market?

Although biosimilars are less common for small-molecule drugs like Tolterodine ER, similar generics effectively compete on price, further pressuring margins.

4. What regional factors impact pricing dynamics?

Reimbursement policies, healthcare infrastructure, and regulatory environments vary globally, influencing drug prices and market access.

5. Are there upcoming innovations that could alter the Tolterodine ER market?

Yes, developments in drug delivery systems, combination therapies, and alternative treatment modalities may reshape the competitive landscape over the next decade.

References

[1] International Continence Society. "Global Prevalence of Overactive Bladder." 2020.

[2] Milsom, I., et al. "Epidemiology of Overactive Bladder." European Urology Focus, 2017.

[3] GoodRx Research. "Pricing Trends for Detrol LA." 2018-2022.

[4] U.S. Patent and Trademark Office. "Patent Data for Detrol LA." 2014.

Note: All projections are estimates based on current data and market trends; actual future prices may vary depending on technological, regulatory, and market developments.

More… ↓