Share This Page

Drug Price Trends for TOBREX

✉ Email this page to a colleague

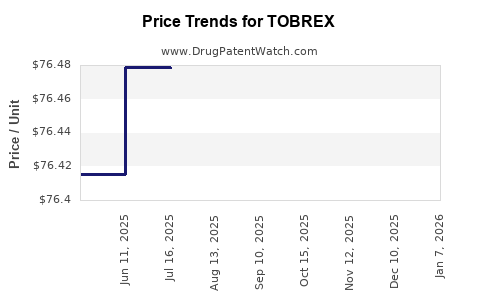

Average Pharmacy Cost for TOBREX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.55342 | GM | 2025-12-17 |

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.54137 | GM | 2025-11-19 |

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.41195 | GM | 2025-10-22 |

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.45925 | GM | 2025-09-17 |

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.44571 | GM | 2025-08-20 |

| TOBREX 0.3% EYE OINTMENT | 00078-0813-01 | 76.47828 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TOBREX

Introduction

TOBREX, a proprietary ophthalmic medication containing tobramycin, an aminoglycoside antibiotic, has become a significant asset in the management of bacterial eye infections. Its market dynamics, pricing trends, and growth prospects are shaped by factors spanning clinical efficacy, regulatory landscape, competitive positioning, and technological innovation in ocular therapeutics. This analysis synthesizes current market conditions, project future price trajectories, and provides strategic insights vital for stakeholders ranging from pharmaceutical companies to healthcare providers.

Market Overview

Product Profile and Clinical Positioning

TOBREX (tobramycin ophthalmic solution) has been widely used in ophthalmology for treating bacterial conjunctivitis, keratitis, and other ocular infections due to its broad-spectrum activity and proven safety profile. Its stability, ease of application, and efficacy underpin its steady adoption in clinical practice.

Regulatory Status and Patent Landscape

Initially marketed in the early 1990s, TOBREX's patent protections have matured, leading to the entry of generic alternatives, which has significantly affected pricing and market share. As of 2023, multiple generic formulations are available globally, intensifying price competition.

Market Size and Segmentation

The global ophthalmic antibiotics market, including drugs like TOBREX, was valued at approximately USD 800 million in 2022, with a compound annual growth rate (CAGR) of around 4.2% predicted till 2030 [1]. North America remains the leading market, driven by high diagnosis rates and healthcare expenditure, while emerging markets like Asia-Pacific show expanding demand owing to increasing ocular infectious disease prevalence and growing healthcare infrastructure.

Market Drivers and Challenges

Drivers

- High Clinical Adoption: TOBREX’s proven efficacy sustains its presence as a first-line treatment, especially in developed markets.

- Growing Burden of Bacterial Eye Infections: Factors such as climate change, contact lens use, and urbanization increase infection incidence.

- Regulatory Approvals & Formulation Innovations: New formulations and combination therapies aim to improve compliance and outcomes, enhancing market attractiveness.

Challenges

- Generic Competition: The expiration of original patents has led to price erosion.

- Emergence of Alternative Therapies: Novel antibiotics and antibiotic-resistant bacterial strains threaten existing drug efficacies.

- Regulatory Hurdles in Emerging Markets: Varying approval processes slow market penetration.

Pricing Trends and Projections

Current Pricing Landscape

In mature markets such as the US, a standard 5 mL bottle of TOBREX typically retails between USD 15 to USD 25 for branded formulations; generics are often priced 20-40% lower. The average wholesale acquisition cost (WAC) for branded TOBREX hovers around USD 14 per bottle.

Factors Influencing Price Movements

- Generic Surge: Introduction of multiple generics has precipitated a price war, reducing average selling prices (ASPs).

- Market Penetration Rates: Adoption rates in various regions influence available pricing strategies.

- Regulatory and Reimbursement Policies: Price controls and insurance coverage significantly dictate net prices.

Projected Price Trajectory (2023-2030)

Based on market trends and comparable antibiotic market behavior, the following projections are made:

- Short-term (2023-2025): Price stabilization around USD 10-15 per bottle in developed markets due to the presence of generics.

- Mid-term (2026-2028): Slight decline of 5-10% annually driven by heightened generic competition and healthcare cost containment policies.

- Long-term (2029-2030): Stabilization at approximately USD 8-12 per bottle, with potential for slight price increases in emerging markets owing to localized regulatory approvals and distribution efficiencies.

Influencing External Factors

Emerging initiatives for value-based pricing and patent litigations could moderate or accelerate these trends. Additionally, innovation in delivery mechanisms—such as sustained-release formulations—might command premium pricing, counteracting downward pressure.

Strategic Market Insights

- Expansion in Emerging Markets: Growing healthcare access and increasing bacterial infections create opportunities for premium pricing in select regions, provided regulatory pathways are navigated effectively.

- Innovation and Differentiation: Development of combination therapies or improved formulations can sustain higher prices and market share.

- Regulatory Evolution: Active monitoring and participation in regulatory processes can facilitate timely approvals, affecting pricing strategies and market penetration.

Key Takeaways

- Market Maturity: The TOBREX market has matured in developed economies, with significant generic competition impacting pricing.

- Pricing Trends: Short-term stability or slight decline in prices is expected, with long-term stabilization at lower-to-moderate levels.

- Growth Opportunities: Expansion in emerging markets and innovative delivery systems offer pathways to premium pricing.

- Competitive Dynamics: Patent expirations and alternative therapies necessitate continuous product and strategic innovation.

- Future Outlook: Stakeholders should focus on regional regulatory navigation, cost efficiency, and product differentiation to optimize profitability.

FAQs

1. What factors primarily influence TOBREX’s pricing?

Generic competition, regional regulatory policies, manufacturing costs, and healthcare reimbursement strategies significantly influence TOBREX pricing trajectories.

2. How does patent expiry affect TOBREX’s market and price?

Patent expiration enables generic entry, increasing availability and lowering prices, typically by 20-40% in the first few years post-expiry, unless protected by regulatory exclusivities.

3. Are there any upcoming formulations that might impact the TOBREX market?

Yes, sustained-release and combination formulations are under development, potentially commanding premium prices and capturing additional market segments.

4. Which regions show the most potential for market growth?

Emerging markets in Asia-Pacific and Latin America demonstrate substantial growth potential due to rising ophthalmic infection rates and increased healthcare investment.

5. How can manufacturers maintain profitability amid declining prices?

Focusing on product innovation, optimizing manufacturing, expanding into new markets, and engaging in value-based pricing strategies are key approaches.

References

[1] Markets and Markets. "Ophthalmic Drugs Market by Application, Type, Route of Administration, Region - Global Forecast to 2030." 2022.

More… ↓